- Mt. Gox has begun repaying collectors who suffered losses when it collapsed in 2014

- Ethereum fell to an intraday low of $2,825 and appeared to be on the right track for 4 consecutive day by day crimson candles, at press time

Bitcoin, the world’s largest cryptocurrency, crashed to its lowest stage since February earlier right now because the market reacted to information of exercise round a Mt Gox-linked pockets. In reality, such was the dimensions of the crash that BTC fell under $55,000 on the value charts, down over 9% on the weekly charts.

It wasn’t alone although, with Ethereum taking BTC’s lead. It recorded worse losses too, with ETH dipping under $3,000 to hit an intraday low of $2,820.

Whale exercise additionally contributed to the losses

Ethereum’s freefall additionally seems to have been exacerbated by whales promoting important Ethereum (ETH) quantities to repay money owed on their sunk bets.

In reality, on-chain information useful resource LookOnChain revealed that ETH’s value declines posed liquidation dangers to Ethereum whales who longed ETH by way of Aave and Compound. As an example, the instrument tracked an handle promoting 26,600 ETH to repay a debt on Aave in a submit on X.

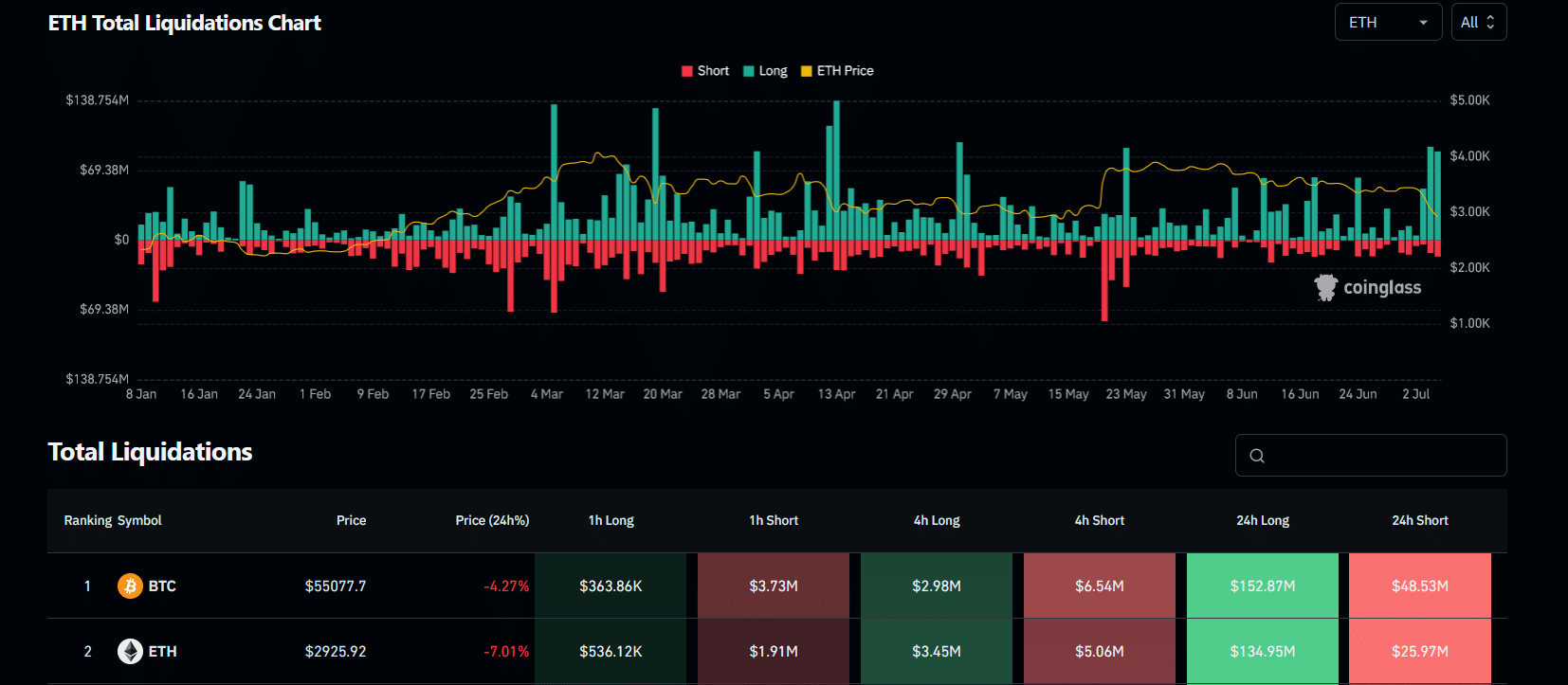

Liquidations

As anticipated, Friday’s market massacre resulted in practically $650 million price of cryptos, together with $537 million in bullish bets, being liquidated in simply 24 hours.

