- Bitcoin ETFs noticed document inflows amid the broader market’s restoration, signaling investor optimism

- Political shifts are driving digital asset inflows, with Republicans seen as being pro-crypto

Amid a broader market restoration, Bitcoin [BTC] ETFs have been gaining traction currently with vital inflows – An indication of a constructive market pattern.

Bitcoin ETF replace

In line with Farside Buyers, Bitcoin ETFs recorded collective inflows of $371 million on 15 October.

Main the pack was BlackRock’s IBIT with $288.8 million, adopted by Constancy’s FBTC at $35 million. Moreover, Ark 21Shares’ ARK ETF reported figures of $14.7 million whereas lastly, Grayscale’s GBTC noticed inflows of $13.4 million.

Whereas some ETFs noticed no inflows, none reported outflows. This may be interpreted as reinforcing the rising curiosity in Bitcoin-based funding automobiles.

Actually, only a day in the past, Bitcoin ETFs recorded their highest single-day web inflows since June – A mixed worth of $555.9 million.

Main this momentum was FBTC which reported $239.3 million inflows – Its largest since 4 June. Moreover, GBTC additionally noticed renewed curiosity with figures of $37.8 million – Its highest since Might and marking its first constructive inflows in October.

This coincided with Bitcoin buying and selling at $67,823.08 on the charts, following a 3.56% hike in 24 hours and good points of 9.44% over seven days. As anticipated, this has fueled hypothesis that the crypto could also be gearing up for an additional all-time excessive.

CoinShares hyperlinks this to election – However why?

Apparently, CoinShares’ newest report additionally highlighted a notable uptick in digital asset inflows, totaling $407 million—A shift attributed to rising investor curiosity tied to a possible Republican win.

This current wave of capital is an indication of heightened curiosity in crypto, one pushed by expectations {that a} GOP-led administration may deliver favorable regulatory shifts to the trade.

The report famous,

“Digital asset investment products saw inflows of US$407m, as investor decisions have likely been more influenced by the upcoming US elections than by monetary policy outlooks.”

The agency supported its evaluation by stating that current inflows align carefully with political developments, quite than financial indicators.

Notably, stronger-than-anticipated financial information had minimal impact on halting prior outflows.

Actually, in response to CoinShares, this uptick in inflows was adopted by the current U.S. Vice Presidential debate. Following the identical, polling momentum shifted towards Republicans, seen as being extra supportive of digital asset initiatives.

Execs weigh in…

ETF Retailer President Nate Geraci supported this angle, highlighting that the outcomes of the U.S. elections may have a significant affect on the digital property trade’s future.

