- USDT led the market at press time, with a commanding 70% share

- On the similar time, Bitcoin examined the essential $60k help degree.

Tether [USDT] commanded the stablecoin market with a commanding 70% share at press time, whereas USDC held the second spot at 20.8%.

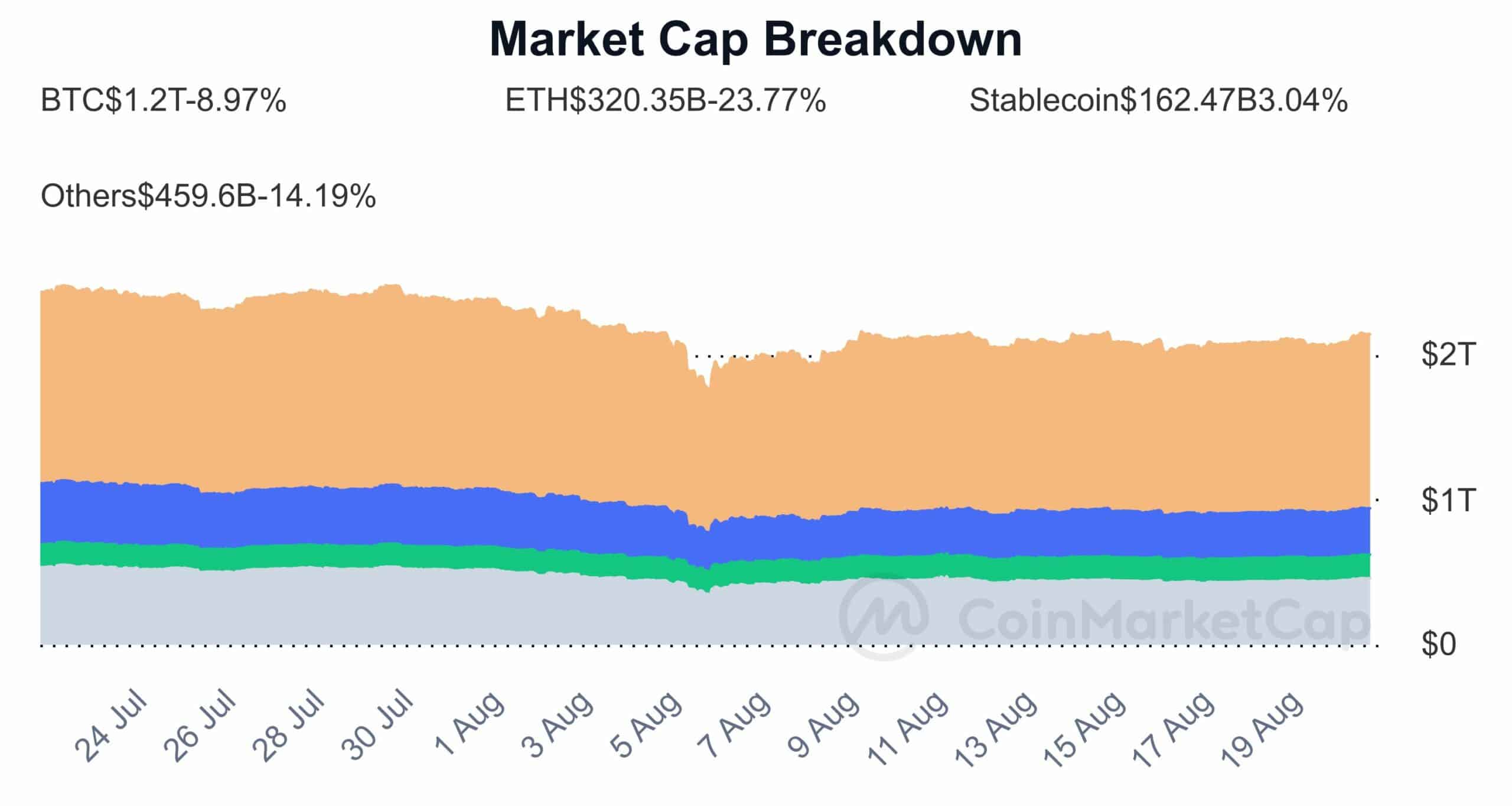

So, with a complete market capitalization of $168 billion, stablecoins make up 8.2% of all the cryptocurrency market.

Simply as USDT reigns supreme amongst stablecoins, Bitcoin [BTC] continues to dominate the broader crypto panorama.

Given their substantial roles, any main actions by both might ship ripples throughout all the crypto world, making their actions a key space of curiosity for AMBCrypto.