Supply: Coinglass

Over $130 million price of ETH lengthy positions have been forcibly closed within the 24 hours resulting in press time too.

Supply: Coinglass

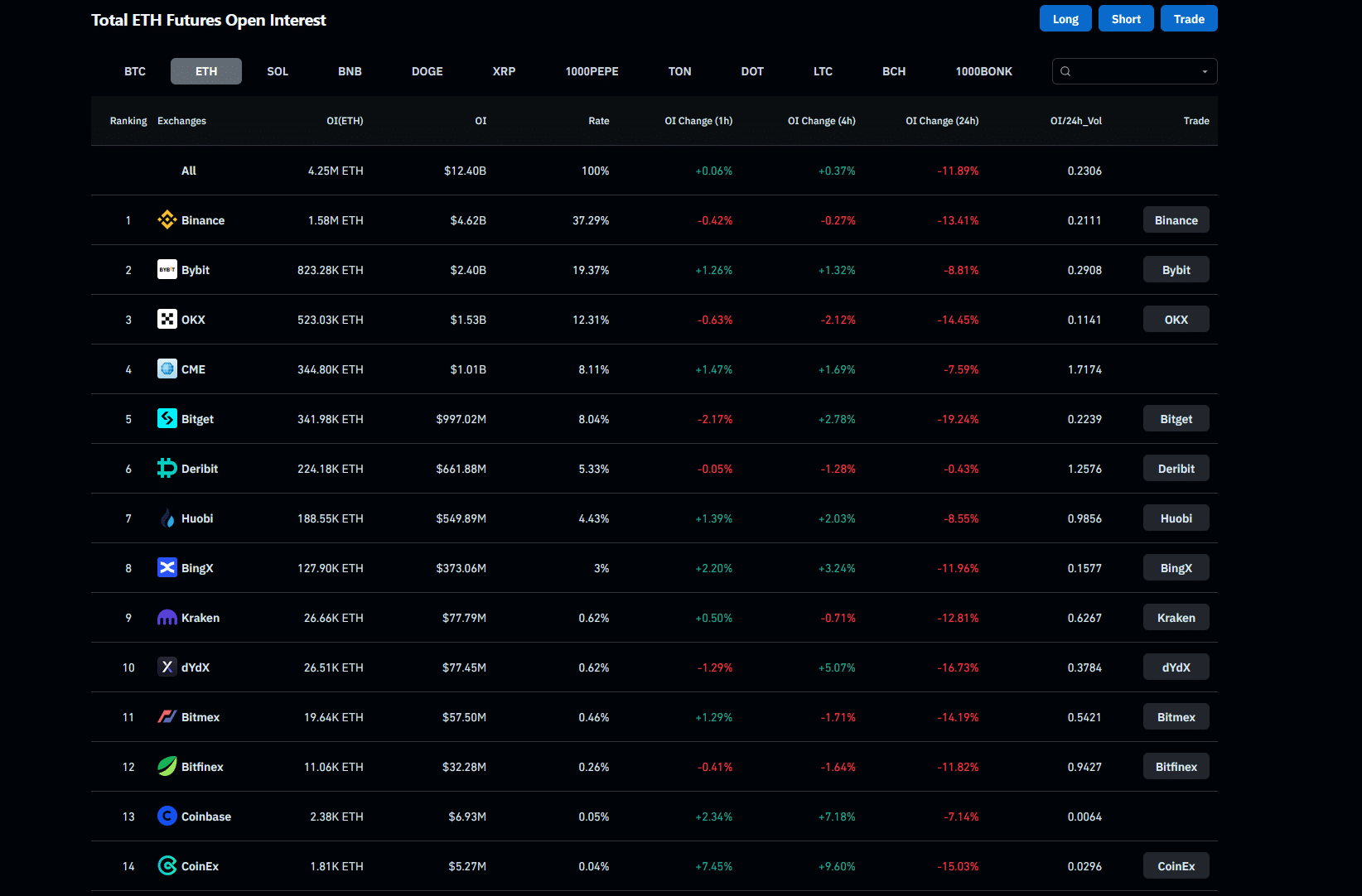

In the meantime, whole ETH Futures open curiosity (OI) throughout prime exchanges declined by virtually 12% over the aforementioned interval too – An indication of funds exiting the market.

