- BTC was approaching its resistance close to its 200-day easy shifting common.

- Promoting stress on the coin elevated within the final 24 hours.

Bitcoin [BTC] has been on a rising development, and the king coin was approaching a vital resistance. The newest evaluation revealed that it’s crucial for the coin to go above that stage with the intention to enter an precise bull market.

Bitcoin approaches a vital resistance

After every week of enhance, BTC confronted a slight correction. To be exact, BTC’s worth elevated by over 5% within the final seven days. However within the final 24 hours, the king coin’s worth dropped marginally.

On the time of writing, BTC was buying and selling at $63,037.03 with a market capitalization of over $1.25 trillion.

Within the meantime, Axel, a well-liked crypto analyst, posted a tweet revealing an attention-grabbing growth. As per the tweet, it was essential for Bitcoin to show its 200-day easy shifting common (SMA) resistance into its new help.

If that occurs, then solely we might enter an precise bull market, as per the tweet. At press time, Bitcoin was testing the resistance.

Due to this fact, AMBCrypto deliberate to have a more in-depth take a look at the coin’s state to see how seemingly it’s for BTC to show this resistance into its new help.

Supply: X

What’s subsequent for BTC?

As per our evaluation of CryptoQuant’s information, promoting stress on BTC was rising. As an example, BTC’s alternate reserve was rising. The coin’s internet deposit on exchanges was additionally excessive in comparison with the final seven day common.

These two metrics indicated that promoting stress on Bitcoin was excessive. Moreover, the coin’s aSORP was additionally purple. This advised that extra buyers had been promoting at a revenue. In the midst of a bull market, it may well point out a market prime.

Supply: CryptoQuant

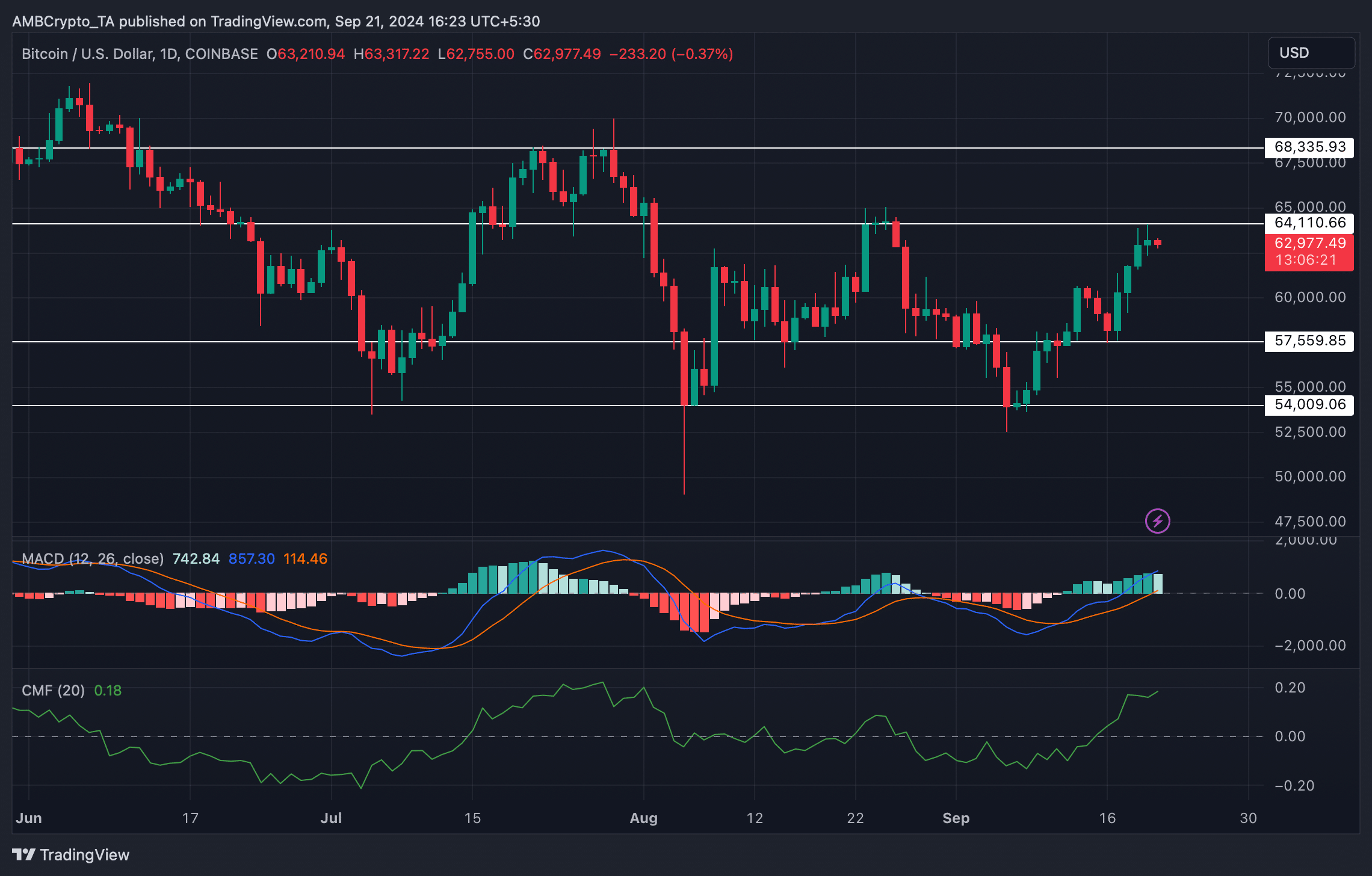

We then took a take a look at BTC’s every day chart to see whether or not it’s poised for a worth correction. We additionally discovered that BTC was approaching a resistance close to $64k. The excellent news was that the MACD displayed a bullish benefit available in the market.

Furthermore, the Chaikin Cash Circulate (CMF) additionally supported the bulls because it moved up, hinting at a breakout above the resistance.

Supply: TradingView

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

Aside from this, Hyblock Capital’s information additionally revealed that BTC’s method in direction of $64k was clear as liquidation would solely rise at that stage. Typically, a hike in liquidation ends in short-term worth corrections.

However, within the occasion of a bearish takeover, it gained’t be shocking to see BTC fall to $57k once more.

Supply: Hyblock Capital