- Bitcoin has a bullish market construction on the each day timeframe.

- The numerous capital influx and powerful momentum favored an upward transfer on the each day chart.

Bitcoin [BTC] noticed elevated demand from ETFs a month after the halving occasion. An AMBCrypto report famous that the altcoin efficiency has eclipsed Bitcoin not too long ago.

One other AMBCrypto evaluation drew parallels between the 2020 post-halving and present tendencies. The Rainbow Chart confirmed that BTC was nonetheless within the purchase zone – does the Bitcoin value prediction agree?

Bitcoin bulls are usually not prepared to drive the problem but

Supply: BTC/USDT on TradingView

The worth motion on the 1-day chart was bullish. Bitcoin dropped under the 61.8% Fibonacci retracement stage (pale yellow) at $59.4k in early Could however was fast to get better.

It has flipped the short-term vary (purple) excessive at $67k to assist. Furthermore, the CMF confirmed a studying of +0.12 to replicate vital capital influx to the market.

The RSI on the each day chart was additionally above impartial 50 to sign bullish momentum. Collectively, the technical indicators pointed towards a bullish Bitcoin value prediction.

This indicated a decrease timeframe liquidity hunt and outlined a consolidation section. The upper timeframe uptrend will possible proceed quickly. The Fibonacci extension ranges at $79.2k and $88.1k can be the goal for patrons within the coming weeks.

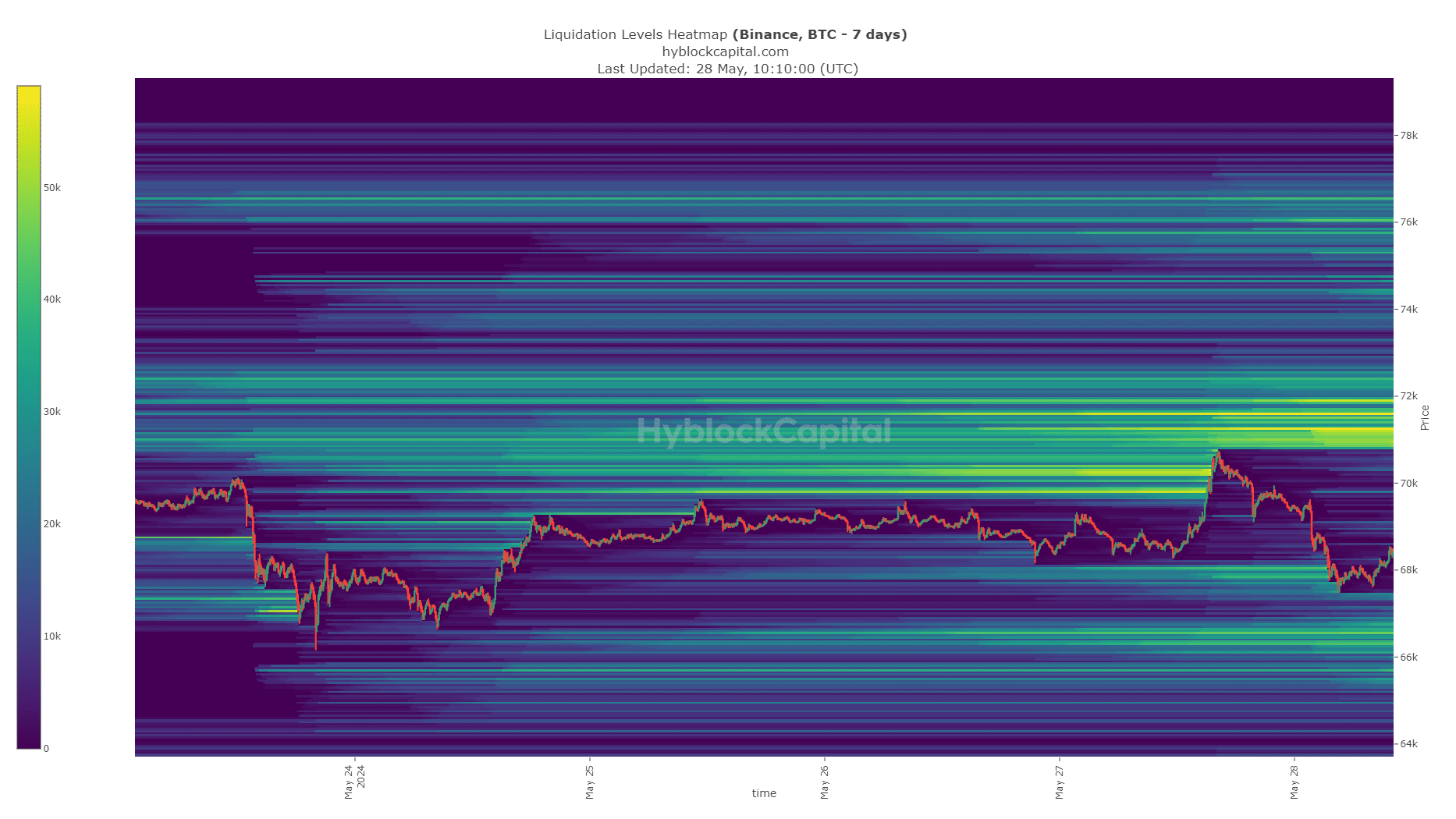

Does the liquidation cluster to the south warrant Bitcoin’s consideration?

Supply: Hyblock

The info from Hyblock confirmed that the $66.2k-$66.7k area was residence to a cluster of liquidation ranges, and BTC would possibly dip to this area.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Alternatively, the liquidity at $67.8k, which has already been swept, is likely to be sufficient to propel Bitcoin again to the $71.2k resistance zone.

Merchants must be ready for each outcomes and handle their threat accordingly. Brief-term volatility was doable and a revisit of the $66.5k stage would offer a shopping for alternative.

Disclaimer: The data introduced doesn’t represent monetary, funding, buying and selling, or different kinds of recommendation and is solely the author’s opinion.