- Bitcoin whales collected giant quantities of BTC over the previous couple of days.

- Holder profitability grew, and miner income declined.

Bitcoin [BTC] witnessed a large surge in whale accumulation over the previous couple of days. Regardless of the worth being extraordinarily near its latest all-time excessive, many whales haven’t misplaced conviction within the king coin.

Bitcoin: Huge gamers make investments

The rising urge for food of whales indicated that there was a excessive expectation that BTC will surpass present worth ranges.

Supply: X

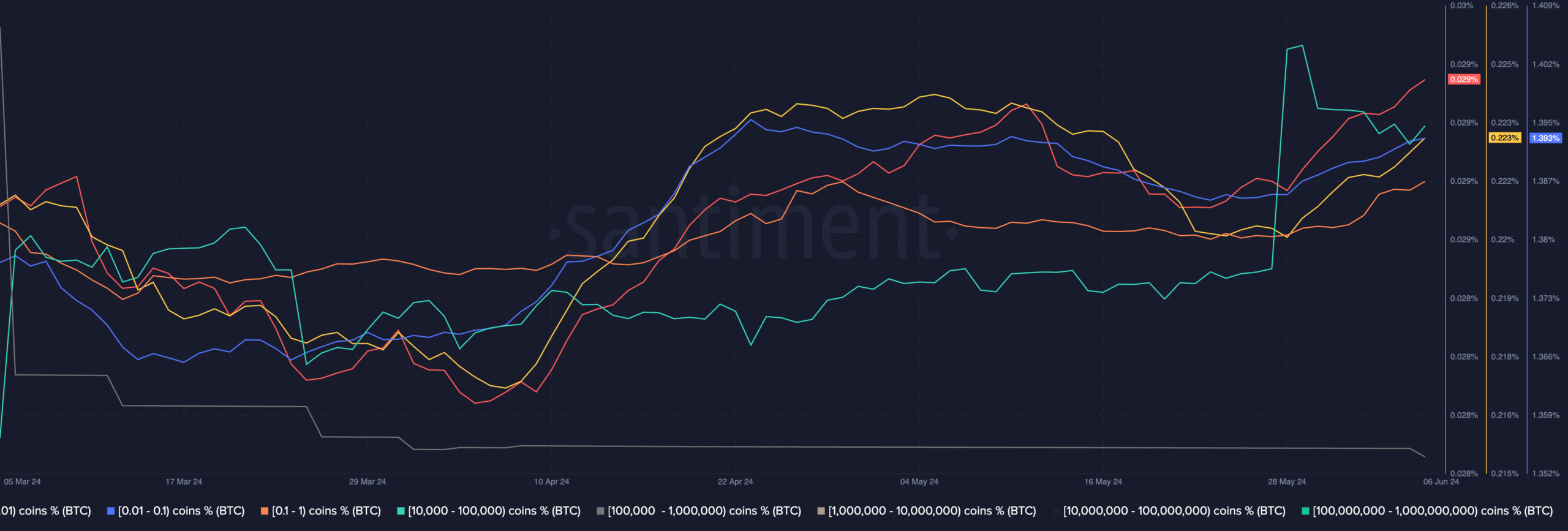

The story remained the identical for retail buyers as nicely. Over the previous couple of days, the curiosity from retail buyers for BTC had grown materially.

Addresses holding anyplace between 0.01 to 1 BTC had grown considerably. The push from each whale buyers and retail buyers can assist BTC break previous beforehand claimed ranges.

Supply: Santiment

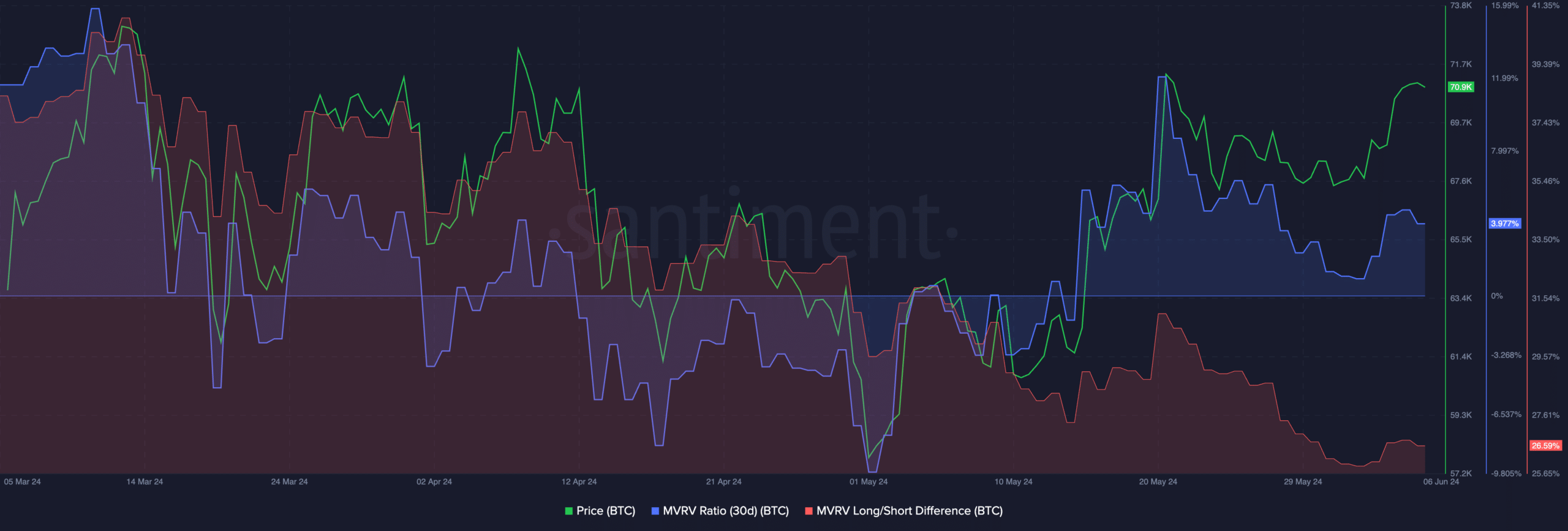

Nonetheless, as BTC’s worth rises, so does the MVRV ratio. AMBCrypto’s evaluation of Santiment’s information revealed that the MVRV ratio for BTC holders had grown considerably.

