- Market tendencies favor Ethereum as ETF launch nears.

- The report confirmed a altering panorama in spot buying and selling quantity, choices, Futures, and perpetual contracts.

Cryptocurrency markets have skilled excessive volatility during the last two months. Market preferences are shifting, particularly for the reason that SEC accepted Ethereum [ETH] spot ETFs in Could.

With the anticipated launch of ETH spot ETFs, traders are getting more and more optimistic.

Though ETH ETFs have but to start out buying and selling, a report by Kaiko and a joint report from Block Scholes and Bybit confirmed altering market preferences.

A change in tendencies

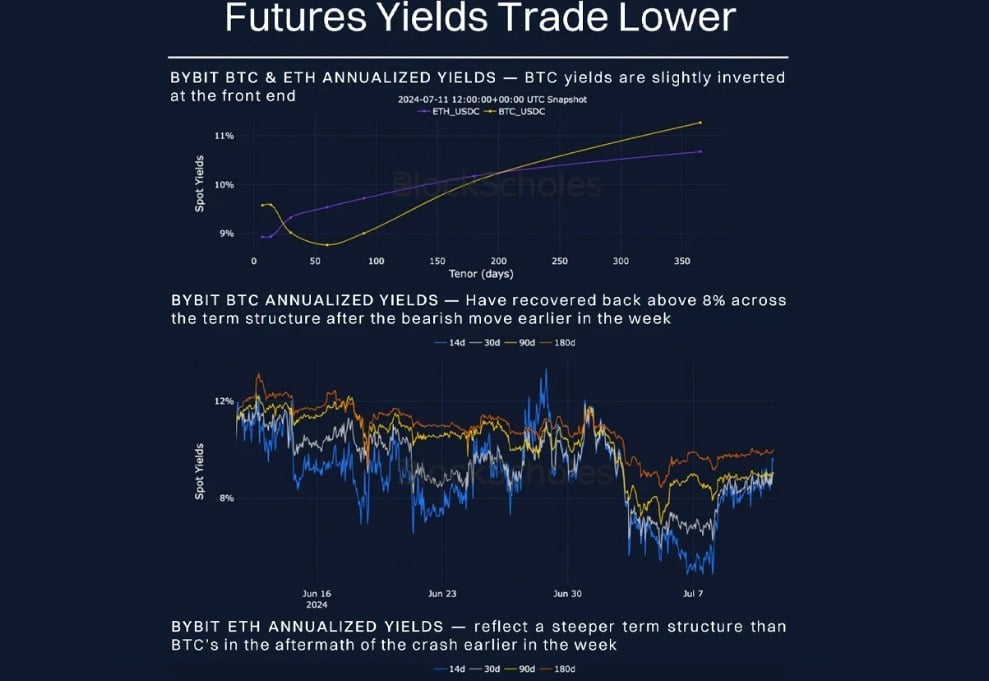

In accordance with the just lately launched report by Block Scholes and Bybit, there was a large panorama shift in spot buying and selling volumes, futures, choices, and perpetual contracts.

The report posited that Ethereum loved a greater volatility premium over Bitcoin [BTC]. This primarily arose from elevated tackle exercise and a optimistic market sentiment shift in the direction of ETH.

Supply: Blockscholes & Bybit

Ethereum positive aspects floor over Bitcoin

The ETH to BTC ratio has sustained a optimistic worth of 0.05 for the reason that approval of spot ETFs. This ratio is significantly larger than pre-approval ranges of round 0.045.

The upper ratio reveals that when the ETH spot ETFs begin to commerce, it’ll proceed to outperform BTC.

Supply: Kaiko

General market sentiment

ETH has gained greater than BTC in a number of areas for the reason that approval of ETH spot ETFs in Could.

Though the crypto market has skilled excessive volatility over the previous two months, ETH Futures have proven extra resilience and faster restoration than Bitcoin’s Open Curiosity.

ETH’s sooner restoration for its future advised a rising optimistic sentiment, with many traders assured in its future.

