- Bitcoin neared a decline under $50k for the primary time since February.

- International inventory markets plummeted amidst Japan and Taiwan’s inventory market crash.

The crypto market has witnessed an enormous decline over the previous 24 hrs. With the market dip, Bitcoin [BTC] has skilled the biggest hit.

As of this writing, BTC is buying and selling at $50436 after a 16.21% decline on every day charts, with a 27% drop on weekly charts.

This huge decline has left merchants and analysts speculating over BTC’s future and the reason for the huge worth drop.

Bitcoin to drop under $50k?

After dropping at $53k, buyers holding lengthy positions of over $600 million had been pressured out, leading to an enormous $300B in whole crypto market decline.

In an extra decline to $50k, greater than $6B lengthy positions had been pressured out of their positions. The worth decline has heightened bearish sentiment, with merchants scrambling to purchase the dip.

In response to information from sentiment, the dialogue of shopping for the dip has spiked. Nevertheless, the information reveals buyers and merchants are much less within the dip.

Supply: X

The decline has elevated buying and selling quantity by 127.75%, additional pushing costs down. The elevated buying and selling quantity outcomes from huge sell-offs as holders promote and shut their positions.

Elevated gross sales end in stress, which negatively impacts worth charts. Thus, emotional promoting and concern of additional decline are pushing merchants to shut their positions at a loss.

Exterior macroeconomics driving BTC

Supply: X

Over the previous seven days, world markets have confronted concern of recession following Federal Reversal’s failure to chop charges.

With the rising U.S. money owed, the crypto markets have skilled greater outflow, particularly from ETFs ensuing from market uncertainty.

Moreover, the Japanese market has despatched shock waves to the crypto market following a crash of over 8% in 24 hrs. Analysts like Marty Social gathering famous on X that,

“Japan rugpulled the world.”

Due to this fact, though the crypto market has tried to carry sturdy over the previous weeks, the plunging world inventory markets have pushed BTC down. Spectator Index reported the state of affairs in Japan reporting that,

“Japan’s stock market falls over 4,000 points, the biggest single-day drop.”

As an example, Japan purchased up the Magnificent 7 and the SPY; thus, such a market crash would have an enormous impression on BTC and the entire crypto market.

Other than Japan, Taiwan’s inventory market has suffered its worst day in 57 years. With elevated fears of a recession within the U.S. financial system, futures are plummeting.

What worth charts recommend

Over the previous 24 hrs, BTC has declined by 17%, thus persevering with a month-long decline. Over the previous 30 days, BTC has declined by 5%, leading to a market cap drop under $1T to $990B, based on CoinMarketCap.

Supply: TradingView

Thus, AMBCrypto’s evaluation confirmed that BTC was experiencing a powerful downward momentum.

The crypto’s Directional Motion Index (DMI) confirmed a sustained downtrend, with the optimistic index at 26 sitting under the unfavorable index at 29.

Additionally, On Steadiness Quantity has declined over the 24 hrs, suggesting the crypto was experiencing sturdy promoting stress.

