- The German authorities transferred BTC value hundreds of thousands of {dollars}.

- Nonetheless, shopping for sentiment remained dominant available in the market.

The final month of the second quarter of the 12 months has been in the perfect curiosity of Bitcoin [BTC] traders. This was the case as BTC witnessed a number of value corrections.

In the meantime, the German authorities made a transfer that may have a detrimental influence on the king of cryptos’ value.

Are traders promoting Bitcoin?

CoinMarketCap’s knowledge revealed that over the past 30 days, BTC witnessed a greater than 11% value decline. Within the final seven days alone, the coin’s worth sipped by over 6%.

On the time of writing, BTC was buying and selling at $61,043.62 with a market capitalization of over $1.2 trillion. Due to the value drop, over 12% of BTC traders had been out of cash, as per IntoTheBlock’s knowledge.

Whereas that occurred, Lookonchain’s newest tweet revealed that the German authorities transferred BTC value hundreds of thousands of {dollars}.

To be exact, the German authorities transferred 750 BTC, value $46.35 million, out once more, of which 250 BTC, value $15.41 million, was transferred to Bitstamp and Kraken.

In consequence, AMBCrypto deliberate to test the info to seek out out whether or not promoting stress on BTC was excessive.

Our evaluation of CryptoQuant’s knowledge revealed that BTC’s web deposit on exchanges was excessive in comparison with the final seven days’ common, hinting at excessive shopping for stress.

The king of cryptos’ change reserve additionally dropped sharply final month, additional establishing the truth that traders had been shopping for BTC whereas its value declined.

Nonetheless, promoting sentiment was dominant amongst U.S. traders, as its Coinbase Premium was within the crimson at press time.

Supply: CryptoQuant

What to anticipate from BTC

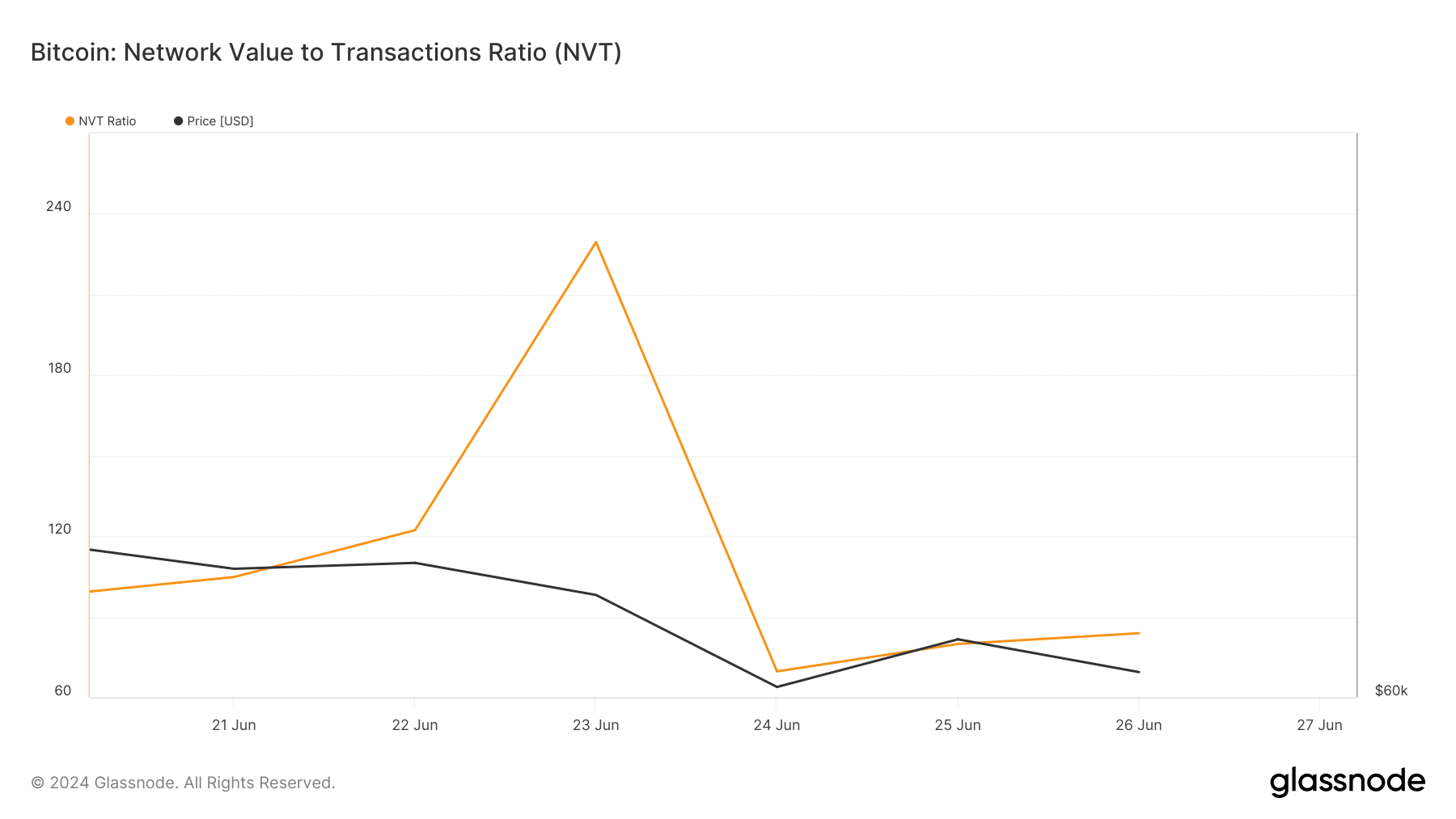

Excessive shopping for stress typically ends in value will increase. Subsequently, AMBCrypto checked Glassnode’s knowledge and located a bullish metric.

As per our evaluation, BTC’s NVT ratio dipped sharply in the previous few days. Usually, a decline within the metric signifies that an asset is undervalued, which hints at a doable value rise within the days to observe.

Supply: Glassnode

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

We then deliberate to investigate the coin’s day by day chart to higher perceive whether or not it was awaiting a value hike. As per our evaluation, BTC’s Relative Energy Index (RSI) was resting close to the oversold zone.

This would possibly exert extra shopping for stress on the coin and assist carry its value. The Chaikin Cash Circulation (CMF) additionally registered a slight uptick, indicating a doable value rise. Nonetheless, the MACD remained within the bears’ favor.

Supply: TradingView