USDT dominance might mood Bitcoin’s surge

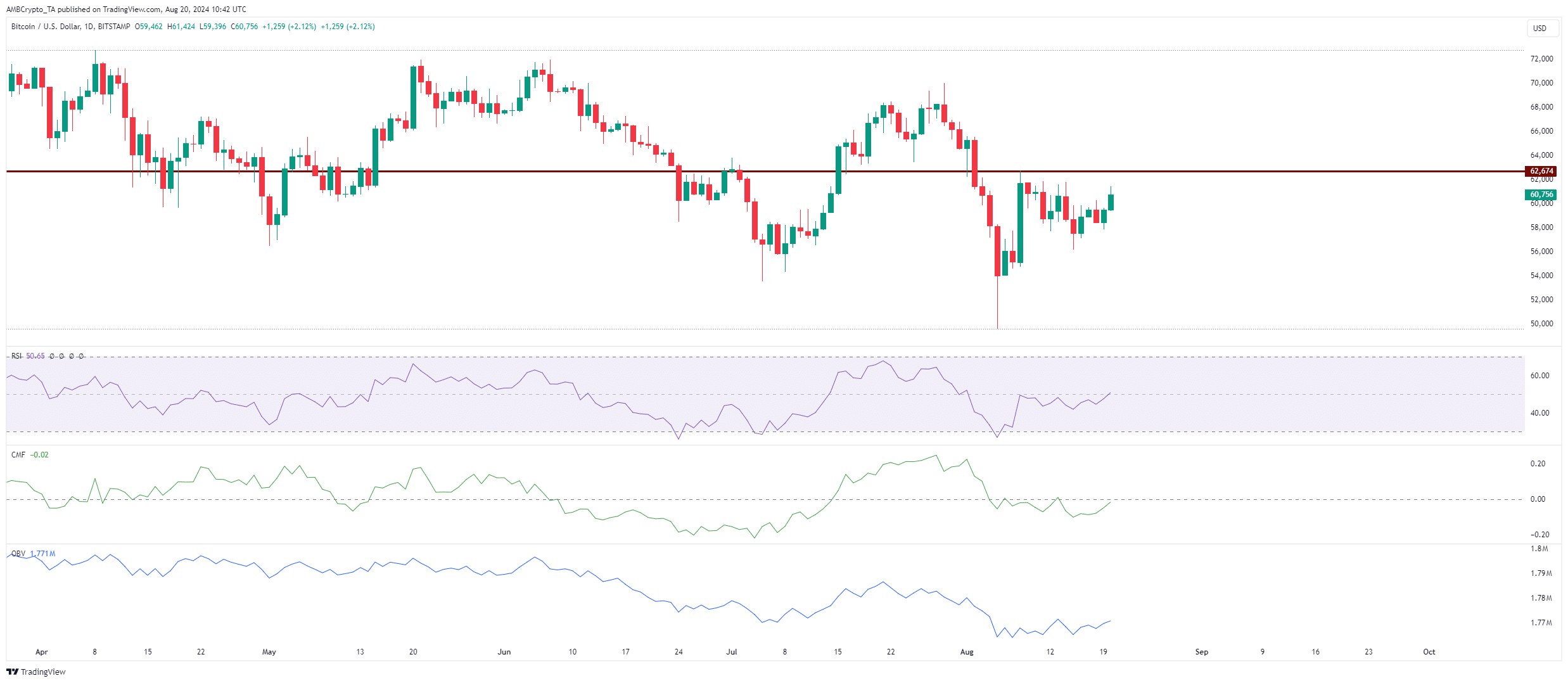

Bitcoin final examined the $60,000 help degree on the eighth of August, however bulls couldn’t maintain the worth. Since then, it has been consolidating for ten days straight.

Nonetheless, a vital bullish push has lifted Bitcoin out of consolidation, with its present value at $60,941.

In the meantime, AMBCrypto’s evaluation of a publish by the info analytics platform Alphractal on X (previously Twitter) uncovered a correlation between Bitcoin and stablecoins.

Supply : Alphractal /X

Traditionally, every time Bitcoin has examined a key resistance degree, it has coincided with a rise in stablecoin dominance.

Put merely, this implies that traders is perhaps turning cautious. By changing their holdings to stablecoins, they defend themselves from Bitcoin’s volatility.

In a separate evaluation, AMBCrypto explored whether or not the excessive USDT dominance might doubtlessly reverse engineer Bitcoin right into a downward pattern. The research revealed the next insights.

