- The crypto and monetary market in Seoul reacted to the martial legislation declared.

- BTC and XRP noticed main affect, however rebounded.

South Korea’s declaration of martial legislation and its fast reversal have rattled the crypto market, creating a pointy spike in volatility. As President Yoon Suk Yeol accused the opposition of threatening democracy, the South Korean crypto market skilled vital turbulence, with Bitcoin and XRP enduring flash crashes.

Analysts have pointed to the “Kimchi Premium” – the value hole between Bitcoin on South Korean exchanges and world markets – as a central indicator of the market’s response.

Bitcoin’s Korea Premium Index reacts

The Korea Premium Index, which displays the distinction between Bitcoin’s value on South Korean exchanges and the worldwide common, recorded a dramatic decline following the political upheaval.

Traditionally, a spike within the index typically correlates with bullish sentiment in South Korea, fueled by native demand. Nonetheless, the latest flip into unfavorable territory suggests a sell-off within the home market as investor confidence waned amid the disaster.

Supply: CryptoQuant

The chart reveals a steep decline within the premium as Bitcoin fell to a low of roughly $93,000 earlier than recovering to round $96,525.

The sell-off indicators an exodus of liquidity from South Korean exchanges, a conduct according to heightened political and financial uncertainty.

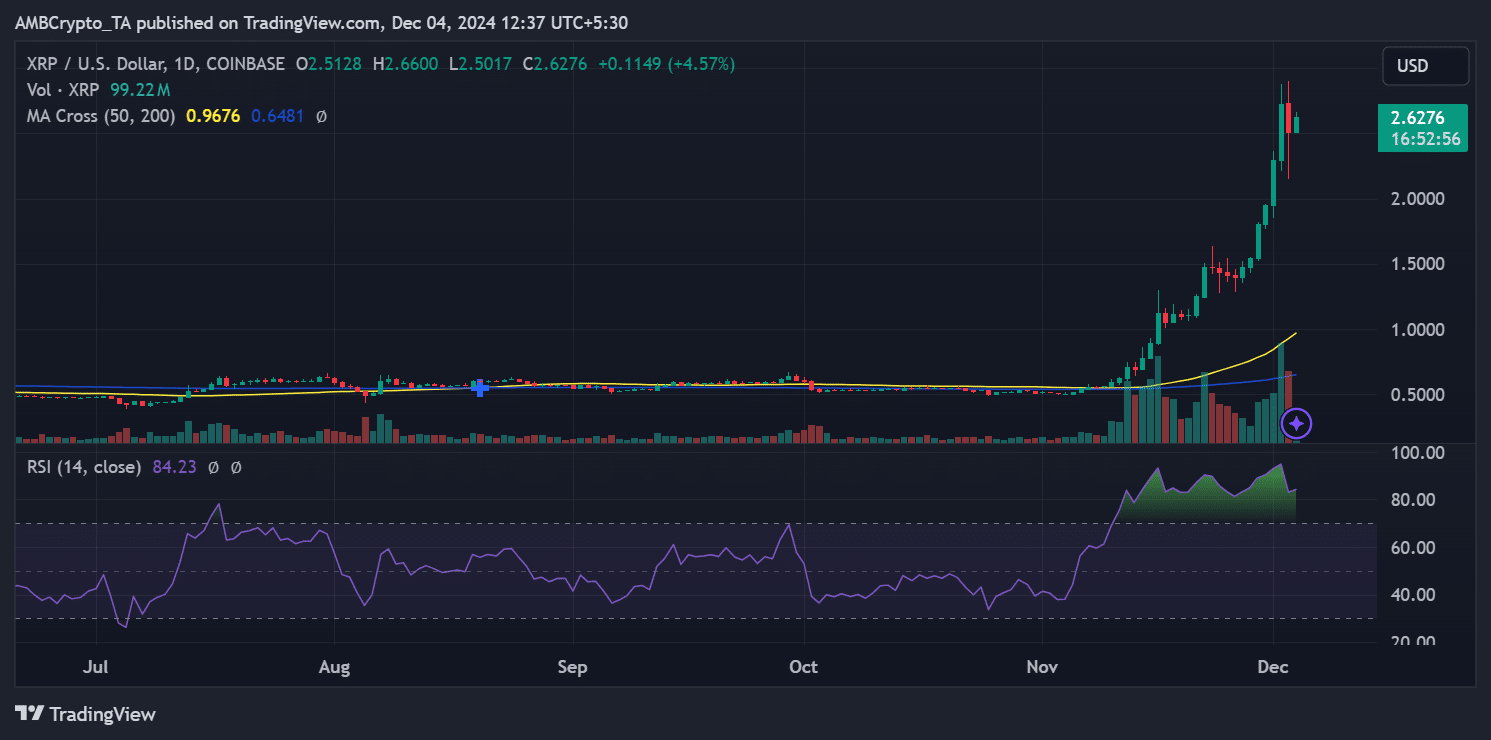

XRP faces parallel volatility

Ripple, one other distinguished cryptocurrency in South Korea, mirrored Bitcoin’s sharp decline. XRP plunged to $2.15 earlier than rebounding to $2.63, as seen within the value chart.

