- XRP bulls battled towards the mid-range resistance zone.

- The futures market clues pointed to bearish sentiment and a consolidation section below $0.6.

Ripple [XRP] has fashioned a bullish triangle sample over the previous 18 months and traders can be hoping an amazing breakout can ensue someday through the bull run. Within the shorter timeframes, a spread formation was anticipated.

Supply: XRP/USDT on TradingView

XRP was already buying and selling inside a spread that stretched again virtually a 12 months, and at press time was just under the mid-range resistance at $0.585. AMBCrypto’s evaluation confirmed a smaller vary might materialize.

Bearish sentiment evident within the futures markets

Supply: CryptoQuant

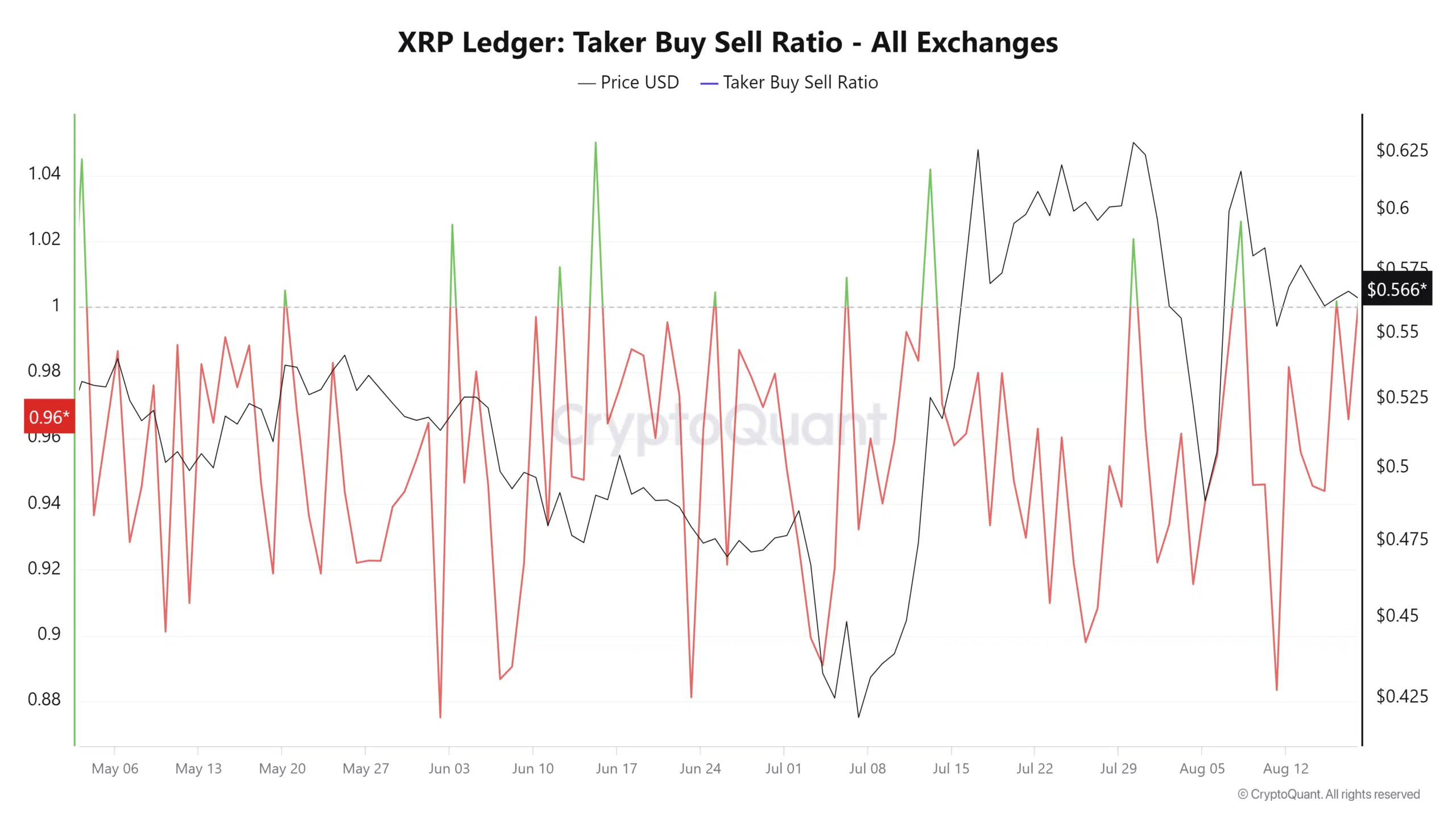

The taker buy-sell ratio measures the quantity of purchase to promote market orders within the perpetuals market. A ratio of below one exhibits extra taker promote quantity, implying higher bearish sentiment.