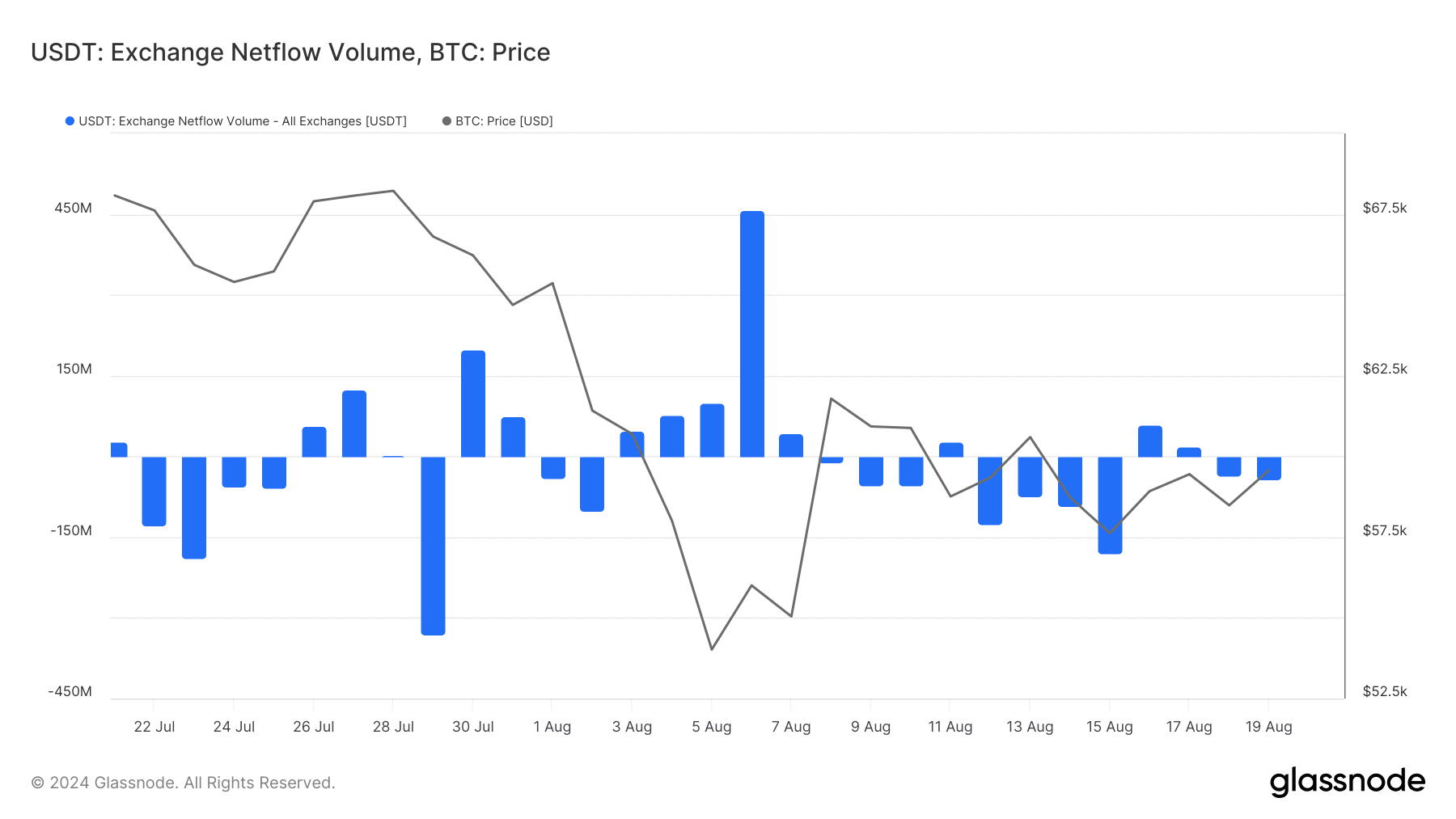

Supply : Glassnode

On the one-month chart, the overall change web stream of USDT slipped into the unfavorable zone, indicating that extra USDT was being withdrawn from exchanges than deposited.

As of the ninth of August, roughly 41 million USDT flowed out of exchanges, a notable enhance from the day gone by’s 35 million.

If this pattern continues, it might dampen Bitcoin’s value surge, doubtlessly stopping it from breaching the $62k resistance degree.

Supply : TradingView

Altcoin season may not take maintain if USDT dominates

In the identical publish, Alphractal concluded that the mixed dominance of Bitcoin and all stablecoins stood at 65.2%, indicating low curiosity in altcoins.

Unsurprisingly, Ethereum’s [ETH] value surged past $2,600. Following Bitcoin’s rise, it reached $2,651 at press time. Regardless of this, the altcoin season index remained bearish.

Learn Bitcoin’s [BTC] Value Prediction 2024-205

Information from CoinMarketCap revealed a putting pattern: whereas Ethereum’s market cap plummeted by 23.77% and Bitcoin’s by about 9% over the previous month, the stablecoin market cap really grew by 3.04%.

Supply : CoinMarketCap

This shift highlighted a rising confidence in stablecoins, which, if unchecked, might dampen the momentum of main cryptocurrencies.