- Information confirmed that the seven-day buying and selling quantity has fallen under $14 billion.

- Worth of BTC continued to soar whereas profitability grew.

As Bitcoin[BTC] approaches its all-time excessive, the anticipation and FUD across the king coin has additionally soared. Regardless of the optimism and curiosity in Bitcoin hovering, the buying and selling quantity round BTC has declined.

Bitcoin volumes decline

Information revealed that the seven-day buying and selling quantity dropped under $14 billion, reaching the identical stage as in 2023 when Bitcoin was buying and selling under $30,000.

This might be a troubling indicator and will counsel that the market has cooled down. On the flipside, it may be seen as a constructive as extra addresses are opting to carry their BTC.

Supply: Santiment

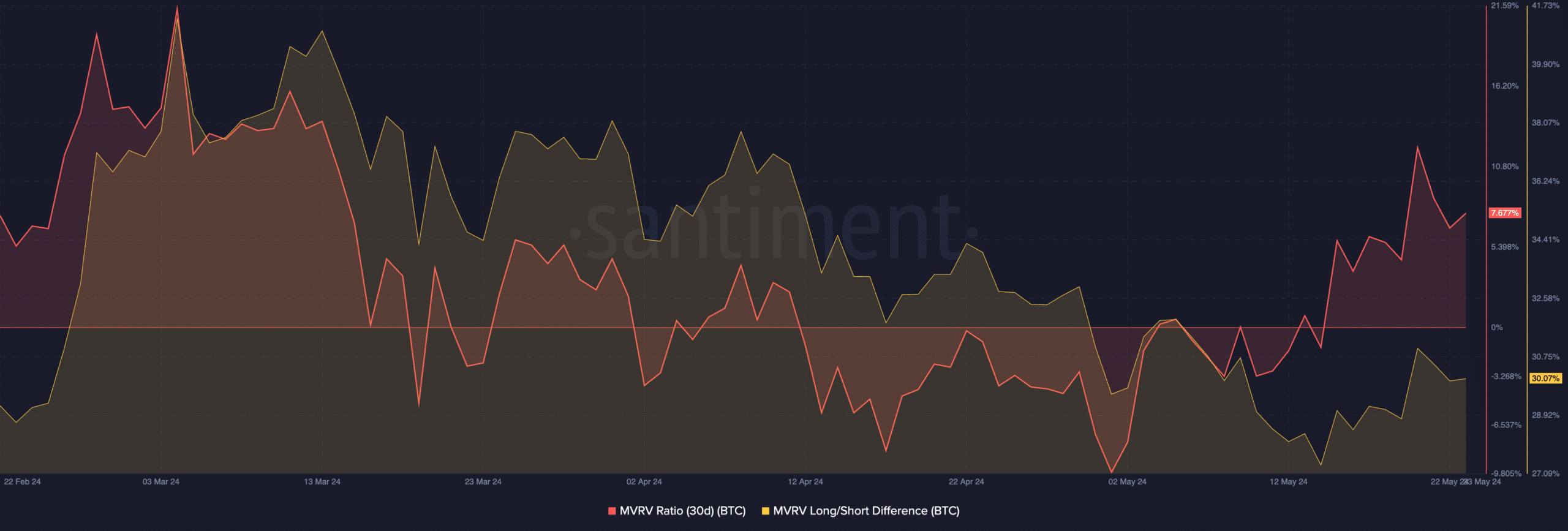

At press time, BTC was buying and selling at $68,899.70 and its value rose by 2.14% within the final 24 hours. The MVRV ratio for Bitcoin soared, implying that almost all holders had turned worthwhile over the previous couple of days.

As a result of surge in profitability, extra holders might be tempted to promote and drive the worth of BTC down.

Nevertheless, the Lengthy/Quick distinction for BTC had additionally grown throughout this era. This implied that the variety of long run holders for BTC rose considerably over the previous couple of days.

Long run holders are much less more likely to promote their holdings and are more likely to indicate a calmer temperament throughout important value fluctuations.

