- Willy Woo primarily based his newest evaluation on the VWAP Oscillator’s upward development

- Retail funding and technical patterns appeared to assist a bullish outlook too

Bitcoin recorded a notable hike not too long ago, with positive aspects of 4.9% seen over the previous week. This uptick has contributed to a broader bullish development throughout the cryptocurrency market. Analysts at the moment are intently monitoring varied indicators to foretell what may lie forward for the world’s main cryptocurrency.

One such analyst, Willy Woo, shared his insights on the Quantity-Weighted Common Value (VWAP) Oscillator for Bitcoin, discussing its potential implications for future market actions.

Woo’s evaluation on the social media platform X delved into the VWAP, a technical indicator that averages the value of an asset whereas contemplating the amount of transactions at every value stage. This strategy provides extra significance to cost ranges with greater buying and selling volumes, offering a extra balanced view of value actions.

For Bitcoin, Woo particularly examined the VWAP utilizing on-chain quantity, which advantages from the transparency of the blockchain to offer clear information to all observers.

VWAP oscillator’s position in predicting Bitcoin’s path

The main target of Woo’s research is the VWAP Oscillator, which measures the ratio between Bitcoin’s spot value and its VWAP, displaying this relationship in a type that oscillates round zero.

Supply: Willy Woo on X

Current tendencies revealed that the VWAP Oscillator has been in detrimental territory for the previous few months, however is now on an upward trajectory. Ought to this proceed, it may quickly attain the impartial zone, signaling a possible shift in market dynamics.

Historic information additionally appeared to point that when the VWAP Oscillator exits the detrimental zone and begins to climb, it typically precedes a interval of bullish momentum for Bitcoin. The worth usually continues to surge till the oscillator peaks in optimistic territory and begins to say no.

In keeping with Woo, this sample signifies that “there is still a lot of room to run before a reversal or consolidation occurs,” making it a difficult time for bearish buyers out there.

Retail buyers and technical indicators assist bullish sentiment

Additional supplementing these bullish observations, a CryptoQuant analyst additionally highlighted an rising variety of purchases from retail buyers. In keeping with the analyst, they’ve now purchased roughly $135.7 million value of Bitcoin over the previous month alone.

Supply: CryptoQuant

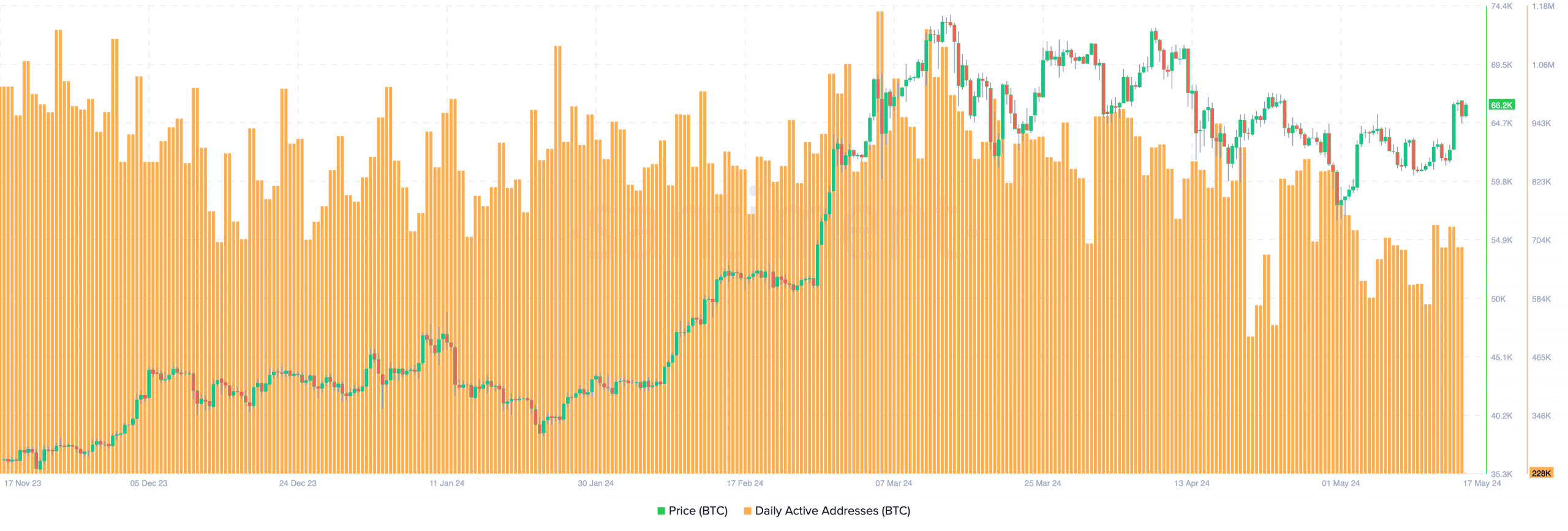

This shopping for spree aligns with a spike in Bitcoin’s each day energetic addresses, as proven by Santiment’s information. The variety of each day energetic addresses surged from roughly 49,000 to over 66,000 in a single day, illustrating a major hike in market exercise.