Supply: Coinglass

Lastly, Ethereum’s CME OI fell by 7.59% too, confirming bearish investor sentiment throughout the board.

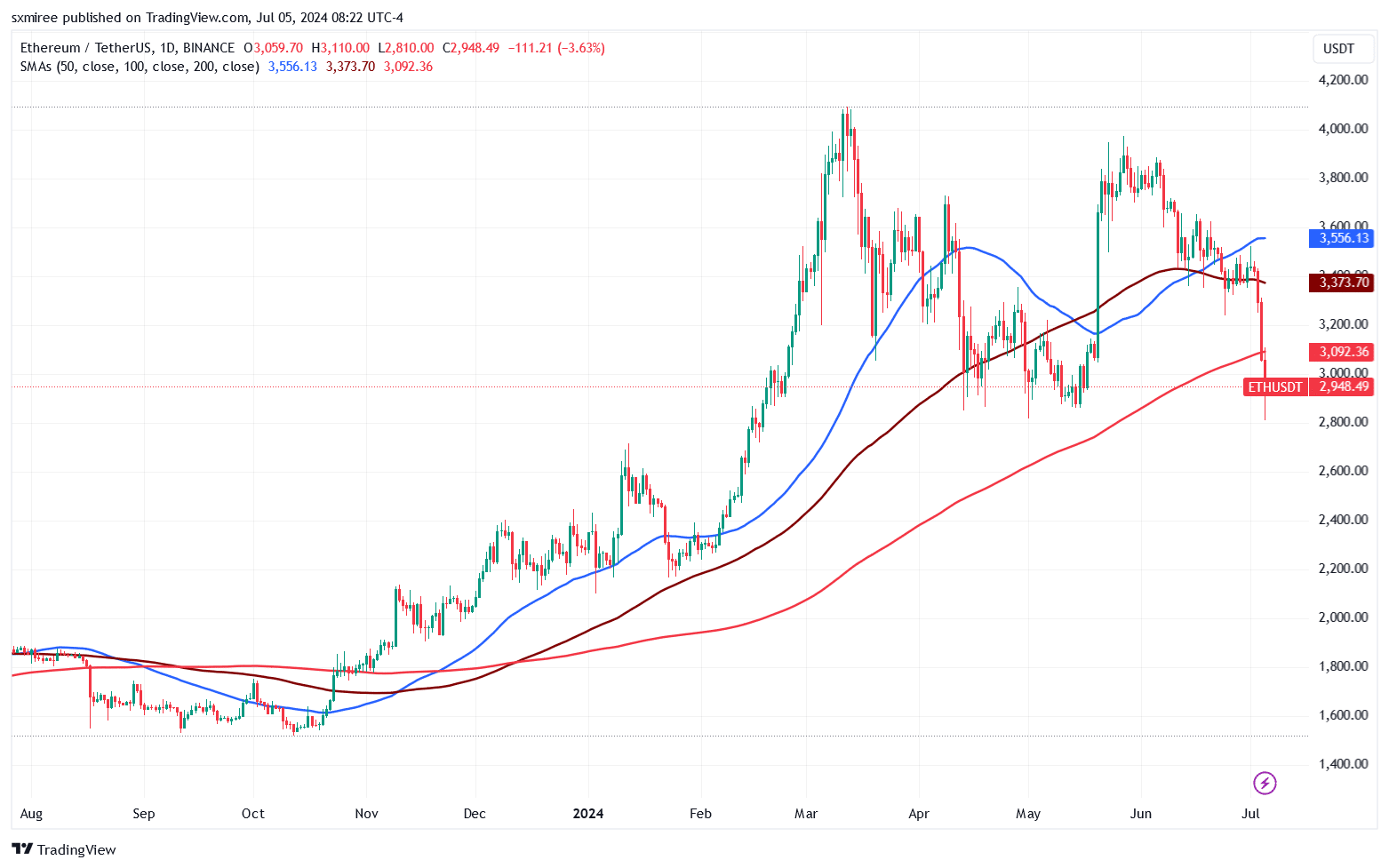

ETH/USDT technical evaluation

ETH/USDT losses, now extending to a fourth day, have piled strain on the pair. Owing to the identical, the pair breached key assist ranges on the top of the stoop. ETH’s value slipped under the 50-, 100-, and 200-simple transferring averages on the day by day chart.

