- BTC losses compounded detrimental sentiment on crypto bull run prospects

- Regardless of the drawdown, analysts urged that the market hasn’t topped.

Bitcoin [BTC] posted extra losses on Monday, twenty fifth June, sliding to $58.6K through the intra-day buying and selling session as market sentiment dropped.

The de-risking was additionally evident throughout US spot BTC ETFs, which recorded the seventh day of outflows totaling $174.45 million on Monday.

The detrimental sentiment has worsened with the pending BTC provide overhang from Mt. Gox, German authorities, and BTC miners.

On Monday’s sell-off, over 57K BTC, or $3.4 billion value of the king coin, was dumped. This begs the query: Is the crypto bull run over?

Is the crypto bull run over?

Because the market chief, BTC’s motion gauges the tempo and state of the crypto bull run.

Apparently, historic analysis of its RSI (Relative Energy Index) urged extra room for a bull run. RSI tracks shopping for and promoting power available in the market.

Per X (previously Twitter) consumer and analyst TechDev_52, the RSI channel, which has precisely flashed the market high and backside, was but to flash a high as of this writing.

Supply: X/TechDev_52

From the chart, a retest of the RSI channel marked the underside of the market, whereas a surge to the highest vary corresponded with the market’s high.

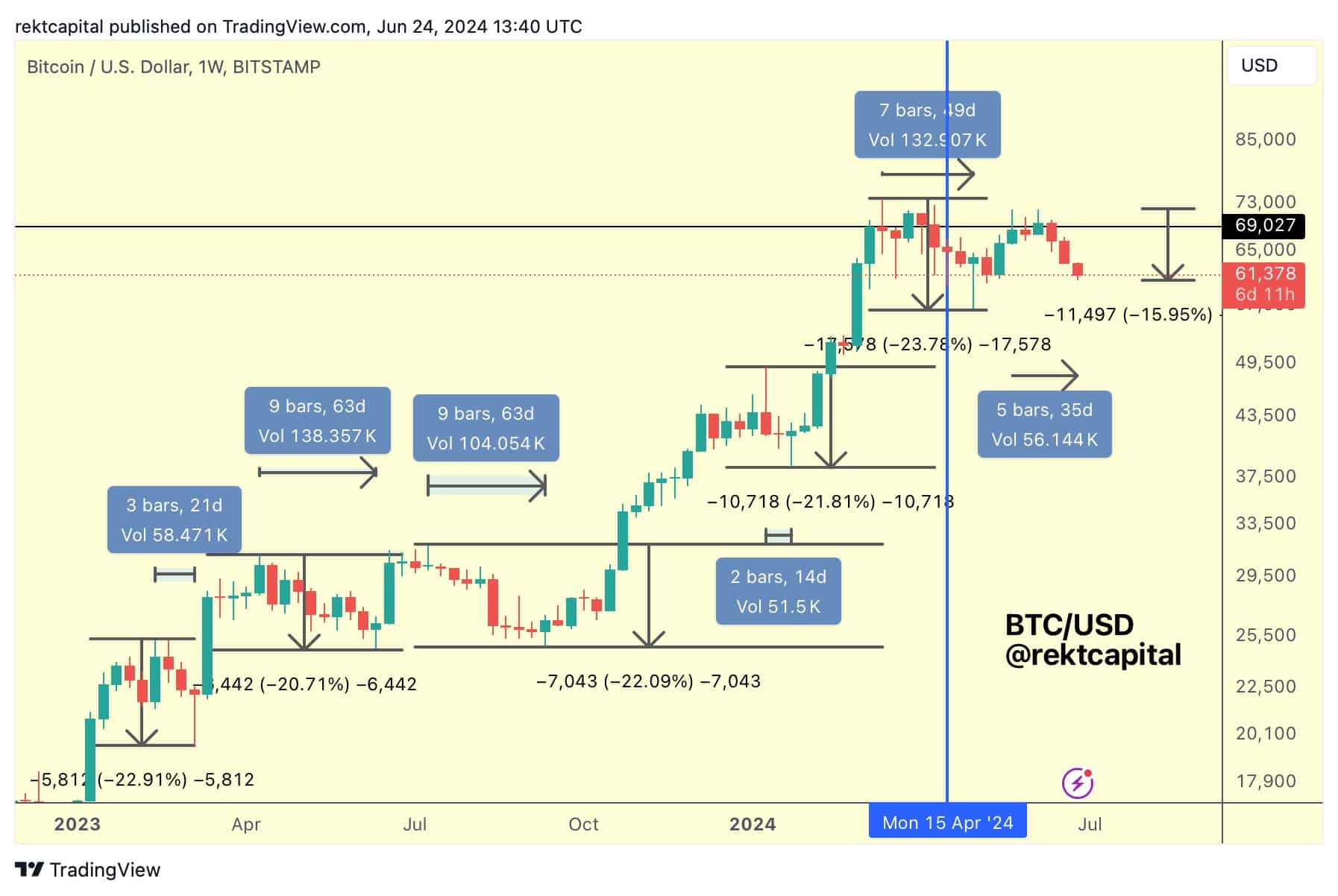

Nonetheless on the value charts, one other market cycle analyst, Rekt Capital, additionally downplayed the current BTC retracement fears. He famous that,

‘The average retrace depth is -22%. The average retrace length is 42 days. This current pullback is -16% deep and 35 days long. This current retrace is not even an average one in depth nor length yet’

Supply: X/Rekt Capital

One other on-chain knowledge level additionally urged the crypto bull run wasn’t over but.

The Market Worth to Realized Worth (MVRV) Z rating, which gauges the BTC market high and backside from a long-term perspective, was additionally but to flash a high sign.

Typical, the market high adopted after the metric hit the worth above 6 (marked pink) or the trending resistance.

Supply: Glassnode

That mentioned, the short-term BTC headwinds from the availability overhang linked to Mt. Gox and others may delay a robust uptrend. Nonetheless, the long-term projection urged extra room for the crypto bull run to increase.