Supply: Blockscholes & Bybit

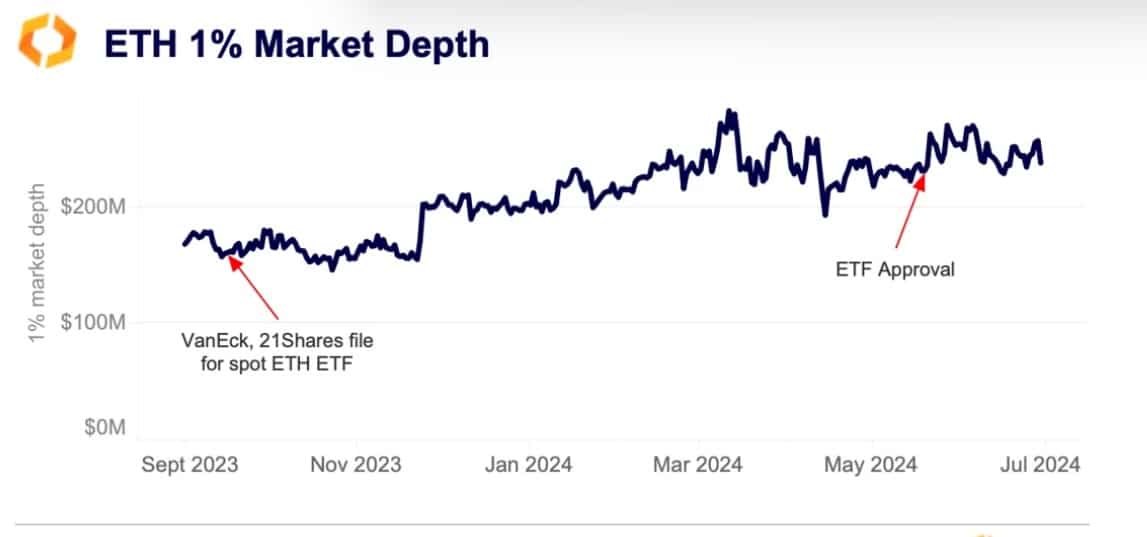

ETH’s buying and selling quantity has been sustained inside the identical vary since Could. In accordance with Kaiko, ETH’s liquidity has been sustained with 1% depth and a constant vary of $250M.

The ETF approval appears to have modified the development after dipping beneath $200M and reversed the development after SEC’s approval. Subsequently, the ETF anticipation has performed a important function in enhancing liquidity.

Supply:Kaiko

Moreover, ETH perpetual contracts have skilled elevated buying and selling quantity. The rise confirmed that traders had been keen to pay a premium to carry lengthy positions, which confirmed confidence in crypto’s future potential.

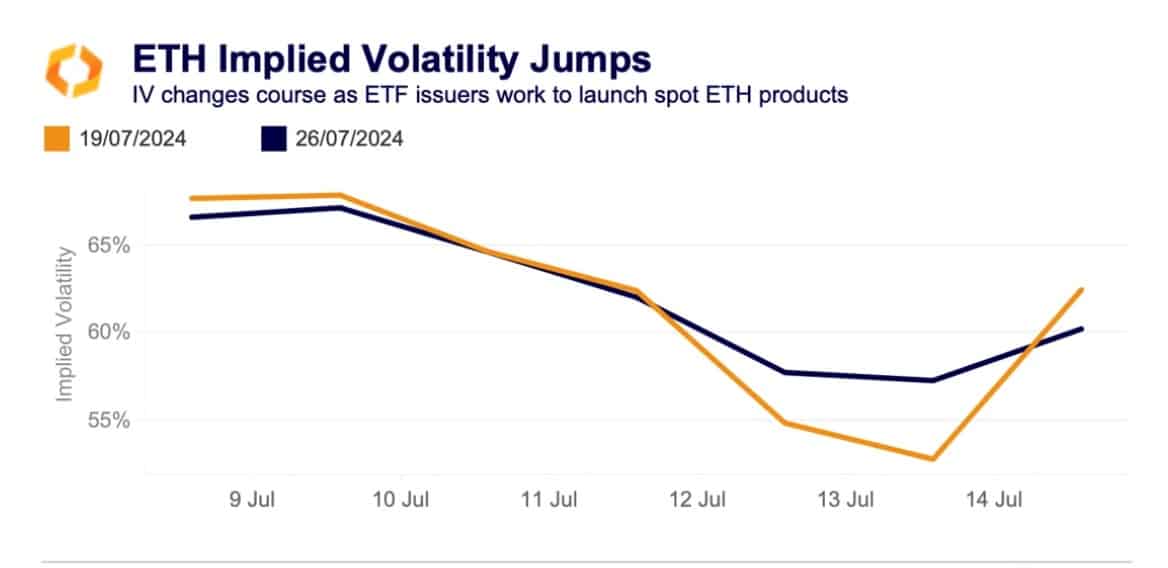

As reported by Kaiko, Implied Volatility surged over the previous seven days. As an illustration, ETH choices set to run out this Friday surged from 53% on the thirteenth of July to 62% at press time.

Learn Ethereum’s [ETH] Value Prediction 2024-25

The surge in these contracts implied that traders had been paying brief positions to guard themselves in opposition to value hikes within the brief run.

This market sentiment reveals appreciable optimism over ETH’s future, particularly with upcoming ETFs this week.

Supply: Kaiko