- International liquidity surged, with an annualized fee of over 6%

- Bitcoin appeared set to make a brand new all-time-high.

The rising international financial liquidity, which is at an annualized fee of over 6%, marked the quickest progress since April 2022. That is set to impression Bitcoin [BTC].

The upward development is following a four-year cycle, just like the one seen in April 2020. This rising liquidity is prone to increase threat asset costs, together with Bitcoin, over the medium time period.

Central banks, together with the Federal Reserve and ECB, are anticipated to implement fee cuts within the coming weeks, signaling the beginning of the worldwide easing cycle.

Nevertheless, short-term headwinds stay, significantly with the continuing “unfavorable Fed liquidity environment” and a possible enhance within the USD power.

The approaching weeks might current golden alternatives, significantly for Bitcoin.

BTC’s cup & deal with sample

The surge in international liquidity will considerably impression Bitcoin’s value. Bitcoin is forming a large cup-and-handle sample, with a breakout anticipated round mid-September, probably throughout or after the Fed’s assembly.

This might set off a significant rally, signaling the beginning of what analysts are calling the 2024-2025 Bitcoin bull run. Buyers are inspired to carry onto their BTC and put together for this upward momentum.

Supply: TradingView

If Bitcoin breaks its ATH, the value may surge in direction of $100,000, particularly if political occasions like a Trump win materialize, as some analysts recommend.

Nevertheless, if BTC encounters rejection close to its ATH, analysts might want to conduct additional evaluation, however the general bias stays bullish.

