- Bitcoin, at $52,000, may symbolize the final golden alternative to buy.

- Giant merchants offloading their BTC holdings may drive the value right down to this essential assist degree.

For the reason that starting of the month, Bitcoin [BTC] has did not exhibit any vital market actions. After reaching a peak of $59,844.10, it has declined to $56,855.25, a transparent indicator of the market’s rising bearish development.

The persistence of bearish pressures could in the end function a strategic benefit for buyers trying to accumulate at decrease costs.

Golden alternative at $52k

Crypto analyst Carl Runefelt has recognized a essential sample in BTC’s current buying and selling exercise. Based on his evaluation, BTC was oscillating inside a descending channel, characterised by a sideways and downward trajectory.

Traditionally, when an asset trades inside such a sample, an additional decline is anticipated.

True to kind, BTC has recorded a 4.62% drop over the past week, with indications that it could proceed to slip to the channel’s decrease boundary.

What makes this situation significantly compelling is the convergence of the channel’s backside with a significant assist zone at $52k.

Ought to BTC’s worth hit this degree, it may set off a big breakout from the descending channel and propel the asset towards new highs.

Supply: X

Runefelt views this situation as a essential shopping for alternative, remarking,

“It could be our last golden opportunity to accumulate it this cheap.”

So, BTC is unlikely to revisit these ranges as soon as it begins its upward trajectory. This prompted AMBCrypto to look at the likelihood of BTC’s worth dipping additional.

Buyers heed Bitcoin’s bearish name

AMBCrypto’s evaluation revealed that giant holders and institutional merchants had been anticipating an additional drop in BTC costs, as evidenced by vital sell-offs out there.

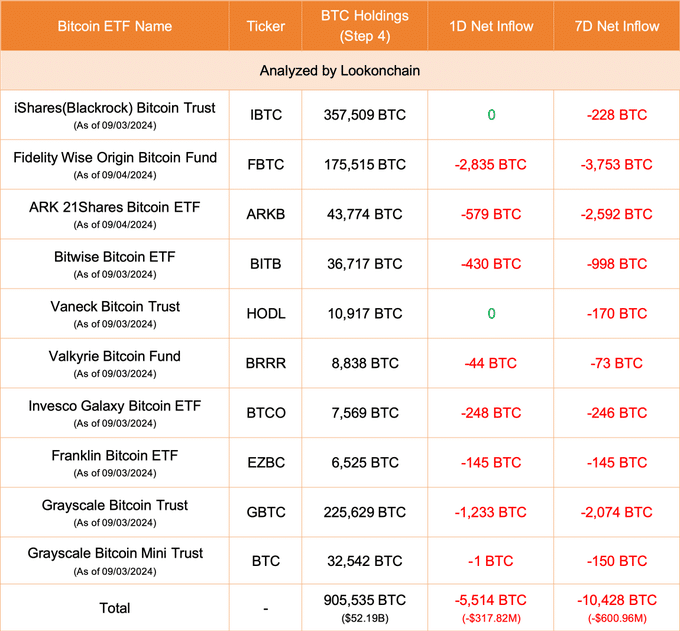

Information from Lookonchain indicated a considerable outflow from BTC spot ETF corporations—primarily catering to institutional buyers—over the previous 24 hours and week.

Particularly, withdrawals totaled 5,514 BTC ($317.82 million) and 10,428 BTC ($600.96 million), respectively.

Supply: X

Additional reporting by Lookonchain highlights actions by Ceffu, a digital asset administration agency, which transferred 3,063 BTC price $182 million final week into Binance [BNB].

This prompt a technique that endorses gross sales over long-term holdings.

Such strikes sign a shift in the direction of much less unstable property, like USD, as buyers search to protect capital worth.

If these tendencies proceed, a dip for BTC to the essential $52k degree, aligning with the underside of the buying and selling channel, seems more and more possible.

Bigger holders in a bearish outlook

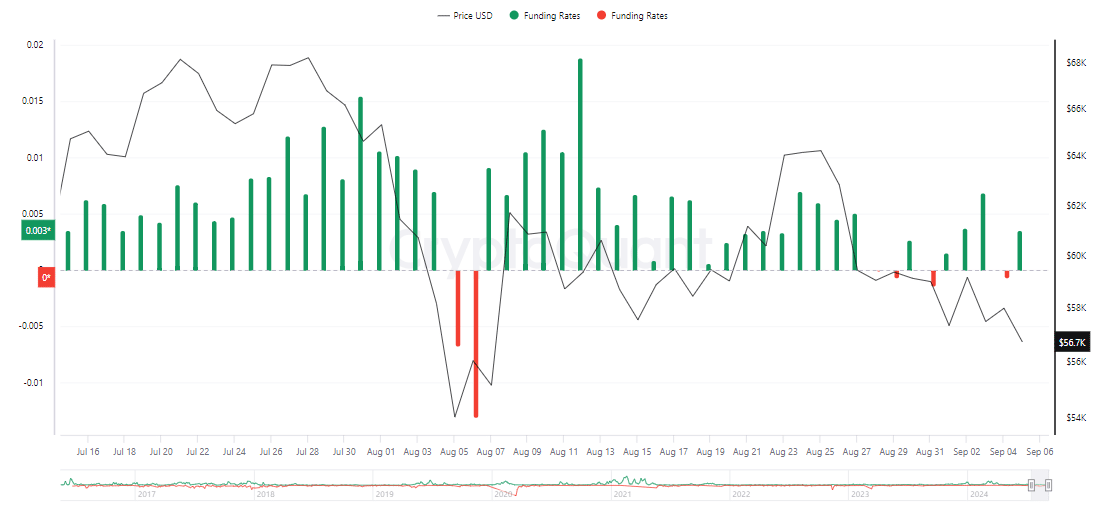

CryptoQuant reported a rising bearish sentiment amongst retail merchants. The Funding Charge has steadily declined for the reason that third of September, dropping from 0.006839 to a press time studying of 0.004357.

Supply: CryptoQuant

If this development continues over consecutive days, it may sign an additional lower in BTC from its present degree.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

The Open Curiosity supported this attitude, displaying a decline towards the bottom level recorded on the first of September. Based on Coinglass, at press time, there was a modest 0.58% drop up to now 24 hours.

Persistent bearish strain is more likely to cut back additional the Open Curiosity, which might immediately affect BTC’s worth, doubtlessly driving it decrease from its present place.