This indicated that almost all holders had been worthwhile on the time of writing. As a consequence of this, the motivation for these holders to promote additionally grows, which might add promoting strain on Bitcoin.

Coupled with that, the Lengthy/Brief distinction for Bitcoin had declined.

This meant that the variety of new addresses holding BTC had grown, and the proportion of long-term holders who’ve held BTC for giant intervals of time had declined.

Brief-term holders usually tend to promote their holdings amidst worth fluctuations and uncertainty.

Supply: Santiment

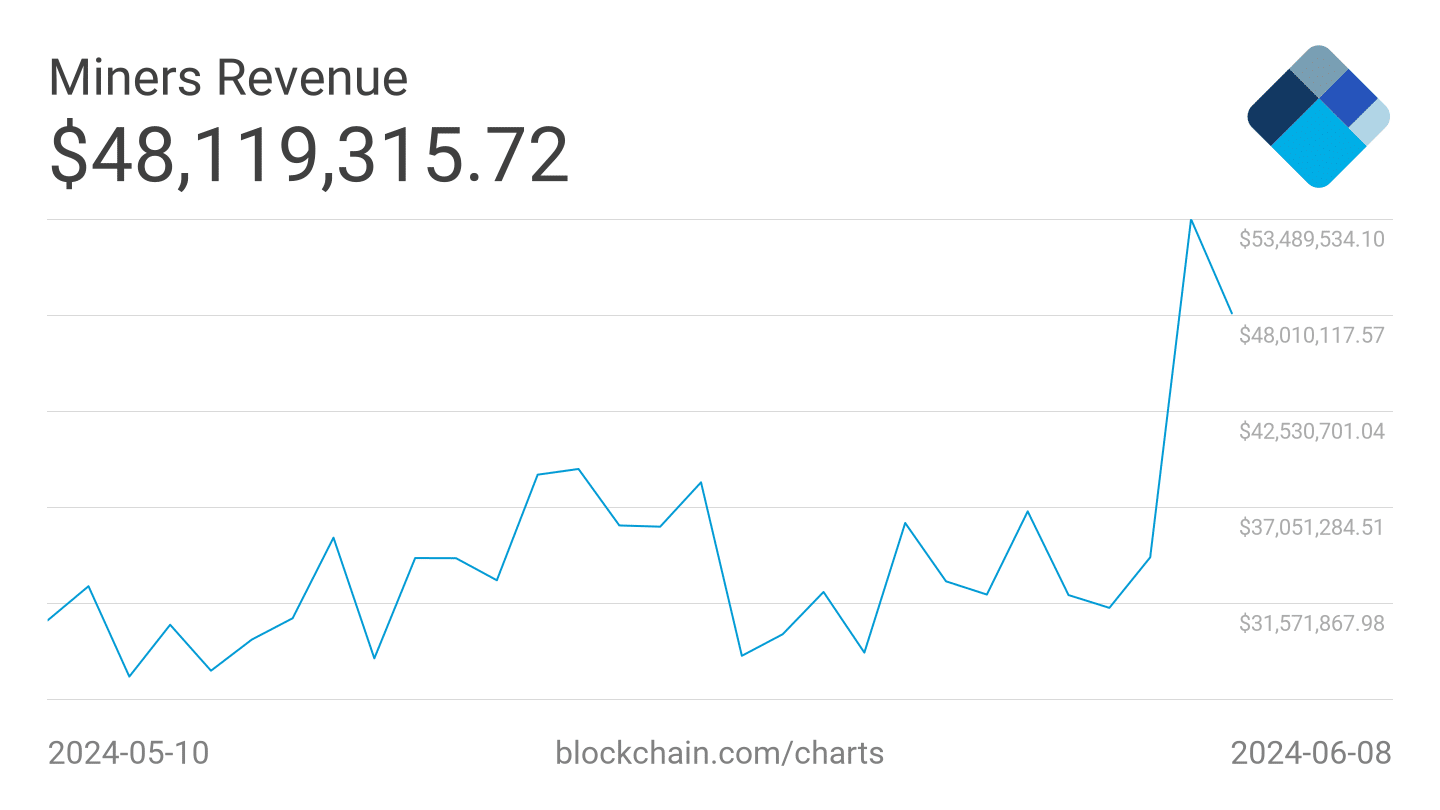

Miner income declines

One other issue that would influence the state of BTC can be how the miners are doing. Throughout the previous couple of days, the income collected by miners had fallen from $53.48 million to $48 million.

If this development continues, miners must promote their holdings to stay worthwhile. This might additional add promoting strain on BTC and drive costs down additional.

Supply: Blockchain.com

Learn Bitcoin’s [BTC] Value Prediction 2024-25

What might assist ease off the promoting strain round BTC can be the curiosity in BTC ETFs. Because the thirty first of Could, ETF inflows have been extraordinarily optimistic.

If curiosity in BTC continues to rise at this fee and extra institutional buyers proceed to purchase BTC, there could possibly be extra upward worth motion sooner or later.

Supply: sosovalue