- Bitcoin’s value elevated by greater than 2% within the final seven days.

- Most metrics regarded bullish on Bitcoin.

Bitcoin [BTC] has not carried out per expectations, because the king of cryptos continued to commerce beneath $70k at press time, regardless of a optimistic weekly chart.

However there was extra to the story, as BTC’s slow-moving value motion may be a prelude to an enormous value hike within the coming days.

Bitcoin is about to pump

CoinMarketCap’s information revealed that BTC’s value had elevated by greater than 2% within the final seven days. On the time of writing, BTC was buying and selling at $69,329.89 with a market capitalization of over $1.3 trillion.

Although BTC continued to commerce beneath $70k, the king of cryptos had a trick up its sleeves, which could quickly lead to an enormous bull rally.

Dealer Tradigrade, a preferred crypto analyst, lately posted a tweet highlighting an fascinating growth. As per the tweet, BTC’s value was consolidating inside a bullish pennant sample.

A breakout above might permit BTC to the touch new highs.

So, the current sluggish value motion might simply be a results of this consolidation section.

BTC to $88k?

AMBCrypto’s take a look at Glassnode’s information revealed that BTC had the potential to surge considerably.

To be exact, BTC’s Pi cycle prime indicators revealed that BTC was nearing its market backside, and a value might permit the coin to go above the $88k mark.

For the uninitiated, the Pi Cycle indicator consists of the 111-day shifting common (111SMA) and a 2x a number of of the 350-day shifting common of Bitcoin’s value.

Supply: Glassnode

AMBCrypto then analyzed CryptoQuant’s information to higher perceive whether or not BTC might attain $88k. We discovered that purchasing strain on BTC was excessive, as its alternate reserve was dropping at press time.

Its Binary CDD remained inexperienced, that means that long-term holders’ actions within the final seven days have been decrease than common. They’ve a motive to carry their cash.

Issues within the derivatives market additionally regarded fairly optimistic. BTC’s Funding Charge elevated, that means that long-position merchants are dominant and are prepared to pay short-position merchants.

Shopping for sentiment amongst derivatives buyers was additionally excessive, which was evident from its inexperienced Taker Purchase Promote Ratio.

Supply: CryptoQuant

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

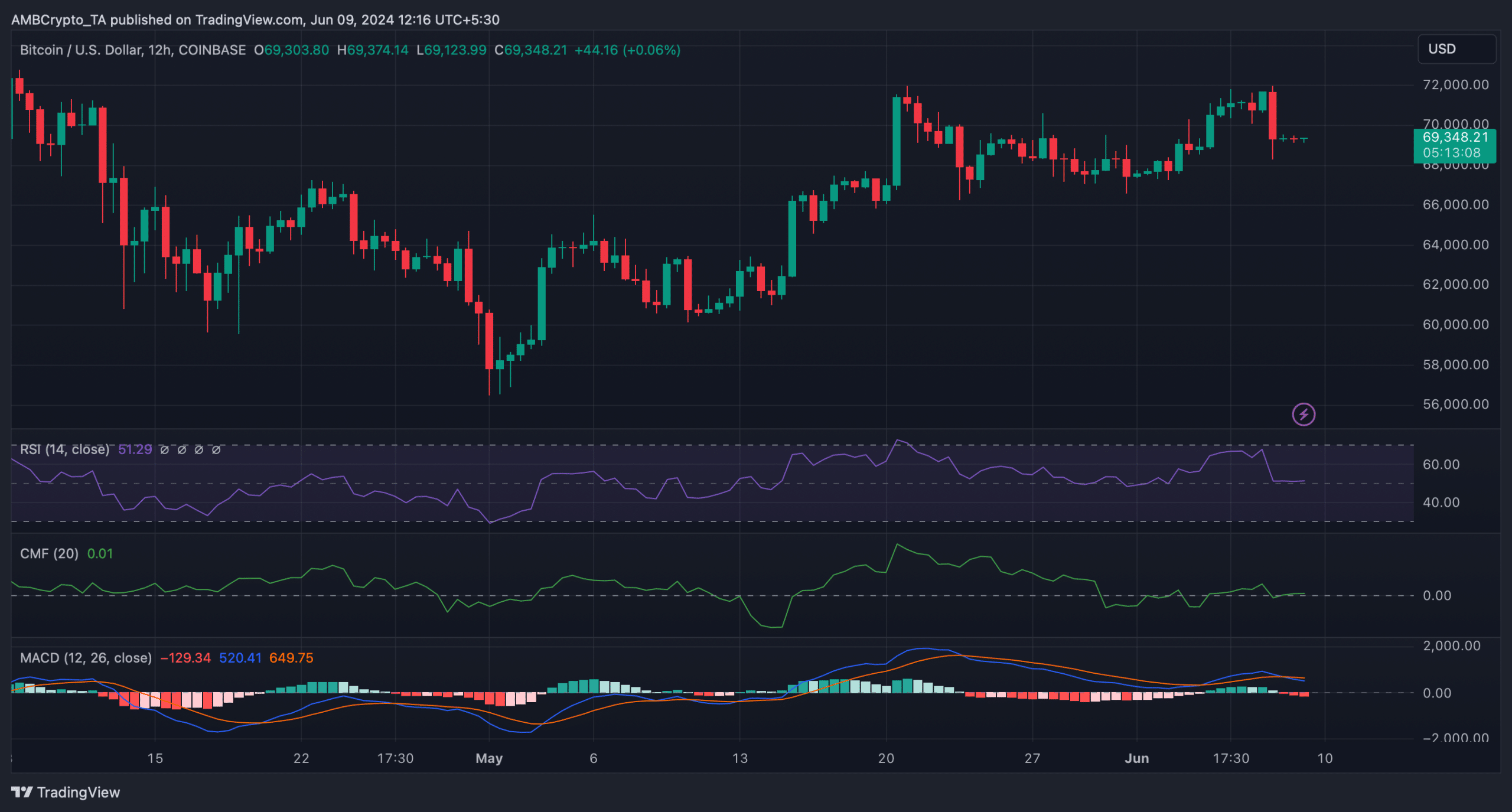

Nevertheless, buyers might need to attend a bit longer to see a Bitcoin pump, as just a few indicators hinted at just a few extra slow-moving days. Notably, the coin’s MACD displayed a bearish crossover.

Furthermore, its Relative Energy Index (RSI) and Chaikin Cash Move (CMF) each moved sideways close to their respective impartial zones.

Supply: TradingView