- Round 4.27% of Bitcoin’s provide was backing spot exchange-traded funds at press time.

- Analyst forecasts a market peak between November 2024 and February 2025.

Bitcoin [BTC] continues to indicate the crypto market why it’s the king coin. After practically a month of consolidation and sideways motion, the market chief hit a brand new file excessive after smashing previous $80K.

The cryptocurrency hiked by over 5% over 24 hours and over 18% within the final seven days, AMBCrypto seen utilizing CoinMarketCap knowledge.

Bullish surroundings for development

Bitcoin’s motion comes on the again of normal market bullishness, particularly after the SEC’s approval of spot Bitcoin exchange-trader funds (ETFs) again in January.

Nearly $26 billion value of BTCs have moved into these funds since itemizing, in accordance with AMBCrypto’s evaluation of SoSo Worth knowledge.

Additionally, inflows have surged dramatically following an preliminary burst of outflows from the Grayscale Bitcoin Belief (GBTC).

Moreover, as of this writing, belongings beneath administration or AUMs for Bitcoin spot ETFs was nearly $79 billion, accounting for five.21% of Bitcoin’s whole provide.

Supply: SosoValue

There are different causes exterior of crypto which may clarify Bitcoin’s efficiency.

Inflation has cooled considerably in the previous few months. The job market has grown higher too.

This led the U.S. Federal Reserve (Fed) to undertake a comparatively dovish method, leaving rates of interest regular throughout final month’s FOMC assembly.

The broad consensus amongst buyers and policymakers was that charges would stay unchanged within the subsequent assembly too, with the potential for a fee lower later within the 12 months if inflation stays in verify.

What this has accomplished is allowed folks to start out spending cash on risk-on belongings like equities and cryptocurrencies.

Bitcoin to get scarcer and dearer?

The growing variety of Bitcoins getting locked into spot ETFs created a shortage within the broader market.

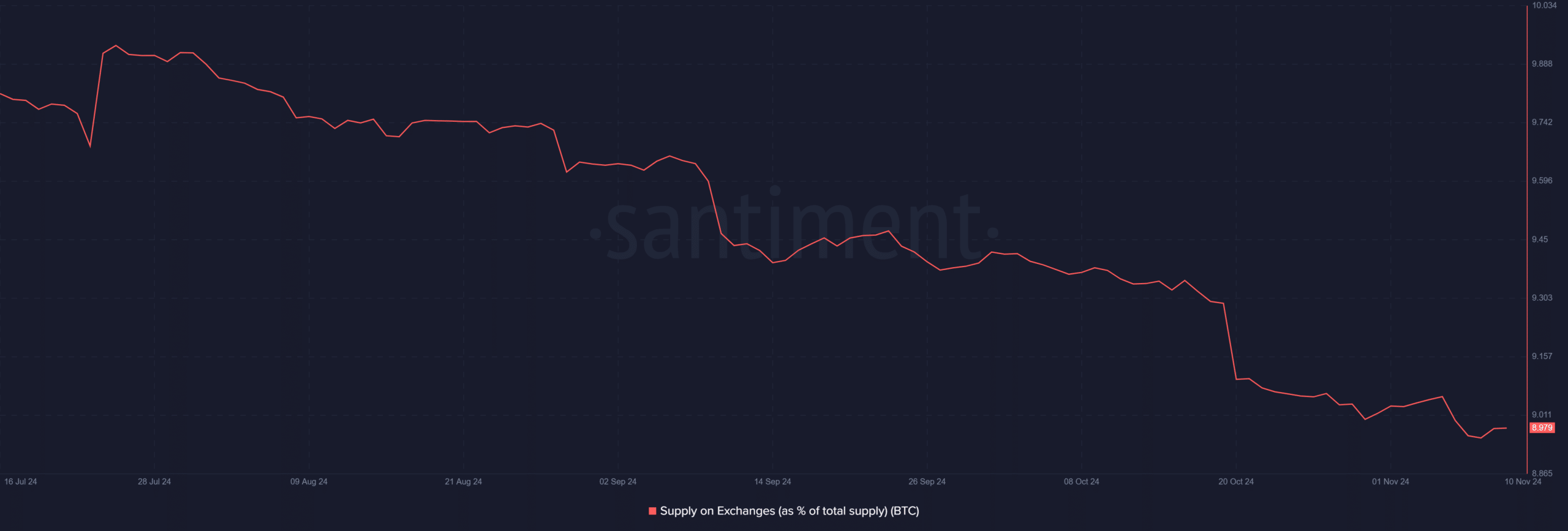

Inasmuch, provide on exchanges continued to witness a decline, as per AMBCrypto’s examination of Santiment knowledge.

Moreover, as of this writing, about 9% of Bitcoin’s whole circulating provide was held on exchanges, down from nearly 12% initially of 2024.

