- Bitcoin might doubtlessly attain $79,000 if present market circumstances persist.

- Technical evaluation and buying and selling patterns counsel an imminent vital worth motion for Bitcoin.

Bitcoin [BTC] stays on the forefront of many discussions and analyses. At the moment, the premier cryptocurrency is buying and selling simply above the $69,000 mark, a slight rise from latest fluctuations, and has reached a 24-hour peak of $69,133.

Regardless of this upward pattern, Bitcoin has not but managed to surpass its March peak of over $73,000. Over the previous week, the forex has seen a modest enhance of 0.7%, with a extra noticeable rise of two% within the final 24 hours.

Bitcoin to $79k?

Famend crypto analyst Ali Martinez brings a recent perspective to Bitcoin’s future together with his newest technical evaluation.

Using the MVRV Excessive Deviation Pricing band chart, Martinez factors out that BTC is close to the +0.5 Customary Deviation (σ) pricing band at $66,800.

Supply: Ali on X

This positioning suggests a possible rise to the 1.0σ pricing band, which might see Bitcoin escalating to round $79,600. His evaluation hinges on Bitcoin’s potential to keep up its present stage, setting the stage for a doable vital enhance.

Echoing Martinez’s optimistic outlook, one other distinguished determine within the crypto buying and selling group, MMCrypto, has taken to X to voice his predictions.

He posits that BTC might both climb to $74,000 or drop to $62,200, depending on market actions within the coming days.

His predictions are accompanied by a chart illustrating a pivotal triangle sample. Based on MMCrypto, this sample is because of resolve inside 48 hours, suggesting imminent vital worth motion.

Supply: MMCrypto on X

Bitcoin’s future outlook

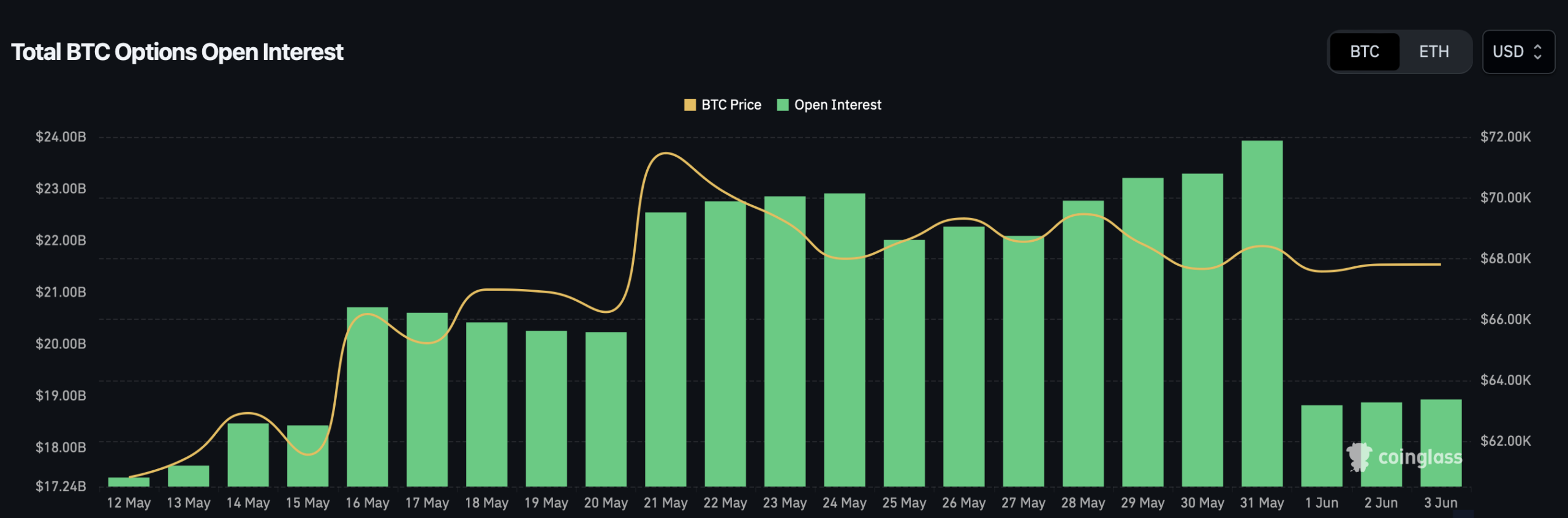

Present market information from Coinglass exhibits a lower in open curiosity in Bitcoin, dropping from $22 billion in late Might to $18 billion at press time.

