Picture supply: Getty Pictures

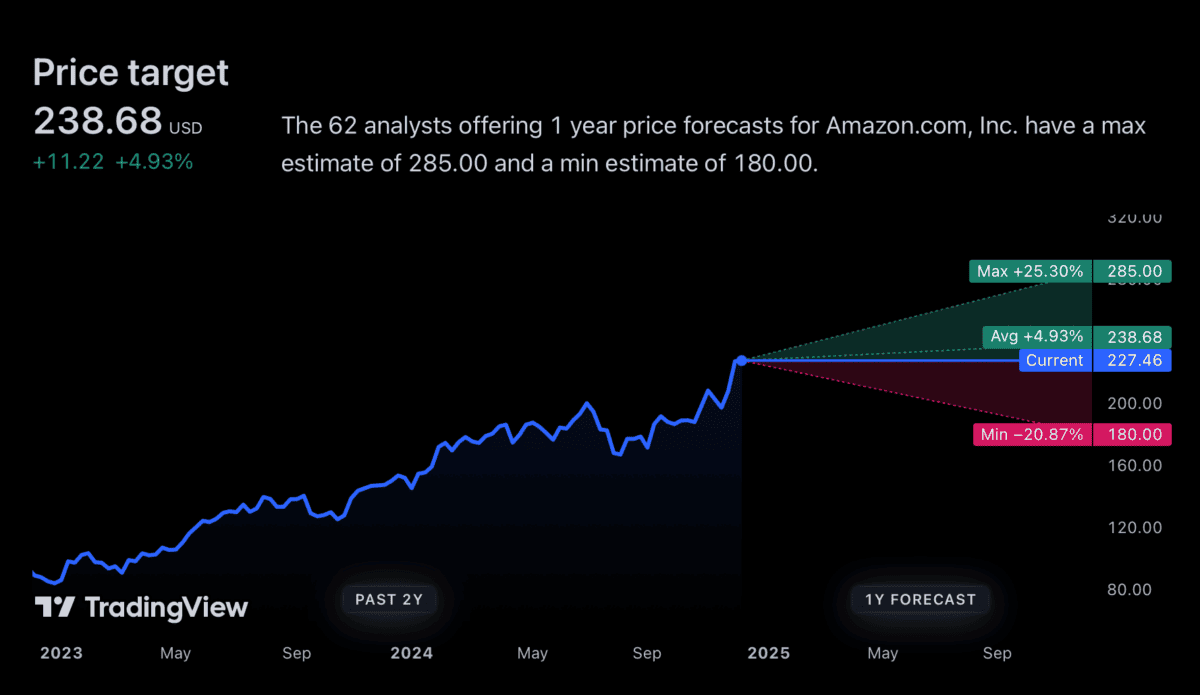

The Amazon.com (NASDAQ:AMZN) share value has comfortably outperformed the S&P 500 this 12 months. However analysts predict a extra subdued efficiency in 2025.

The common value goal for Amazon over the subsequent 12 months is 5% increased than the present stage – beneath expectations for the index. However I believe the corporate’s newest innovation may give the inventory a lift and that makes it value contemplating for buyers on the lookout for shares to purchase.

Promoting automobiles

There are just a few issues individuals can’t purchase on Amazon. Till just lately, that included automobiles, however the firm has just lately expanded into permitting individuals to purchase automobiles by means of its platform.

Up to now, the one producer on the platform is Hyundai, however extra corporations are anticipated to hitch in 2025. And there are potential advantages for either side. Itemizing by means of Amazon may assist sellers entry an even bigger buyer base. And for {the marketplace}, it may generate revenues with little or no by means of related prices.

Up to now, so good. However promoting automobiles on-line has been tried earlier than and the dealership mannequin has confirmed onerous to disrupt. So is there any motive to assume it’s going to succeed this time?

Scale

Success isn’t assured, but it surely doesn’t value Amazon a lot to attempt the thought out and it does have begin by way of what may doubtlessly be the largest impediment. The problem is scale.

The operation wants each consumers and sellers, however attracting one with out the opposite’s onerous. Distributors are unlikely to checklist in locations individuals don’t look and consumers received’t search in locations that don’t have many automobiles.

Amazon although, has a bonus right here. Its market already attracts a big variety of customers and it would be capable of use this to assist it persuade producers to checklist on its platform.

If it will probably do that, having extra consumers ought to carry extra sellers and the cycle continues. In order an Amazon shareholder, I believe there are motive to imagine that is at the least value exploring.

Dangers

It’d prove that even the mighty Amazon can’t disrupt the prevailing method of shopping for and promoting automobiles. However even when it fails, I’m not anticipating a big hit by way of returns.

When it comes to funding dangers, I’m way more centered on the opportunity of the corporate attracting antitrust consideration. This has been a difficulty for Alphabet this 12 months and I believe the chance is actual.

Amazon works so nicely as a result of the varied bits of its community help one another. {The marketplace} attracts customers to different providers, that are the principle revenue engines for the enterprise.

Both one with out the opposite could be a a lot weaker – and a a lot much less enticing funding. So that is the place I believe the true risk to Amazon is over the approaching 12 months.

Price a glance?

I believe the transfer into promoting automobiles is one thing of a shot to nothing. I don’t anticipate a big downside if it fails and if it succeeds it might be a really good addition.

In my opinion, the corporate’s in a greater place than anybody else to make promoting automobiles on-line work. And I believe it may enhance the Amazon share value in 2025.