- Consultants have outlined a number of elements indicating BTC’s potential for a long-term rally.

- Prevailing knowledge recommend an imminent drop in worth earlier than any upward motion.

Following a latest plunge to the $58,000 area, Bitcoin [BTC] has suffered a 1.33% loss over the previous month. Brief-term analyses predict additional declines as buying and selling progresses.

Regardless of these fluctuations, some analysts stay optimistic, viewing the present downturn as a quick setback. They preserve a constructive long-term outlook for the cryptocurrency.

Bitcoin exhibits promising long-term potential

Analyst Mister Crypto highlighted that BTC is at present forming a bullish flag sample, much like its positioning in 2023, which preceded a brand new all-time excessive.

If this sample holds, BTC is anticipated to expertise a significant surge, doubtlessly reaching a brand new all-time peak.

Supply: X

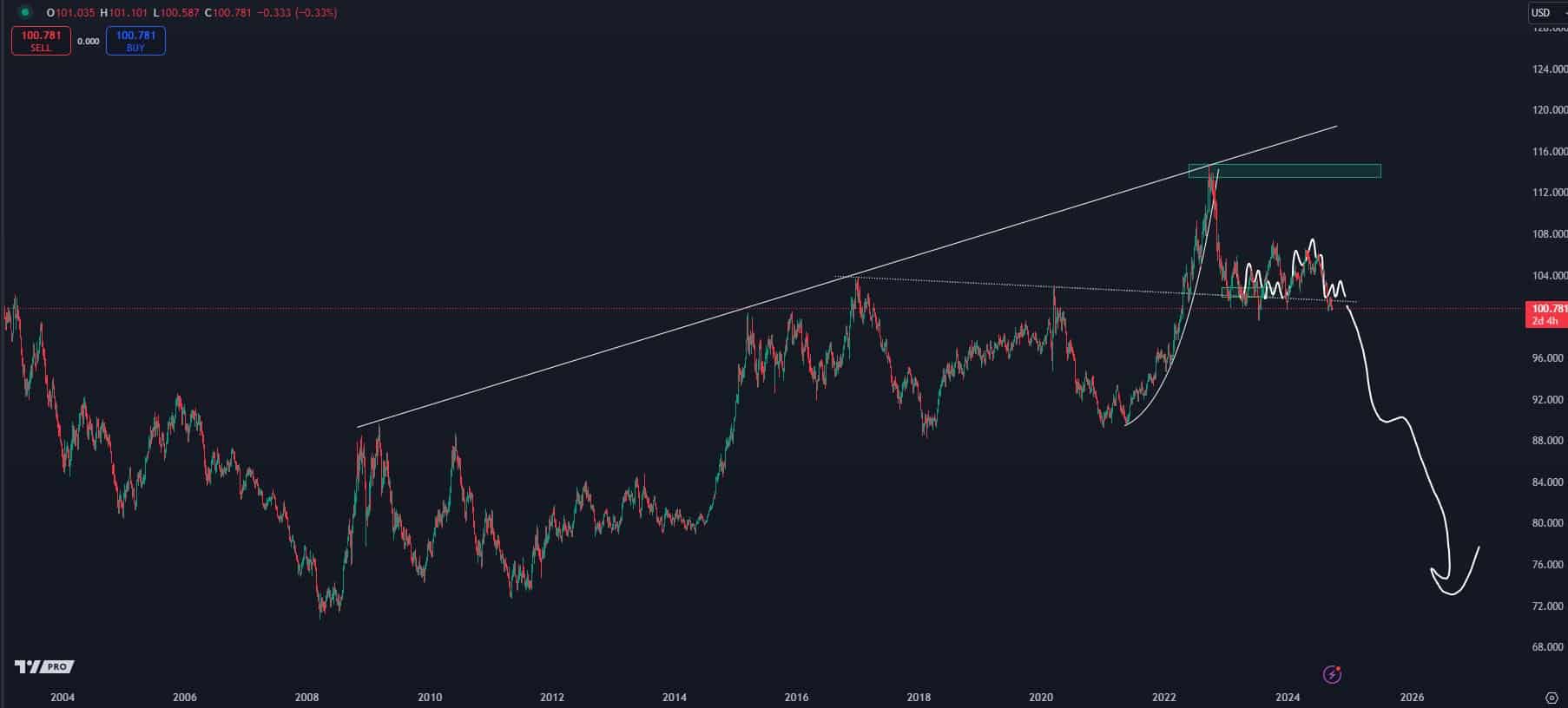

One other analyst Crypto Kaleo, who has monitored BTC’s motion towards the DXY (U.S. Greenback Index) for over 19 months, famous that the correlation has been constant. The DXY chart tracks the U.S. greenback’s worth relative to a basket of foreign currency echange.