This discount in open curiosity, which measures the entire variety of unsettled contracts, might be a precursor to market stabilization or a shift in dealer sentiment.

Supply: Coinglass

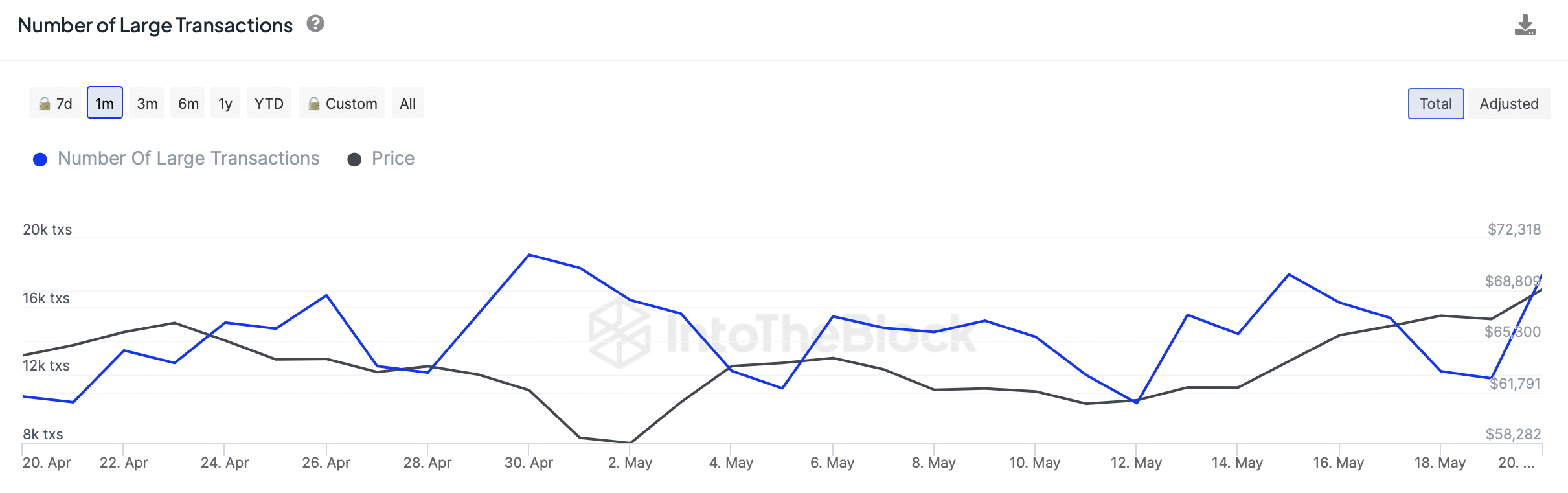

Furthermore, information from IntoTheBlock signifies a rise within the variety of massive Bitcoin transactions, hinting at potential upward momentum as substantial market gamers probably gear up for extra substantial strikes.

