Picture supply: Getty Photos

Since 11 October 2022, the Subsequent (LSE:NXT) share value has been the fourth-best performer on the FTSE 100. Overwhelmed solely by 3i Group, Marks and Spencer and Rolls-Royce Holdings, the retailer has managed to ship distinctive share value development by promoting mass-market-to-premium clothes and homewares.

Insider transactions

Nonetheless, over the previous three weeks, two of the corporate’s administrators have been decreasing the scale of their shareholdings.

In late September, Lord Wolfson, the chief government, bought 290,000 shares for £29.23m (£100.08 a share). On 9 October, Jeremy Stakol (and his spouse) disposed of £2.6m of inventory. The CEO of its Lipsy unit bought at a median value of £98.79.

As a shareholder, I attempt to ignore the commentary surrounding such gross sales.

There are numerous private the reason why somebody would possibly wish to eliminate their shares. And I don’t suppose it’s unreasonable for a person who has a big proportion of their wealth tied up in a single funding to — periodically — convert a few of it into money. In any case, you possibly can’t spend shares.

However as with so many issues in life, timing is the whole lot.

These disposals occurred after the corporate issued its half-year outcomes for its 2025 monetary 12 months (FY25). It issued one other earnings improve and now expects to report a FY25 revenue earlier than tax of £995m.

That’s most likely why — as I write (11 October) — the corporate’s share value stays above £100. Traders don’t seem like too alarmed by these insider transactions.

Contained in the boardroom

Like me, I think they’ve confidence within the management of Lord Wolfson. When he took over the operating of the enterprise in August 2001, he was the FTSE 100’s youngest CEO.

Again then, the corporate’s share value was round 940p. An funding of £10,000 on the time would now be price greater than £107,000. No marvel his whole remuneration bundle was £4.52m final 12 months.

After all, nothing is assured in the case of investing. Historical past doesn’t essentially repeat itself.

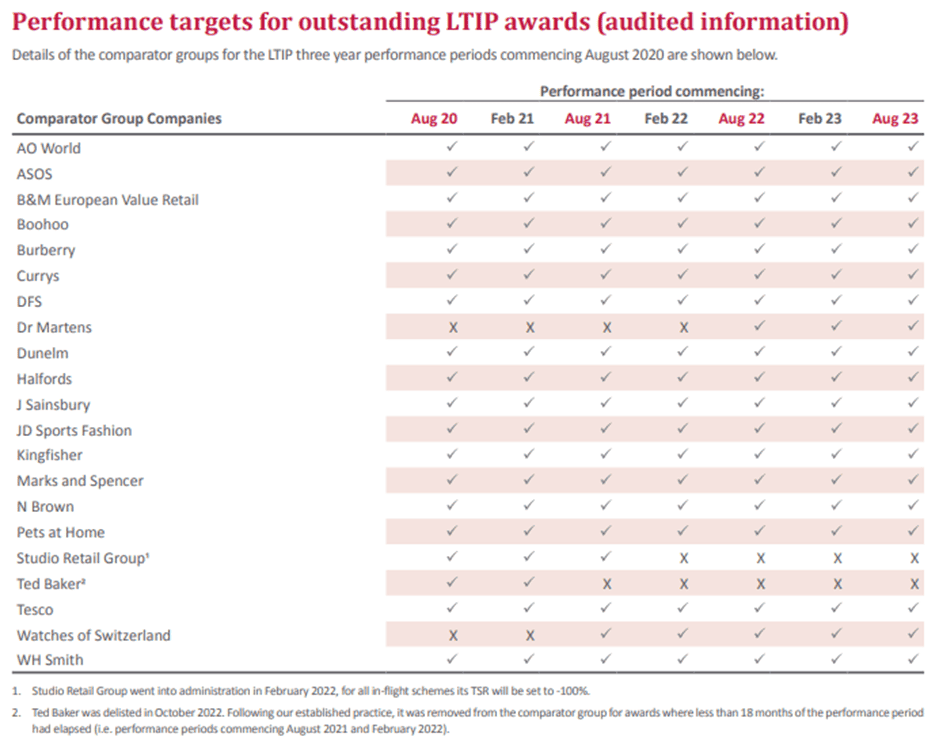

Nonetheless, all of Subsequent’s administrators are contributors within the firm’s long-term incentive plan. They obtain 100% of their bonus if the retailer can ship whole shareholder returns — over three years — better than 80% of 20 different listed “broadly comparable” companies.

This looks as if a wise metric for measuring efficiency. And it means the pursuits of the administrators are carefully aligned with mine.

Because the desk under exhibits, since August 2020, only a few have completed higher than Subsequent.

Regardless of the spectacular development in its share value and earnings, the inventory trades on an affordable ahead price-to-earnings ratio of 14.2.

Okay, it’s not in discount territory — it’s broadly in step with its common over the previous 20 years — however it suggests to me that the shares aren’t unreasonably priced.

Doable challenges

Nonetheless, holding its clothes related is a continuing problem. It’s additionally weak to the rise of ‘fast fashion’ and others producing low-cost imitations.

As well as, it’s closely uncovered to the home financial system — 84% of its income got here from the UK in FY24. A fall in disposable incomes would have an effect on its gross sales and earnings.

However over the previous twenty years, underneath Lord Wolfson’s stewardship, the corporate’s overcome many challenges. It’s completed higher than a lot of its rivals and I see no apparent purpose why this will’t proceed.