Kaleo predicts a decline within the DXY, which is predicted to catalyze a Bitcoin rally, as these charts usually transfer inversely. Such a improvement might propel BTC to main ranges.

Supply: X

Regardless of this optimistic outlook, AMBCrypto has noticed that some merchants and buyers are at present opting to promote within the quick time period.

Merchants are backing out of BTC

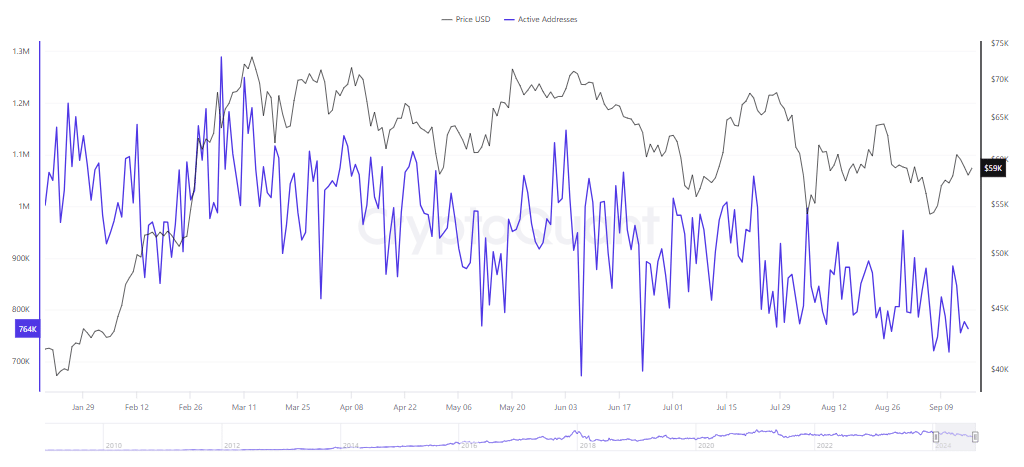

Merchants are displaying lowered curiosity in BTC, indicated by a noticeable lower in buying and selling exercise.

Present knowledge reveal a drop within the variety of lively BTC addresses—from 885,329 to 764,033—suggesting a bearish sentiment amongst members.

Supply: CryptoQuant

Moreover, there was a noticeable improve within the BTC alternate provide, which represents the whole variety of property accessible throughout numerous exchanges.

The accessible BTC has risen to 2.58 million, which might doubtlessly result in a worth drop if not matched by corresponding purchaser curiosity.

Such developments level to a possible short-term decline in BTC costs until there are adjustments out there scenario.

The bears are nonetheless current

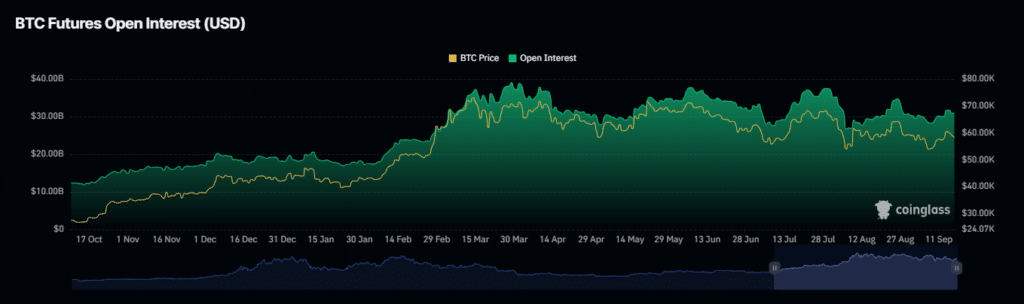

A extra bearish short-term outlook for BTC is rising as latest liquidation knowledge from Coinglass reveals unfavorable outcomes for merchants anticipating an increase. On the time of reporting, over $23.96 million price of lengthy positions have been forcefully liquidated.

Liquidation knowledge accommodates the main points in regards to the pressured closure of buying and selling positions, triggered when merchants fail to fulfill margin necessities or when their trades transfer considerably towards them.

Supply: Coinglass

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Moreover, open curiosity—a metric indicating investor curiosity in an asset—has decreased by 0.44%, as reported by Coinglass.

If these developments persist, a continued decline in each metrics might additional depress BTC costs within the quick time period.