Supply: Coinglass

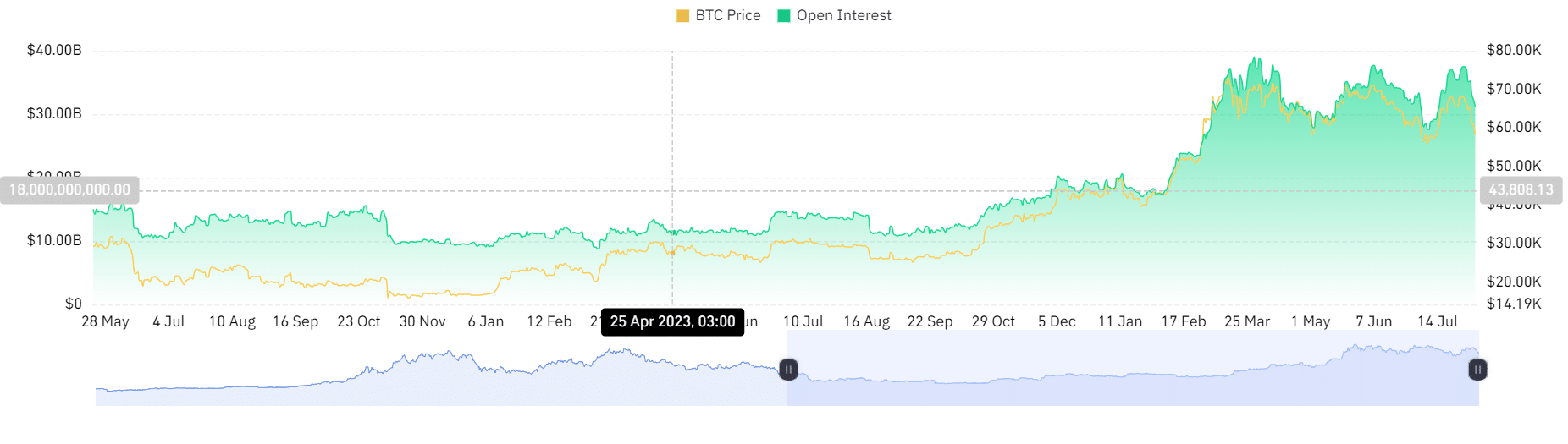

Trying additional, ABCrypto’s evaluation of Coinglass confirmed that its Open Curiosity had declined from $37B to $31B. Such a decline in Open Curiosity reveals that leveraged positions are forcefully closed.

Traders betting on worth will increase are closing their positions at a loss with out opening new ones.

Supply: Coinglass

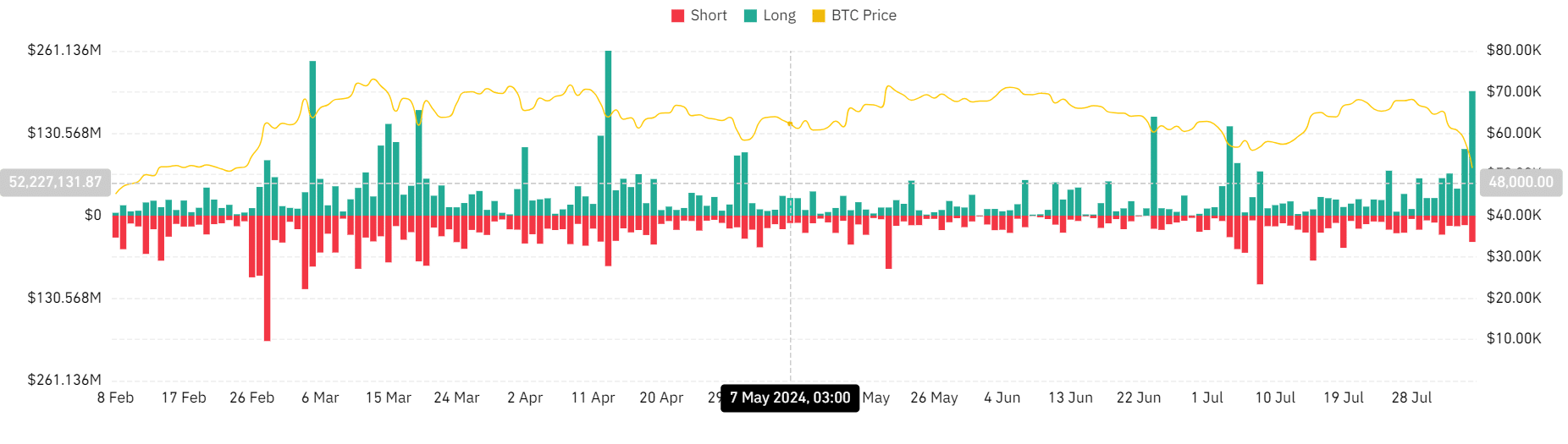

This phenomenon is additional strengthened by elevated liquidation for lengthy positions. Liquidation for lengthy positions has elevated from $105M to %200M on every day charts.

This recommended that the holders are unwilling to carry their positions as they lack confidence in BTC’s present path.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Will BTC decline under $50k?

BTC has declined from $66k to $50k during the last week. With elevated monetary market considerations and bearish sentiment, the crypto market is ready for a risky August.

Due to this fact, if the prevailing market situations persist and BTC closes under $50670 on every day charts, it can discover its subsequent help round $47779.