Supply: TradingView

The final time ETH/USDT fell under all three development traces on the day by day timeframe was in August 2023. On the time, the crypto market noticed losses occasioned by stories of Elon Musk’s SpaceX promoting its Bitcoin holdings.

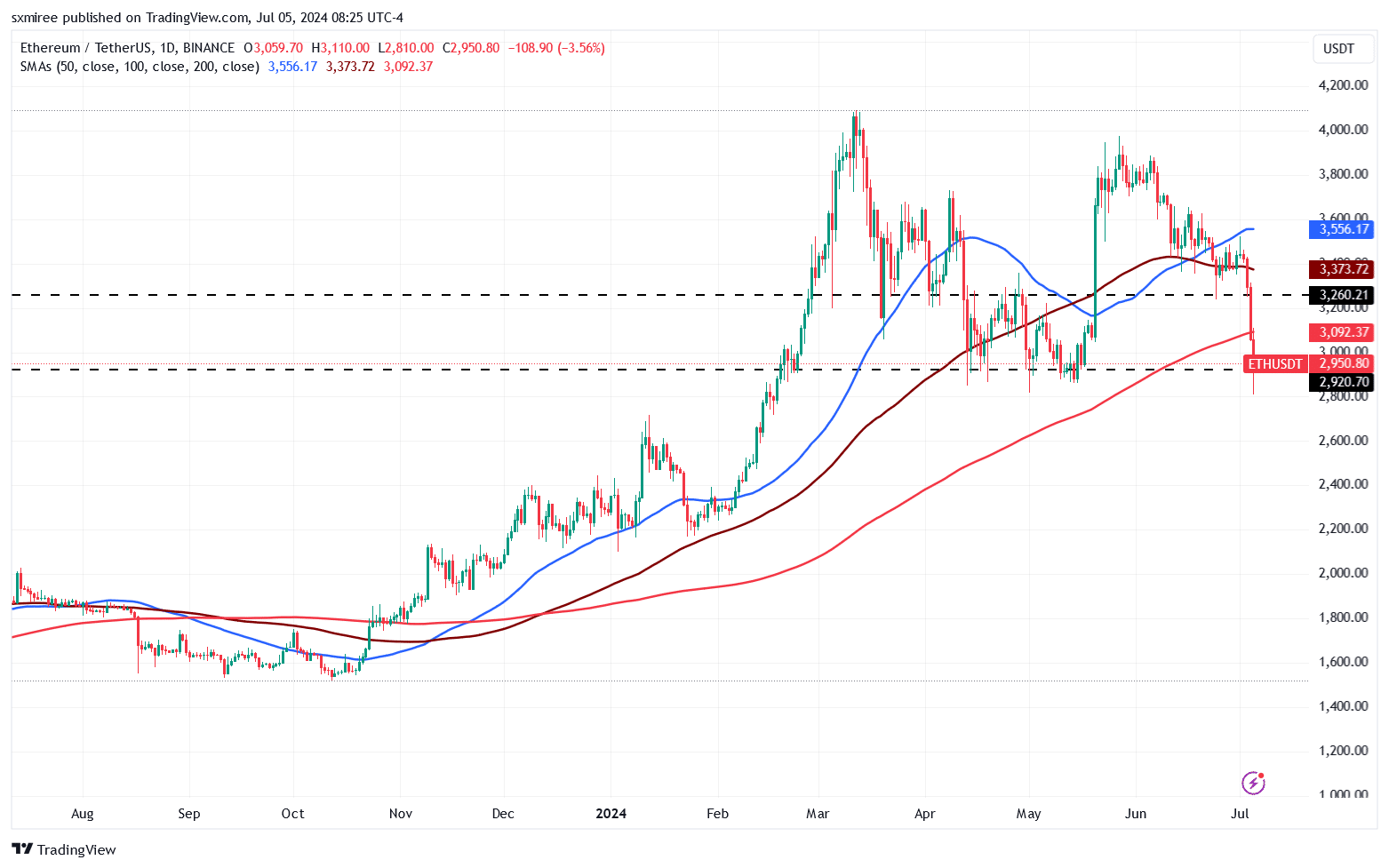

ETH was final noticed at $2,920, ranging 40% under its all-time excessive, in response to CoinMarketCap. Ethereum’s subdued efficiency this week has strengthened a bearish outlook within the brief time period too.

Supply: TradingView

The ETH/USDT pair is now positioned to face resistance across the $3,200-level, which it beforehand contended between mid-April and mid-June.