Previously few months, this ratio has been predominantly bearish. This helped clarify why XRP has retraced each the rallies to $0.7 that occurred up to now 12 months.

Supply: CryptoQuant

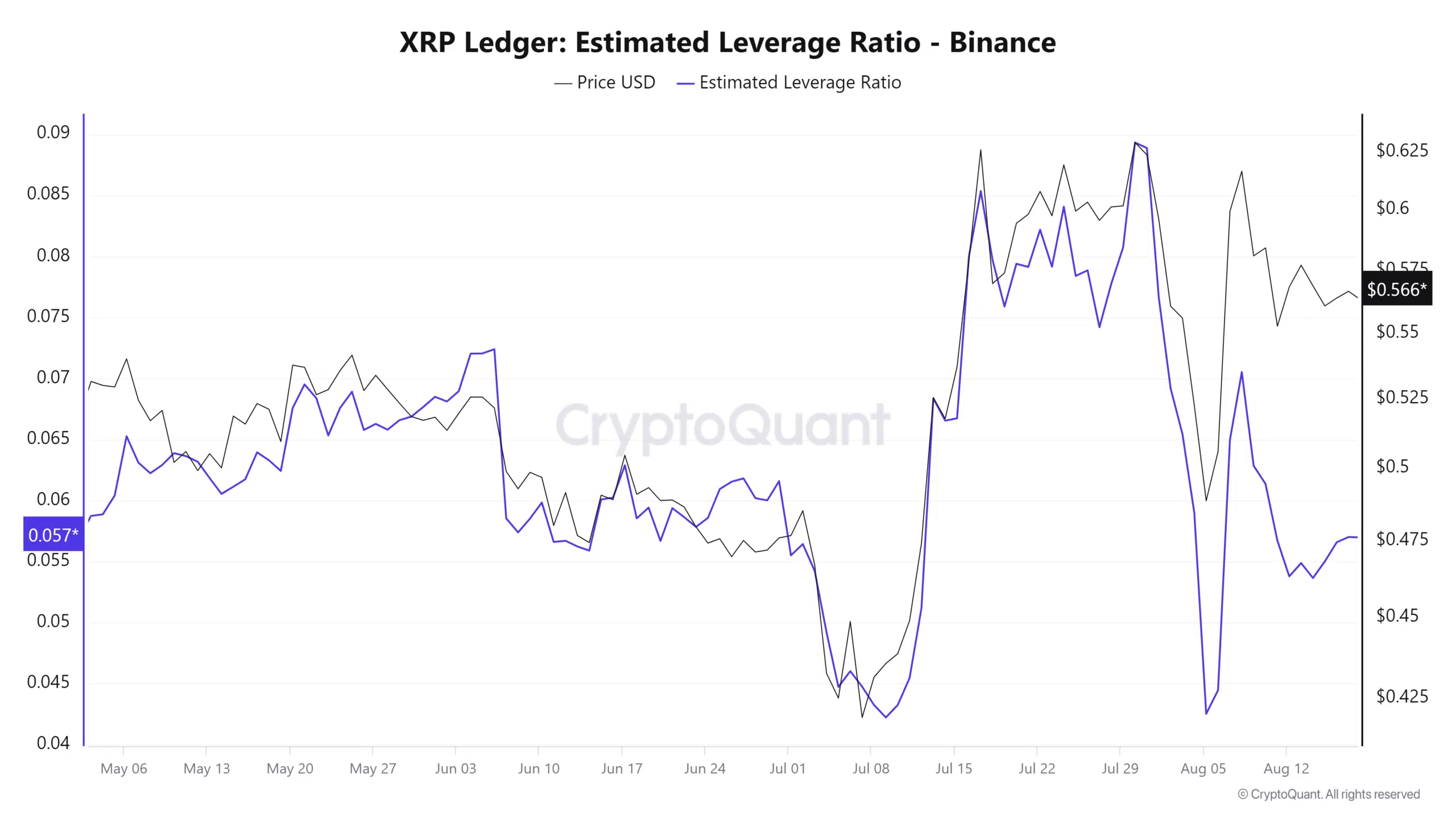

Since late July the estimated leverage ratio has fallen dramatically. This meant that individuals taking extra threat and higher leverage was decreased, probably because of the value volatility.