The Relative Energy Index (RSI) signifies overbought situations, suggesting that XRP’s restoration could face resistance within the quick time period.

Supply: TradingView

Moreover, the numerous buying and selling quantity through the flash crash underscores heightened panic promoting and subsequent speculative accumulation. Evaluation confirmed that the amount spiked within the final buying and selling session on third December as the value fluctuated.

South Korea has traditionally been a significant marketplace for XRP, with native exchanges typically accounting for a share of world buying and selling quantity.

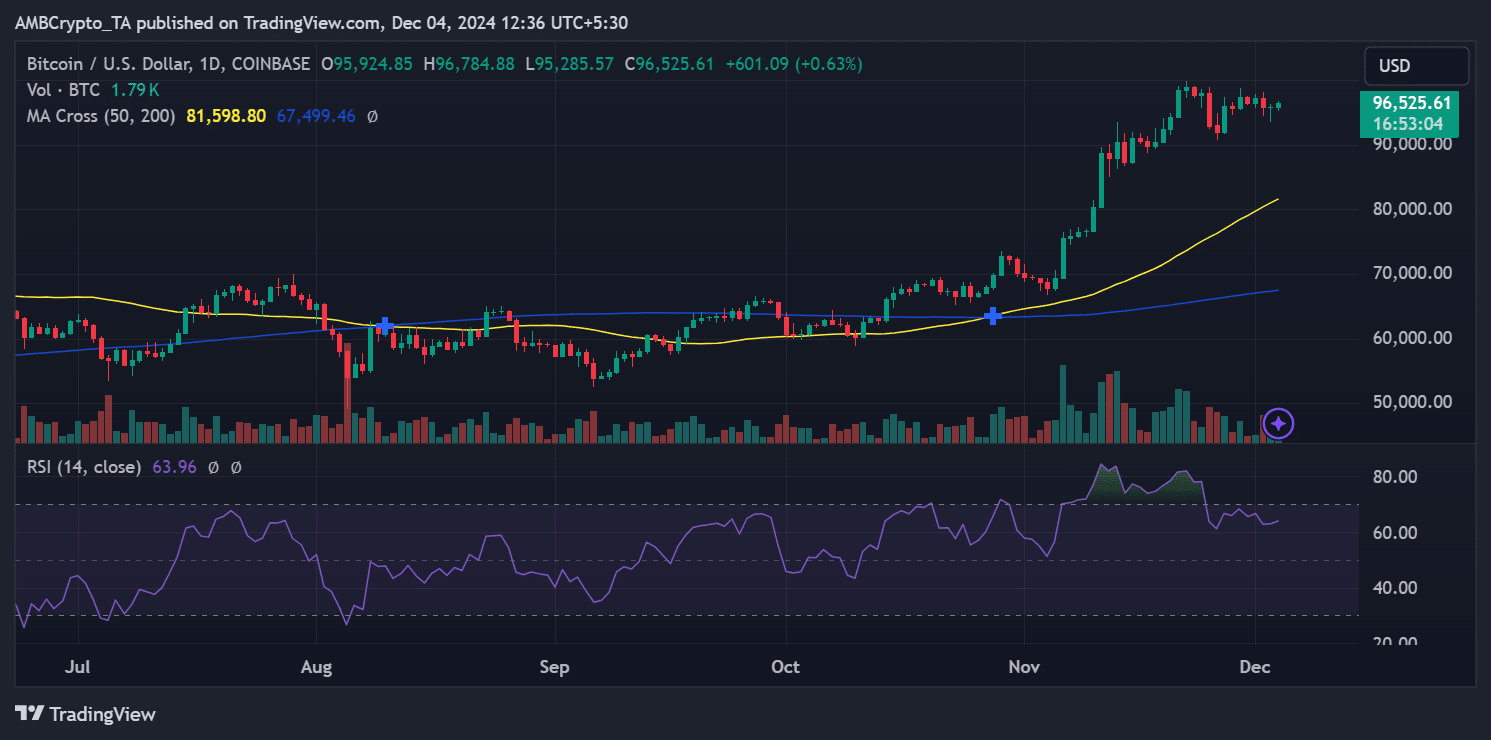

Bitcoin’s development post-martial legislation raise

Regardless of the flash crash and improvement in South Korea, Bitcoin’s value chart illustrates a broader resilience out there. The 50-day and 200-day transferring averages present a continuation of the upward development, albeit with indicators of cooling momentum.

The RSI for Bitcoin suggests comparatively impartial situations, implying that the flash crash could have been an overreaction somewhat than a systemic downturn.

Supply: TradingView

The rebound in Bitcoin’s value following the preliminary dip highlights the broader market’s potential to soak up shocks, even amidst localized turbulence. Nonetheless, the muted buying and selling quantity through the restoration suggests cautious sentiment amongst world traders.

Is your portfolio inexperienced? Try the Bitcoin Revenue Calculator

The unfolding political drama in South Korea has laid naked the vulnerability of crypto markets to exterior shocks, significantly in areas the place digital property have a robust retail presence.

The sharp fluctuations in Bitcoin and XRP costs mirror each native panic and world opportunism as merchants react to evolving situations.