Supply: Santiment

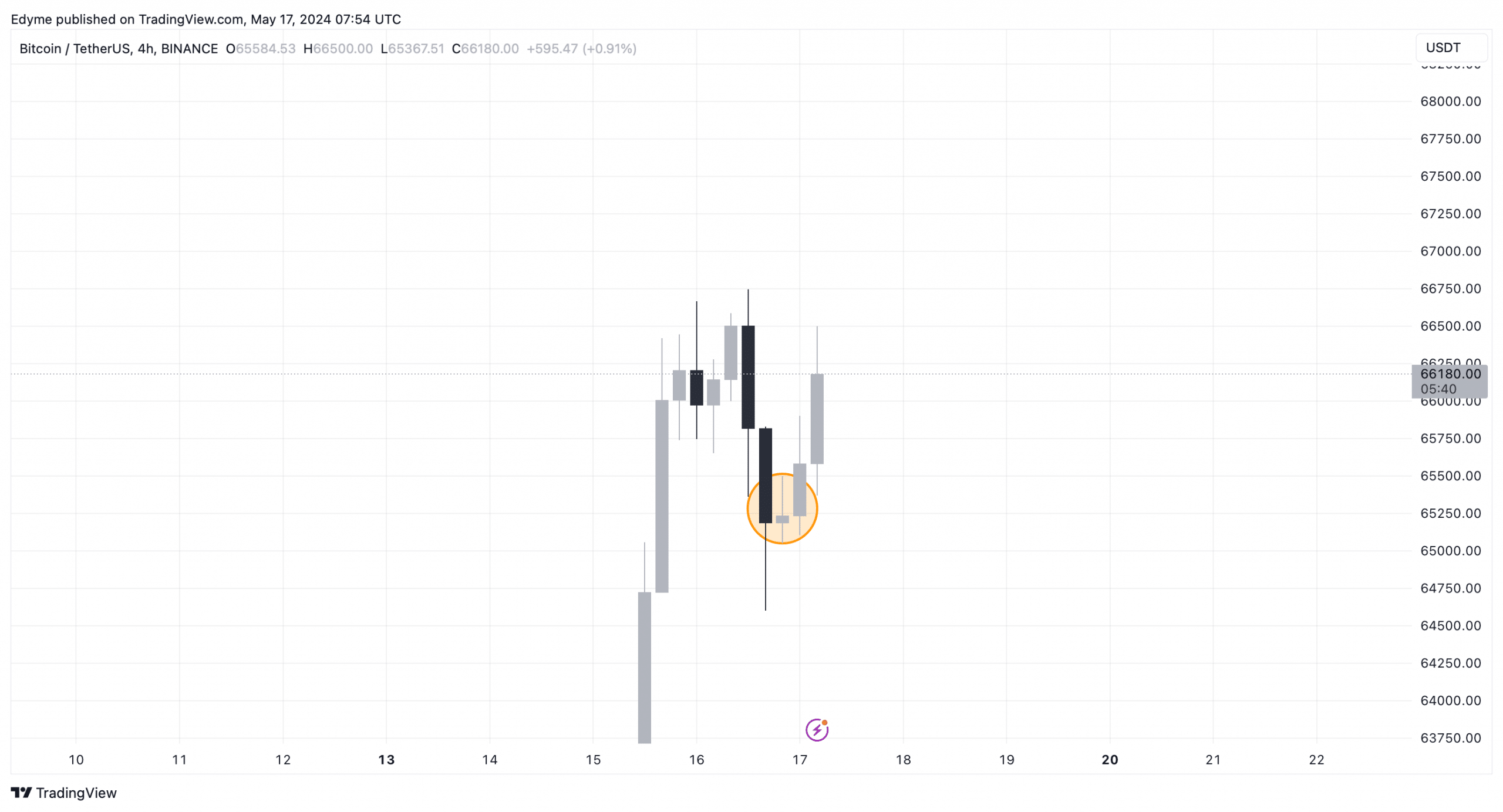

From a technical evaluation perspective too, Bitcoin’s chart on the 4-hour timeframe confirmed some promising indicators. The looks of a bullish deserted child sample adopted by a bullish engulfing candlestick that closes above its predecessor is a very optimistic bullish sign.

Supply: BTC/USDT, TradingView

These technical patterns align with Woo’s prediction, indicating that Bitcoin is perhaps gearing up for extra positive aspects. Notably, one of many catalysts behind BTC’s present bullishness is the discharge of the newest CPI information which was barely decrease than the anticipated 0.4%, as beforehand reported by AMBCrypto.