Supply: Santiment

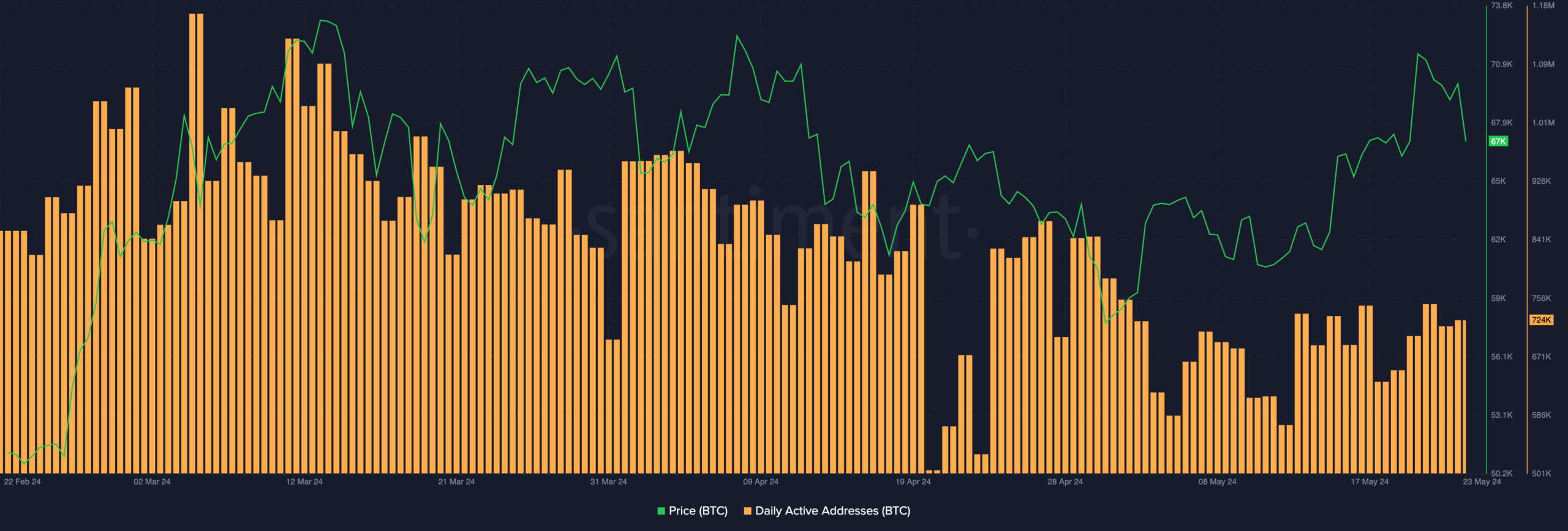

One other indicator of curiosity in Bitcoin can be the variety of energetic addresses on the community. AMBCrypto’s examination of Santiment’s knowledge revealed that the variety of day by day addresses on the Bitcoin community fell considerably over the previous few weeks.

Supply: Santiment

One of many causes for a similar might be the state of the NFT sector. Over the previous couple of weeks, the NFT gross sales, consumers and sellers declined.

The gross sales quantity for Crypto Slam fell by 75.36% over the previous couple of days. Coupled with that, the full variety of the NFT transactions on the community decreased by 60% as properly.

Supply: Crypto Slam

Is your portfolio inexperienced? Examine the Bitcoin Revenue Calculator

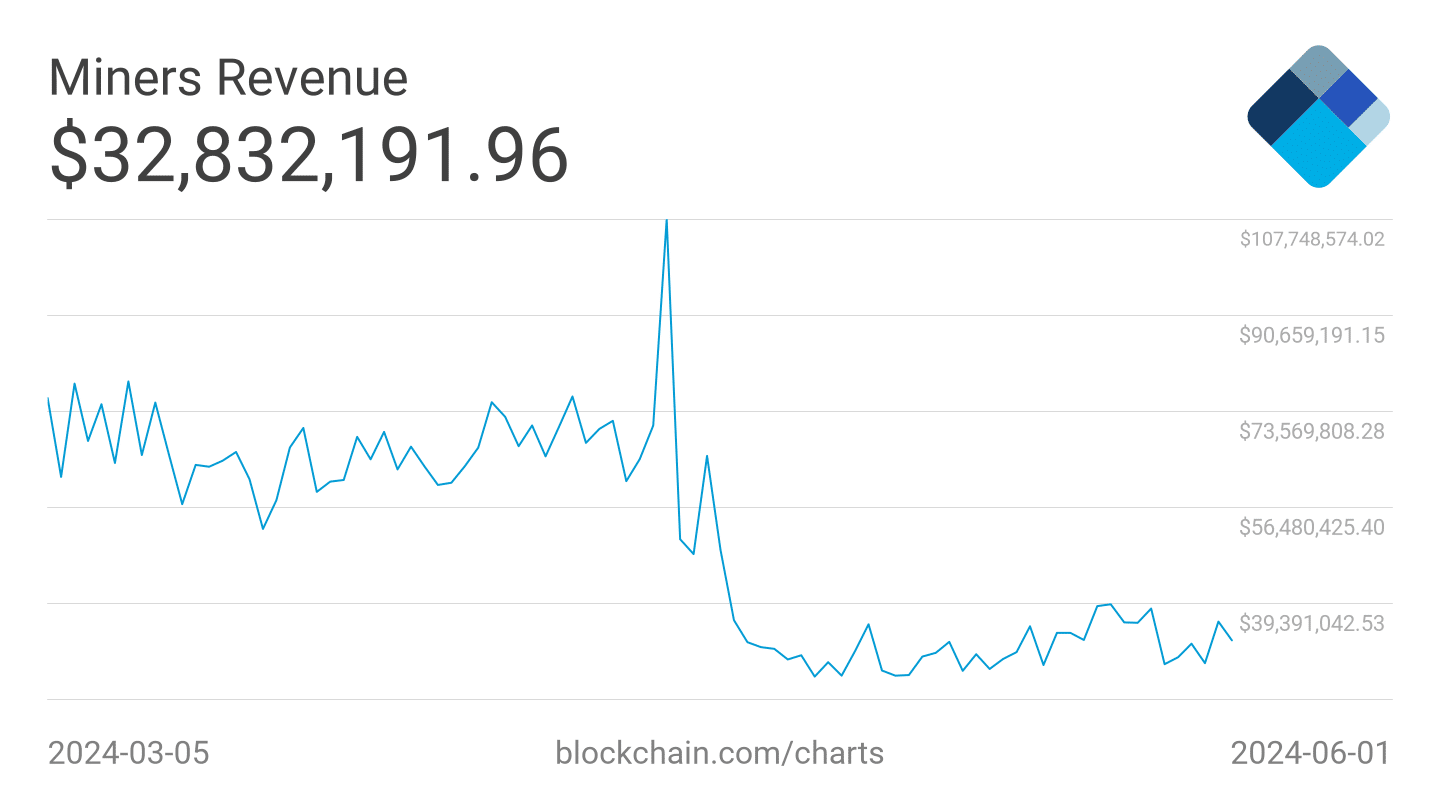

If exercise on the community continues to say no, miner income can get impacted.

Within the current previous, the day by day income generated by Bitcoin miners had fallen considerably over the previous couple of days. If this continues, miners must promote their holdings for earnings, inflicting downward stress on BTC.

Supply: Blockchain