He stated,

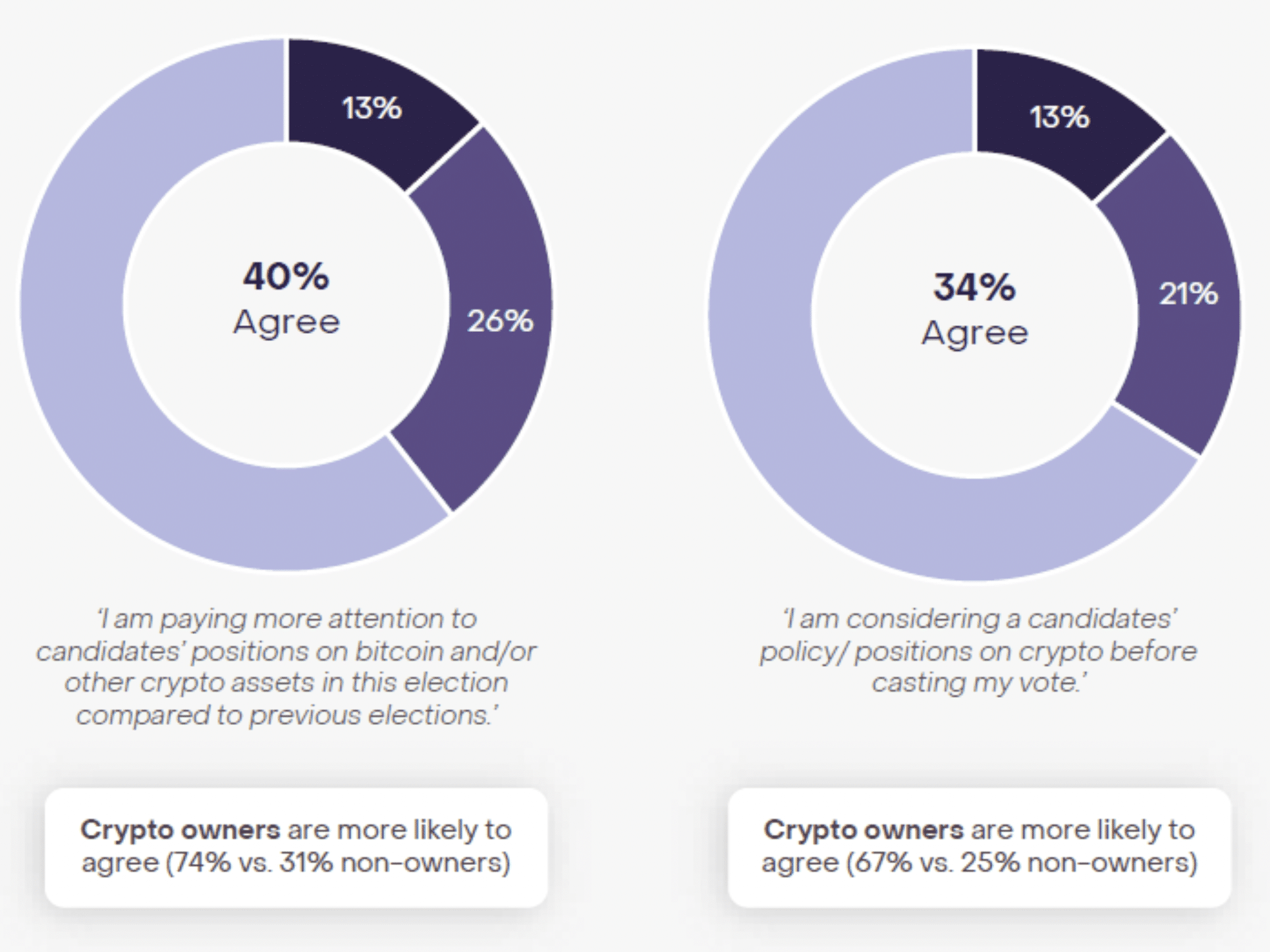

“46% agree that crypto & blockchain are future of finance. 34% said they were considering candidates’ crypto positions before voting.”

Supply: Nate Geraci/X

Geraci added,

“Becoming mainstream issue.”

Supply: Nate Geraci/X

Right here, Geraci highlighted insights from a current Ballot performed for Grayscale, one analyzing the interaction between cryptocurrency and the upcoming elections.

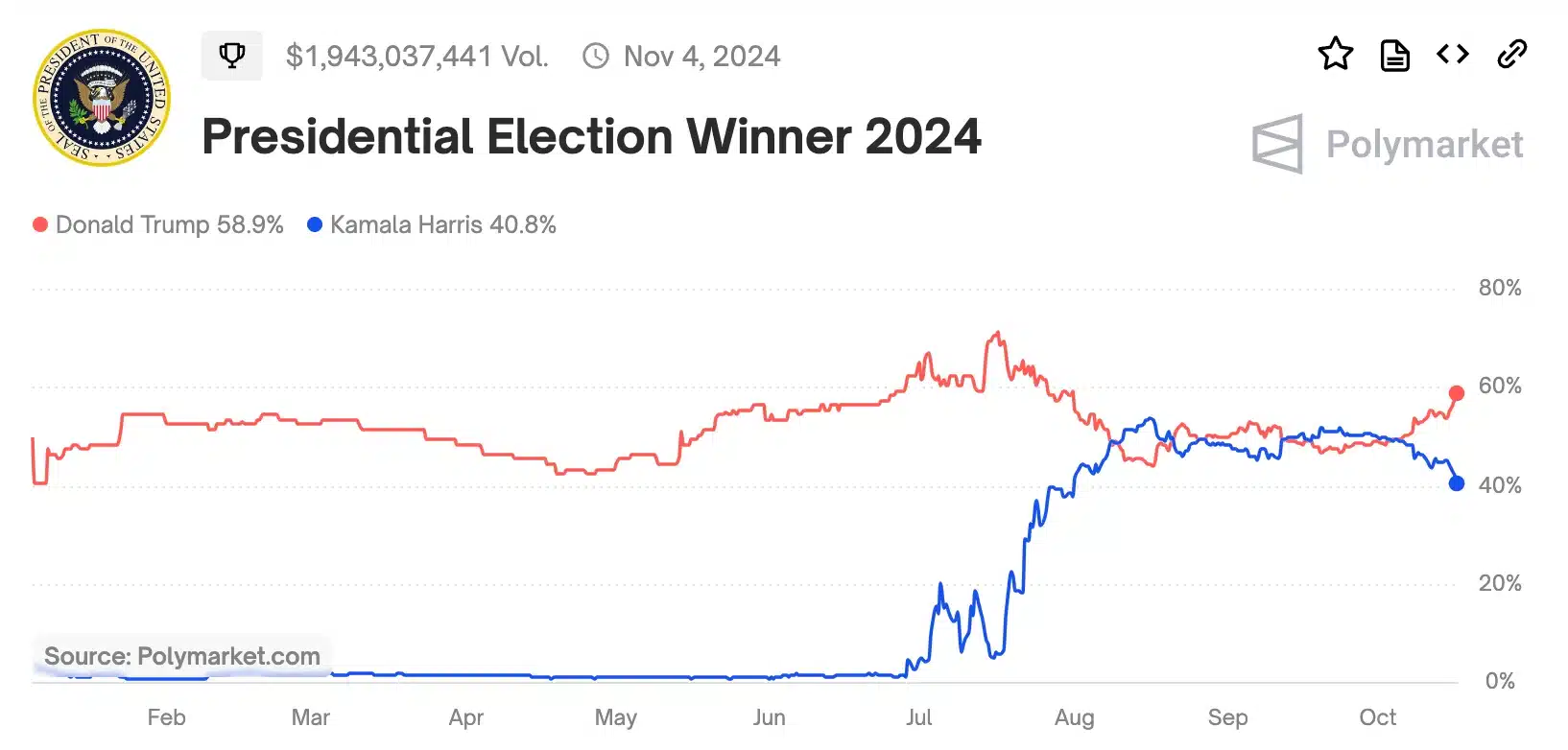

With Trump gaining traction because the Republican candidate on Polymarket, the ultimate stretch guarantees to deliver pivotal developments for the sector.

Supply: Polymarket