This units up situations for a wholesome spot-driven rally.

Analyzing the XRP liquidation heatmap for value pattern clues

Supply: Hyblock

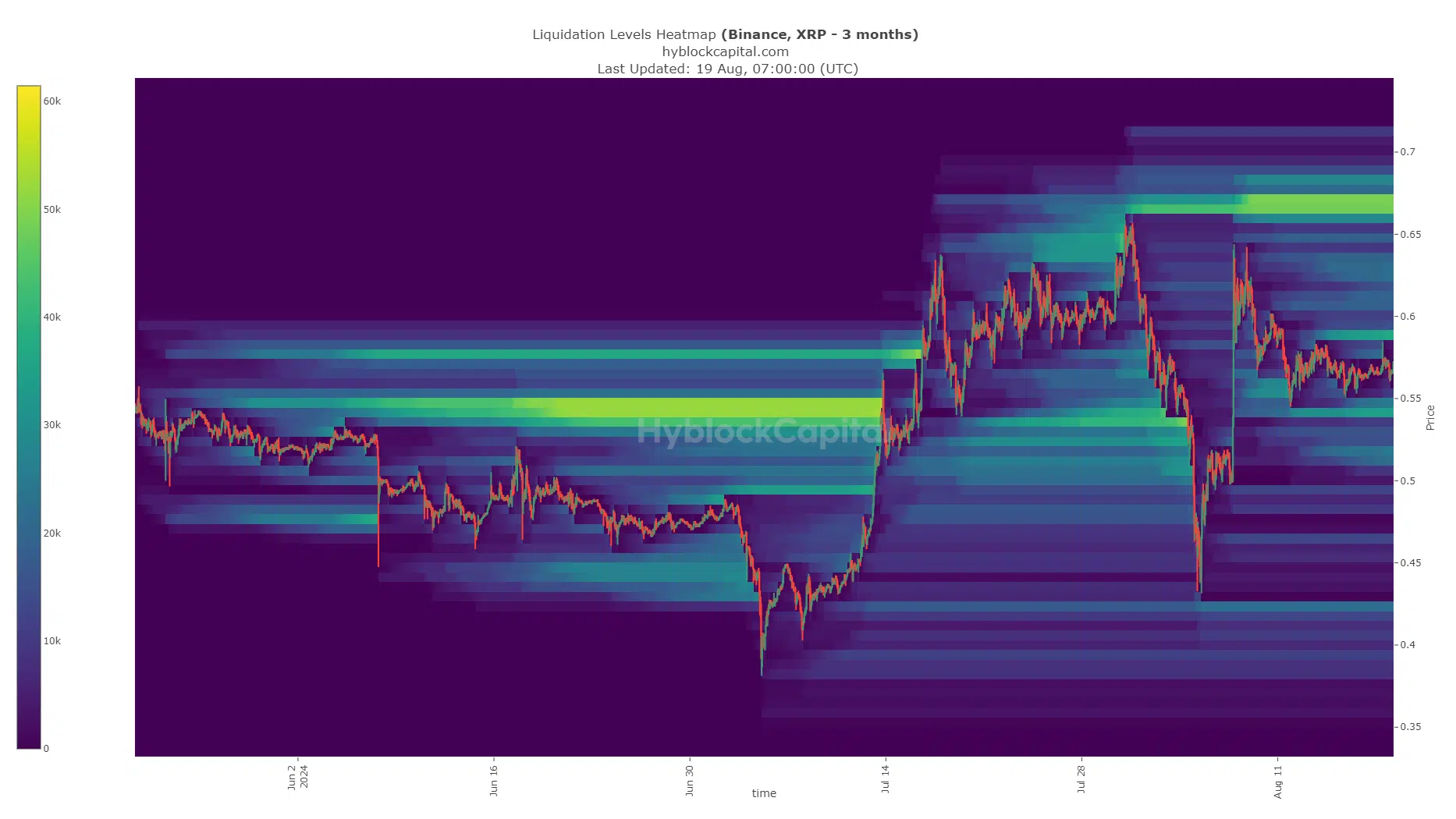

The most important liquidity pool on the 3-month look-back chart was at $0.67, just under the vary highs at $0.7. In the meantime, two extra appreciable magnetic zones have developed at $0.589 and $0.541.

