Picture supply: Getty Pictures

I’m looking for one of the best dividend shares to purchase to make a profitable passive earnings. By concentrating on huge dividends at the moment, I may have a greater likelihood of producing life-changing wealth once I ultimately retire.

I reinvest any dividends I obtain to purchase extra UK shares which, in flip, provides me extra dividends for additional reinvestment. Over time, this highly effective cash-building idea — often known as compounding — can enable these with even a modest quantity to speculate every month to construct a giant nest egg for retirement.

And the more cash I’ve to do that at the moment, the faster I can probably meet my investing aims. That is the place the knowledge of shopping for shares with massive dividend yields comes into play.

Dividend guidelines

In fact, there’s extra to smart dividend investing that simply concentrating on near-term dividend yields. As somebody who invests for the lengthy haul, I’m in search of firms which have a superb likelihood of offering an honest dividend at the moment and rising it over time.

So I’m additionally looking for firms which have a number of — or, ideally, all — of the next qualities:

- Lengthy information of dividend development

- Constant earnings

- Main positions in rising markets

- Various income streams

- Financial moats (often known as aggressive benefits)

- Strong steadiness sheets (with robust money flows and/or low debt)

- Dividend cowl of at the very least 2 instances

10.9% dividend yield

With all of this in thoughts, I believe Phoenix Group Holdings (LSE:PHNX) shares are price critical consideration at the moment.

Dividends are by no means assured. However based mostly on the corporate’s 10.9% ahead dividend yield, a £20,000 funding proper now may make me £2,180 in passive earnings this 12 months alone. I may then reinvest this to assist me make these important compound positive factors I described.

The excellent news is that Metropolis analysts count on Phoenix to proceed elevating shareholder payouts by to 2026 too, driving the yield comfortably above 11%.

| Yr | Predicted dividend per share | Dividend yield |

|---|---|---|

| 2024 | 54.3p | 10.9% |

| 2025 | 56.1p | 11.2% |

| 2026 | 57.5p | 11.5% |

Payout development

As a monetary providers inventory, Phoenix Group’s very weak when financial situations worsen and folks have much less cash to spend. It lacks the earnings stability of companies like utilities, defence and healthcare, as an illustration.

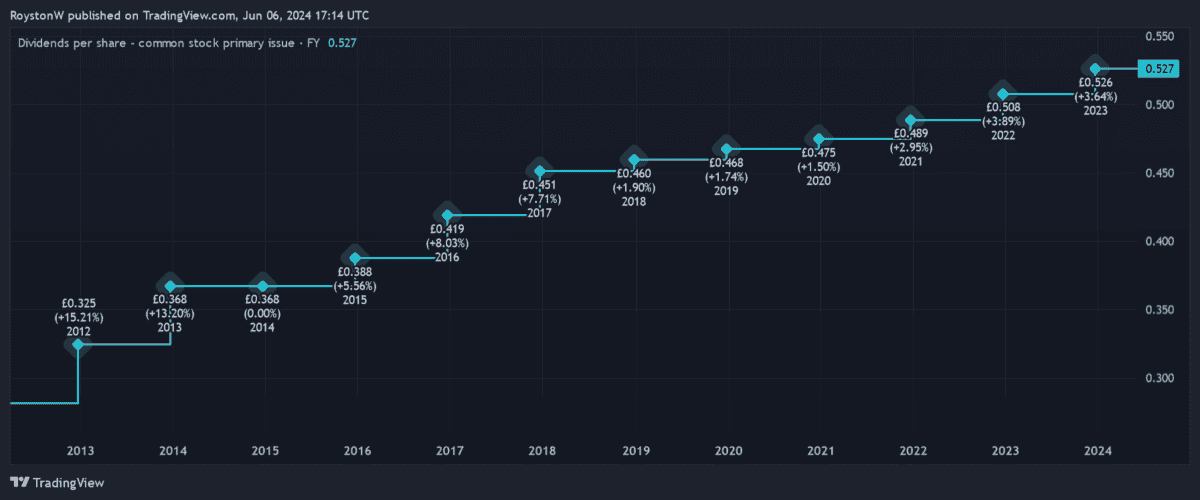

Earnings have definitely been unstable at Phoenix in recent times. But this FTSE 100 share nonetheless has an distinctive document of dividend development, as proven within the graph beneath. Not like many UK shares, Phoenix even continued to lift shareholder payouts through the pandemic.

This has been underpinned by the corporate’s rock-solid steadiness sheet, whereas market-leading positions within the mature life insurance coverage and pensions markets have additionally helped to help payouts, regardless of robust situations.

Phoenix is a money machine and in 2023, it generated a whopping £2bn of money, beating its £1.8bn goal by a wholesome margin.

And with a Solvency II capital ratio of 176% — on the higher finish of its 140-180% goal — the corporate seems in fine condition to proceed paying massive and rising dividends by the forecast interval.

As I say, I’m additionally on the lookout for firms that may enhance payouts over the long run. I’m assured Phoenix will be capable to do that as Britain’s rising ageing inhabitants supercharges the life insurance coverage and retirement merchandise trade.