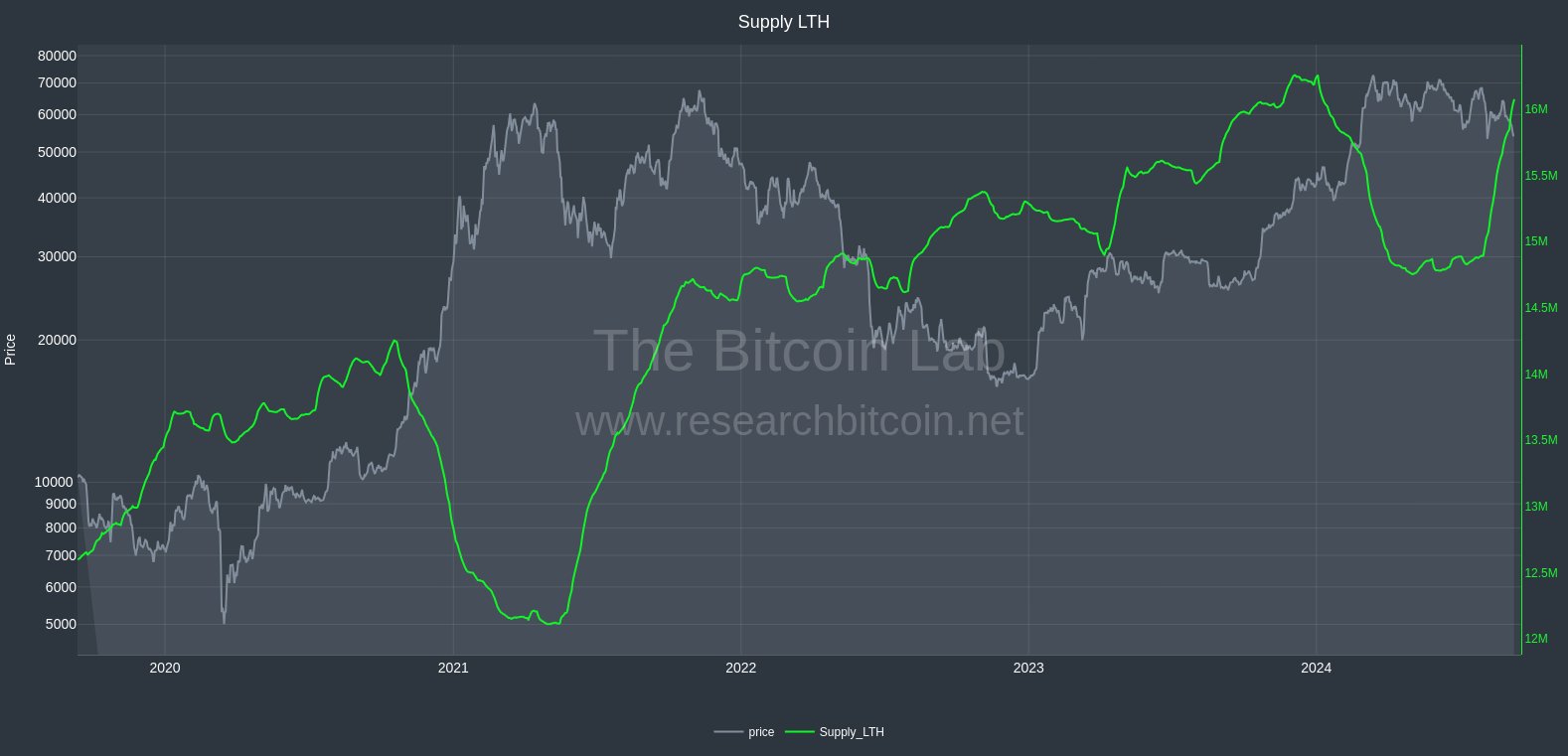

Lengthy-term holder provide

One other bullish indicator is the Bitcoin long-term holder provide, which is nearing a brand new ATH.

Till press time, long-term holders have saved 16.13 million BTC for greater than 155 days, with the earlier ATH reaching 16.29 million BTC in December 2023.

This sturdy accumulation by long-term holders, together with establishments, alerts that core stakeholders stay dedicated, reinforcing the chance of BTC heading larger within the coming months.

Supply: The Bitcoin Lab

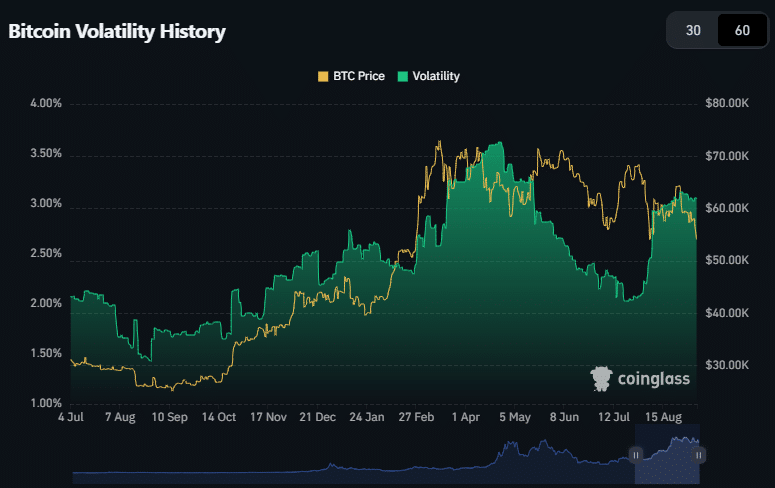

Bitcoin volatility and Funding Charges

Bitcoin’s volatility ranges have additionally returned close to cycle highs, which may very well be each optimistic and adverse for merchants.

Whereas leveraged merchants would possibly face challenges, long-term holders see this as a promising signal of upcoming value actions.

Though volatility stays decrease than 2021 ranges, it is going to probably enhance as institutional gamers re-enter the market.

