- Bitcoin topped $88K after an replace on Trump tariff plans.

- For prolonged restoration, the earlier help of $90K-$93K was an important hurdle to be cleared.

On Monday, Bitcoin [BTC] topped $88K following President Donald Trump’s ‘less severe’ tariff plans scheduled for April 2nd.

Initially, most macro analysts from QCP Capital and Coinbase had warned of potential draw back dangers in case of renewed tariff wars in early Q2.

Because of this, the aid BTC rally after final week’s Fed assembly was prolonged to $88K. Nevertheless, analysts have been nonetheless divided on the BTC’s potential restoration above $90K.

Blended Bitcoin projections

Bullish analysts cited technical charts and structural shifts, suggesting that BTC might reclaim $90K and an all-time excessive (ATH).

In reality, Bob Loukas, a dealer and analyst, famous that bulls have been in management and the rally might final 15 weeks, citing historic and structural shifts on value charts.

He mentioned,

“No real excuses left now for the bulls, the Cycle count is on their side. (Week 3)…If the bull market is in control we could move mostly up for 15 weeks.”

Supply: X

Arthur Hayes, founding father of BitMEX alternate, reiterated an analogous bullish outlook however cited the Fed’s shift from QT (quantitative tightening) to QE (quantitative easing) as a key catalyst.

He famous that BTC might faucet $110K and zoom to $250K earlier than retesting current lows at $76K.

“(Bitcoin) price is more likely to hit $110k than $76.5k next. If we hit $110k, then it’s yachtzee time, and we ain’t looking back until $250k.”

Nevertheless, others have been cautious or projected range-bound value motion for some time. On his half, BTC dealer, Cryp Nuevo, anticipated one other dip to the $80K space, citing a possible liquidity-driven hunt for cease losses beneath $83K.

Pseudonymous Glassnode researcher, VizArt, cautioned that an ATH could be a ‘pipe dream’ with out reclaiming $90K-$93K. He acknowledged,

“Most recent investors, who bought during Nov 2024 to Feb 2025, have a cost basis between $90k–$93k. Any bounce into this zone is likely to face selling pressure from those seeking to exit at break-even. Without reclaiming this supply zone, a new ATH remains a pipe dream.”

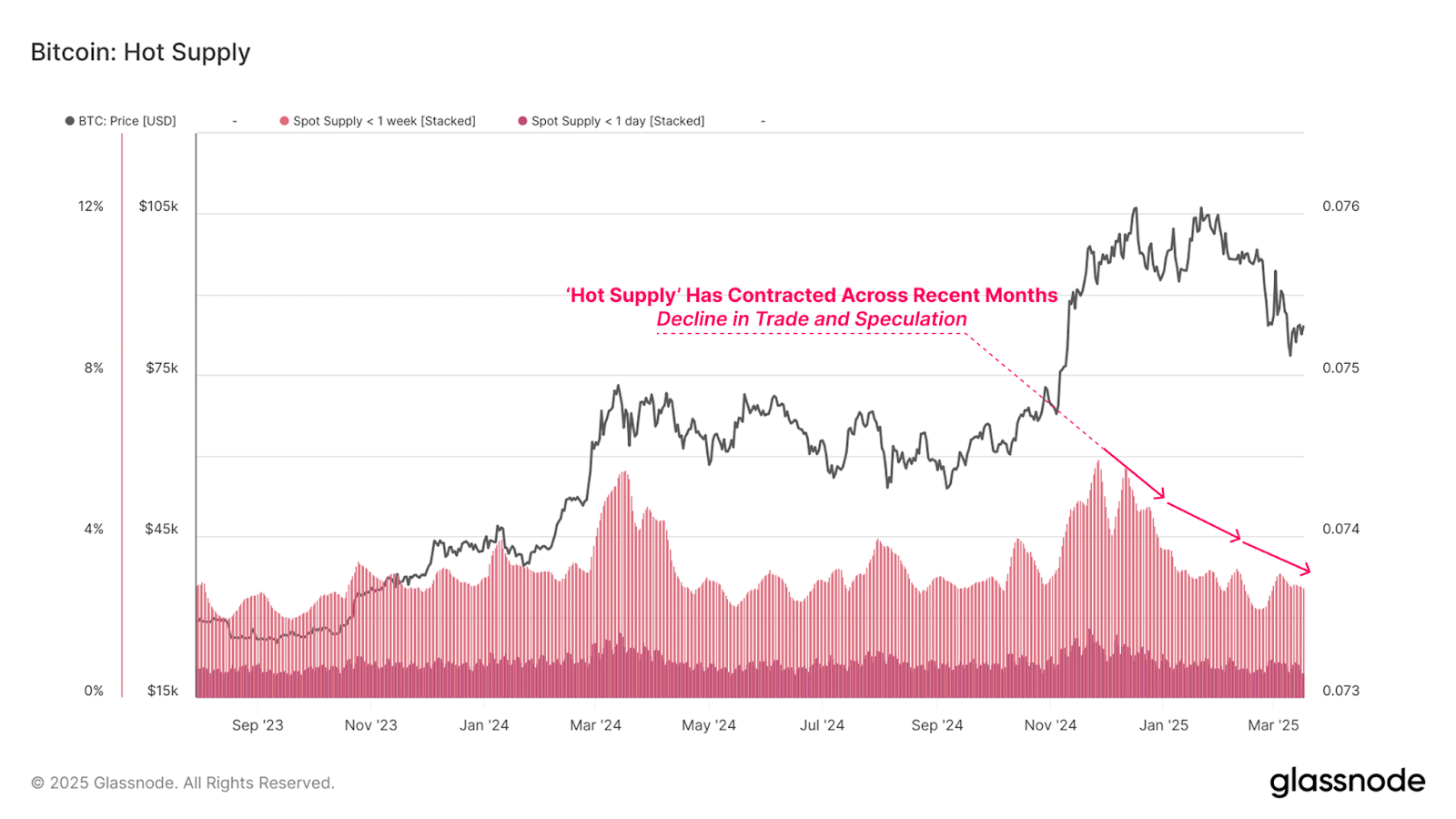

In accordance with Bitfinex analysts, BTC could possibly be caught in a range-bound value motion attributable to decreased speculative curiosity and exercise, citing Bitcoin’s sizzling provide. They acknowledged,

“A contraction in the Hot Supply metric—from 5.9 percent in December 2024 to 2.8 percent today—underscores the cooling of speculative participation.”

Supply: Glassnode

Per Bitfinex analysts, a sustained BTC restoration might solely be possible if there was macro readability and renewed ETF inflows.

The spot BTC ETFs noticed a $744M influx final week, breaking the 5-week outflow streak. However, it remained to be seen how BTC value would react to Trump’s April tariffs.