Supply: IntoTheBlock

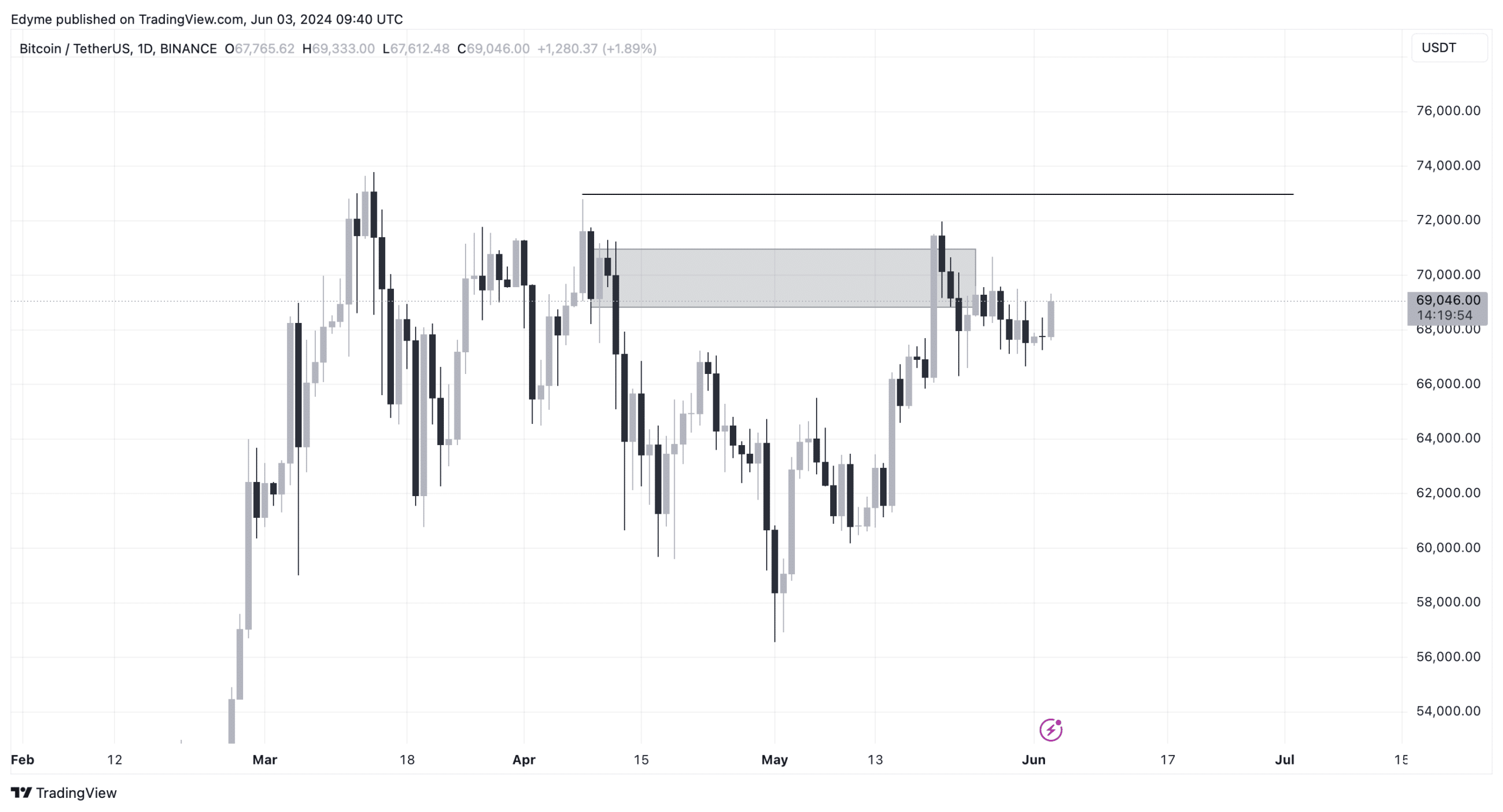

Technical evaluation of BTC’s day by day chart reveals that the asset has just lately encountered a serious provide zone after breaking downward constructions.

This encounter at a essential resistance stage might dictate Bitcoin’s short-term worth trajectory. If Bitcoin can breach the $72,000 mark, surpassing the earlier decrease excessive, it might invalidate bearish forecasts and sign a powerful bullish pattern.

Is your portfolio inexperienced? Examine the Bitcoin Revenue Calculator

Based on a latest report by AMBCrypto, which references CryptoQuant analyst XBTManager, BTC is presently consolidating energy in anticipation of an upcoming surge.

The analyst predicts a steep ascent in Bitcoin’s worth, much like patterns noticed within the third and fourth quarters.