Supply: Coinglass

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

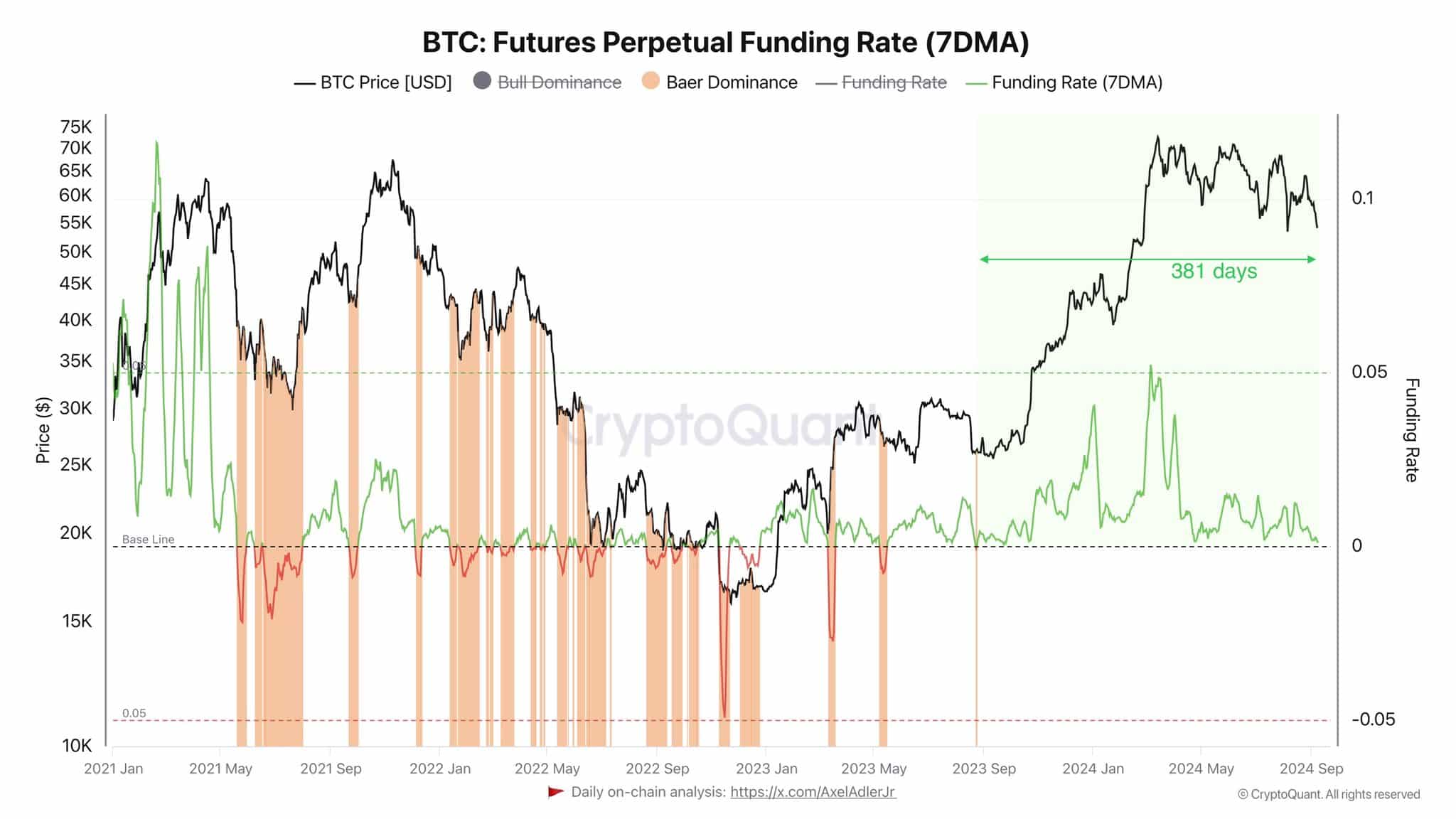

Bitcoin’s Funding Charges have stayed bullish for over a 12 months, supporting expectations of a robust value rise.

Bulls have dominated the Futures marketplace for 381 days. Rising international liquidity will probably preserve pushing Bitcoin’s value larger within the close to future.

Supply: CryptoQuant