- Market analysts urged that Bitcoin could outpace altcoins because the BTC/ALT ratio reached historic ranges.

- Bitcoin additionally reached a brand new all-time excessive as trade reserves continued to say no.

Over the previous month, Bitcoin [BTC] has been the focus of market exercise, attracting each retail and institutional traders. This curiosity has pushed a 34.16% worth surge inside a month.

Prior to now 24 hours, BTC has gained an extra 1.06%, hitting a file worth of $94,002.87, at press time.

AMBCrypto’s evaluation identified that rising market developments and knowledge point out Bitcoin could possibly be on the verge of one other important upswing.

Analyst predicts potential upside for BTC

Fashionable crypto analyst Benjamin Cowen highlighted a crucial second for BTC, suggesting that Bitcoin could also be on the verge of one other important rally.

In keeping with Cowen, the ALT/BTC pair reached a valuation just like its degree on the twenty fourth of November 2020, simply earlier than a significant shift in liquidity from altcoins to BTC.

Historic knowledge exhibits that in 2020, this liquidity divergence propelled Bitcoin to new highs over 5 weeks, whereas altcoins largely stagnated.

Supply: X

Cowen notes the parallels, stating,

“The ALT/BTC pairs are at the same valuation today as they were in November 2020, right before the final drop of ALT/BTC pairs began.”

If the sample repeats, BTC might see a meteoric rise, establishing new highs as altcoins take a again seat through the anticipated shift.

Stablecoin minting might sign inflows to BTC

Current knowledge confirmed a major rise in stablecoin minting, with a complete market capitalization of USDT now reaching $128.90 billion, which is usually a bullish sign for the broader crypto market.

In a notable growth, Tether [USDT] lately minted one billion USDT on the Ethereum blockchain.

Such large-scale minting usually displays rising demand and is usually used to accumulate different cryptocurrencies by market members.

Given the current ALT/BTC sample, it’s doubtless that a good portion of this newly minted USDT will movement into Bitcoin if historical past repeats itself.

Falling trade reserves level to market shift

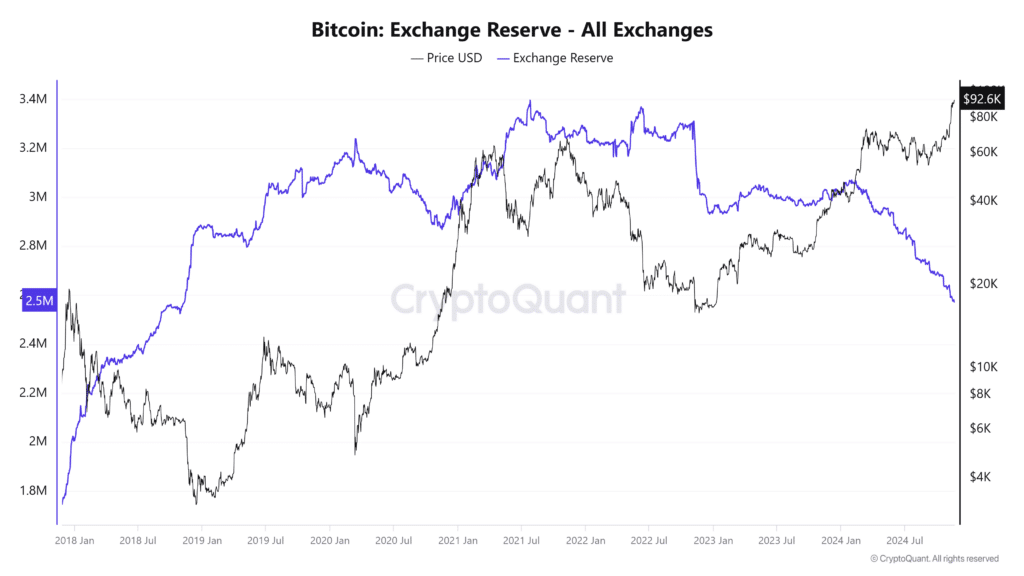

Information from CryptoQuant revealed a notable decline in Bitcoin trade reserves, with each day and weekly figures displaying decreases of 0.34% and 0.77%, respectively.

As of this writing, the overall Bitcoin reserve on exchanges has dropped to 2,572,477.995 BTC, marking its lowest degree since 2019.

Supply: Cryptoquant

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

A constant decline in accessible BTC on exchanges is usually thought of a bullish indicator, because it suggests market members are opting to carry their Bitcoin in non-public wallets relatively than promoting.

This shift displays rising confidence in Bitcoin’s long-term worth.