Supply: Santiment

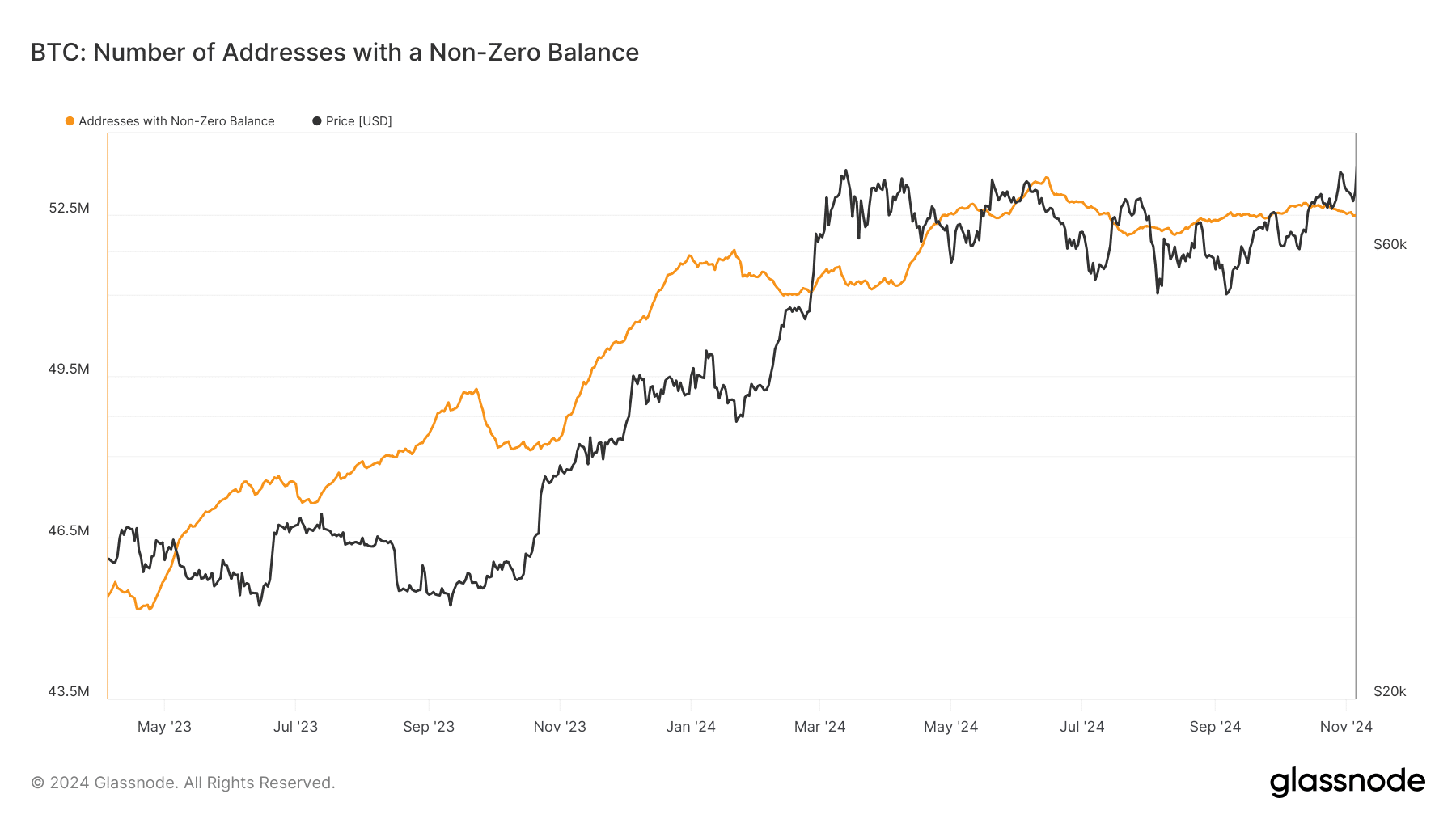

Additionally, whereas provide was shrinking, there was no let-up on the demand facet. Opposite to prior bull cycles, 2024’s Bitcoin rally was pushed by each retail and institutional curiosity.

Utilizing Glassnode, AMBCrypto noticed a marked enhance in whale entities holding 1K cash, whereas addresses with non-zero balances rose as effectively since 2024 started.

Supply: Glassnode

Rocket set for the moon?

This bullish situation of depleting provide and hovering demand had the potential to push Bitcoin to historic highs this cycle.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Famous technical analyst Ali Martinez had earlier predicted that the market peak could be hit someday between November 2024 and February 2025.

So, $80K seems to be like simply the beginning as we launch from the bottom degree. The rocket has sufficient gas for the moon, it appears!