- Bitcoin’s worth elevated by over 3% within the final 24 hours.

- Market indicators appeared bullish on BTC.

Bitcoin’s [BTC] demand has been on the rise for almost all of the time since its inception. This was evident from the rise within the variety of addresses holding 1 BTC.

Nonetheless, for the reason that coin has restricted provide and the variety of addresses holding 1 coin is growing, BTC may quickly face promoting stress.

Bitcoin traders are rising

On the thirtieth of June, IntoTheBlock revealed that the variety of addresses holding 1 BTC had risen to the coveted 1 million mark.

The tweet additionally talked about that institutional traders had been growing their tempo of accumulating BTC. Nonetheless, since BTC has a restricted provide, the large gamers may as properly select to promote their holdings and earn a revenue.

Due to this fact, AMBCrypto deliberate to try BTC’s shopping for and promoting stress to gauge what’s happening within the minds of holders.

Per our take a look at CryptoQuant’s information, BTC’s Fund Premium was crimson at press time, which means that institutional traders had been promoting BTC. Its aSORP was additionally crimson, suggesting that extra traders had been promoting at a revenue.

In the midst of a bull market, it might point out a market prime.

Nonetheless, shopping for sentiment round BTC was dominant, as its Change Netflow Complete had declined, in comparison with the final seven-day common.

Issues within the Futures market additionally appeared fairly optimistic, as BTC’s Taker Purchase Promote Ratio was inexperienced. This meant that purchasing sentiment was dominant within the derivatives market.

Supply: CryptoQuant

What to anticipate from BTC?

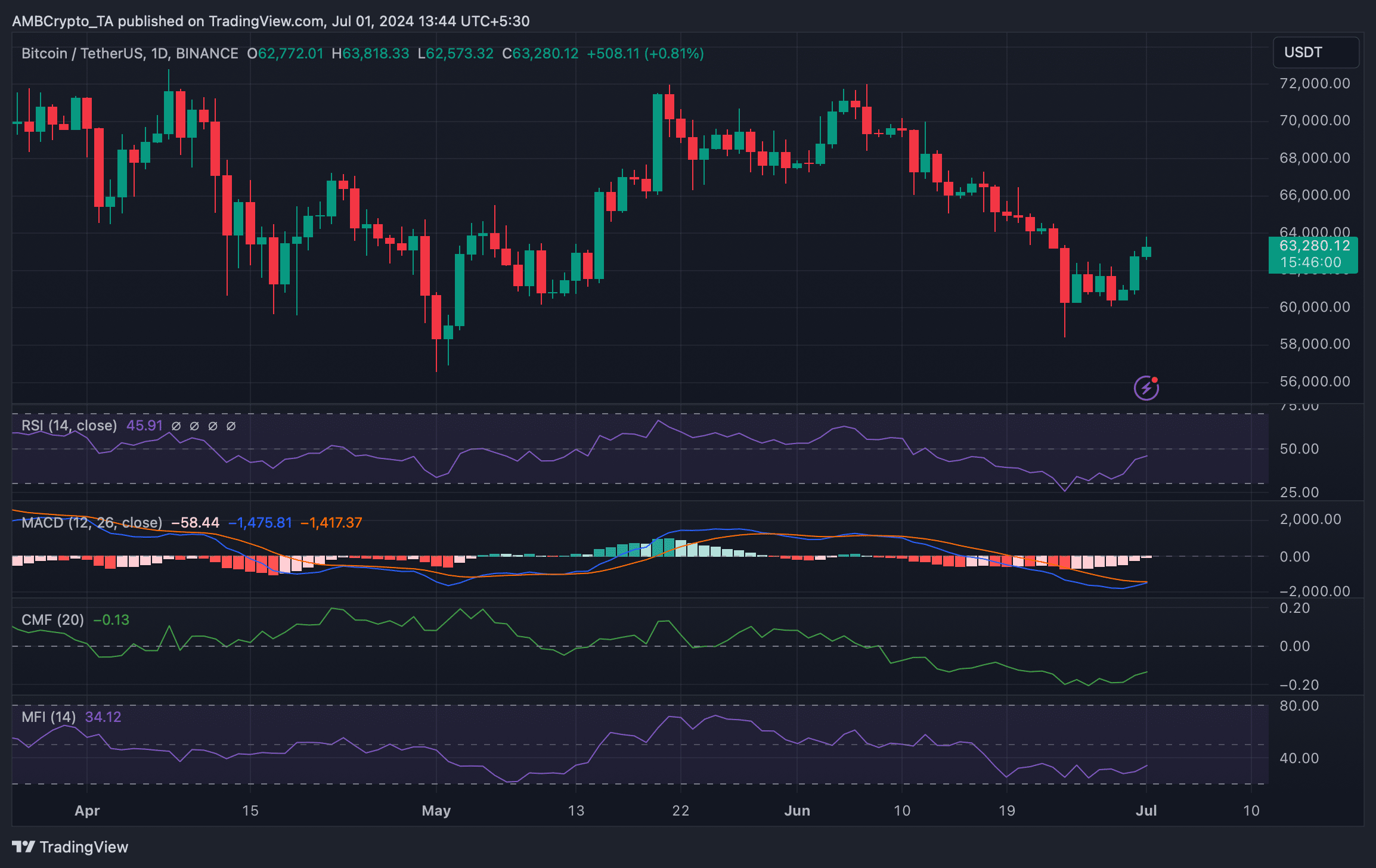

AMBCrypto then analyzed Bitcoin’s every day chart to grasp how the promoting and shopping for stress was affecting the coin’s worth. We discovered that a lot of the market indicators appeared fairly optimistic.

For example, the MACD displayed the opportunity of a bullish crossover. Its Relative Energy Index (RSI) registered an uptick and was headed in the direction of the impartial mark of fifty.

The Cash Circulation Index (MFI0) additionally moved upward. At press time, it had a worth of 34, which means that extra money was flowing into BTC.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

On prime of that, the Chaikin Cash Circulation (CMF) additionally adopted the same growing development. These indicators advised that the probabilities of BTC’s worth shifting up had been excessive.

On the time of writing, BTC was up by over 3% within the final 24 hours and was buying and selling at $63,199.90.

Supply: TradingView