Supply: Hyblock

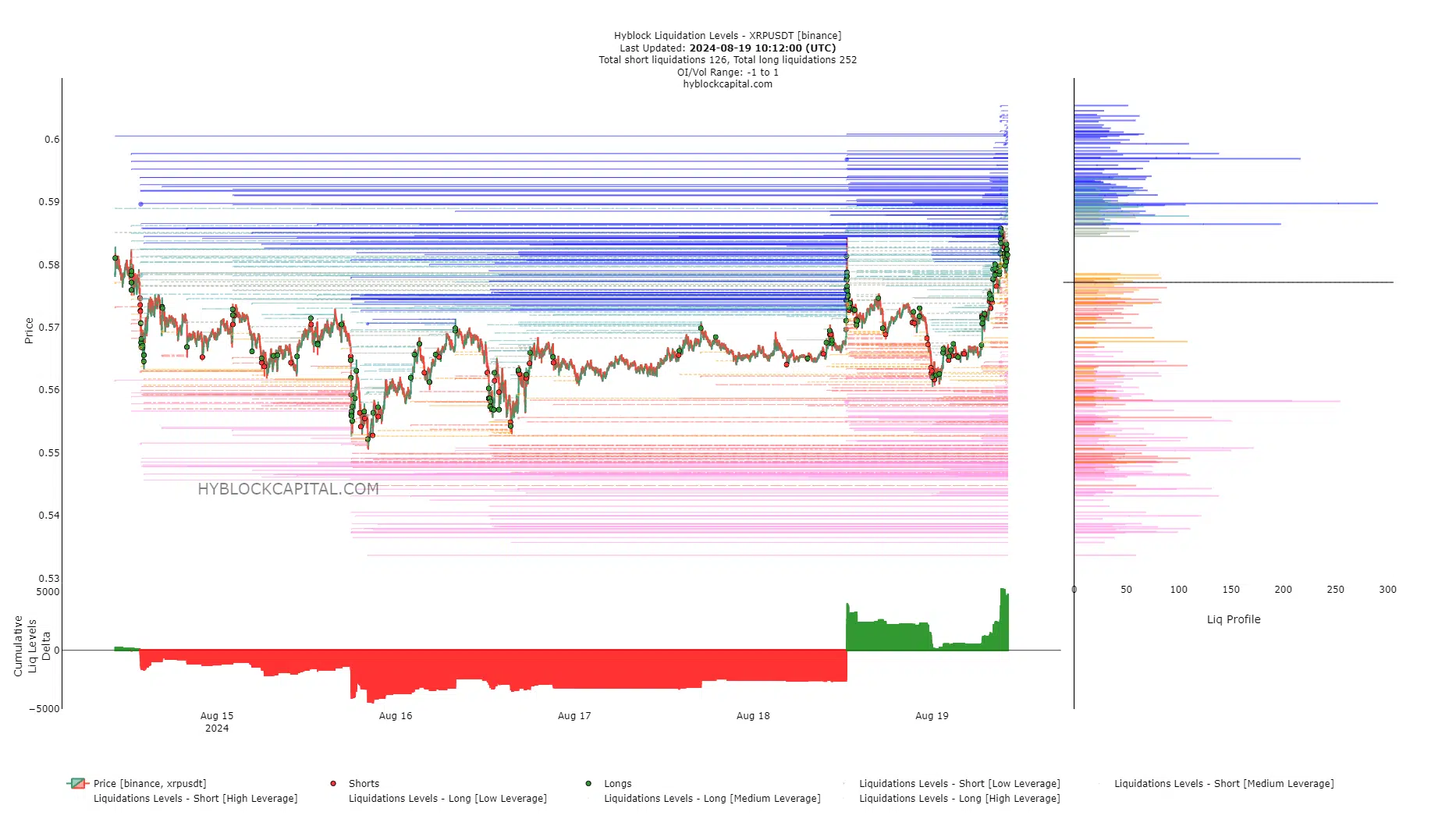

In the meantime, the short-term liquidation ranges information confirmed that the lengthy ranges had been starting to outnumber the shorts.

Learn Ripple’s [XRP] Value Prediction 2024-25

The rising constructive delta might see a pointy value transfer right down to hunt the overeager bulls.

The cumulative liq ranges delta was not but excessive sufficient to warrant expectations of such a reversal. If XRP reaches the $0.59-$0.6 resistance zone, this case might change.