- Bitcoin doesn’t have a bullish sentiment within the brief time period, however a transfer towards $67k could possibly be probably.

- Macro information occasions concerning September expectations could have dealt a bearish blow to BTC.

Bitcoin [BTC] is the king of crypto, not simply because it has the biggest market capitalization. It’s the most sturdy and the earliest available in the market, and has been a wind vane for the sentiment over the previous decade.

Its worth actions affect many of the crypto market and will help reply the query of why crypto is down immediately.

Supply: Farside Buyers

The ETF flows have been subdued over the previous two days, a short-term signal of bearish sentiment. It probably is not going to dictate the long-term development. That is because of liquidity and what the broader market expectations are.

The FOMC assembly threw a spanner within the works

The US Federal Reserve has not modified its benchmark fed funds fee from the 5.25%-5.5% vary. Whereas this was excellent news, it additionally didn’t give any constructive indications a few September fee reduce.

FOMC’s assertion learn,

“Inflation has eased over the past year but remains somewhat elevated.”

It continued,

“The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run.”

Knowledge from the CME FedWatch confirmed that the market doesn’t anticipate a fee reduce in mid-September. Earlier than the FOMC assembly, this was not the case, and a 0.25% (25 foundation level) fee discount was anticipated in September.

This hawkish information might need led to Bitcoin’s costs tanking.

Clues from metrics and liquidation ranges

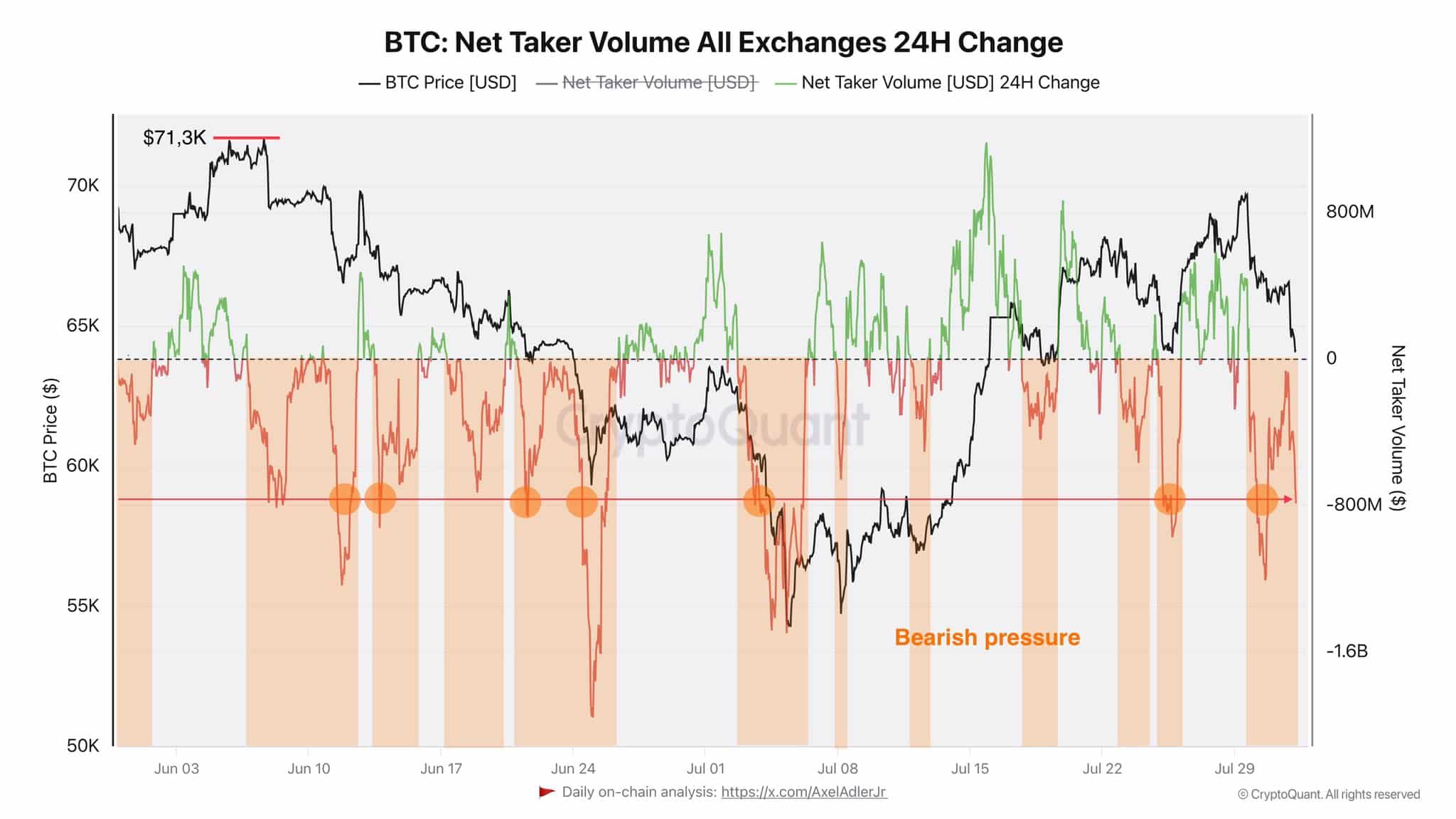

Supply: Axel Adler on X

Crypto analyst Axel Adler posted on X (previously Twitter) that the web taker quantity has proven predominantly bearish stress over the previous two months.

Measuring the distinction between taker purchase and taker promote orders may give hints in regards to the sentiment. For reference, taker signifies market orders and maker signifies restrict orders.

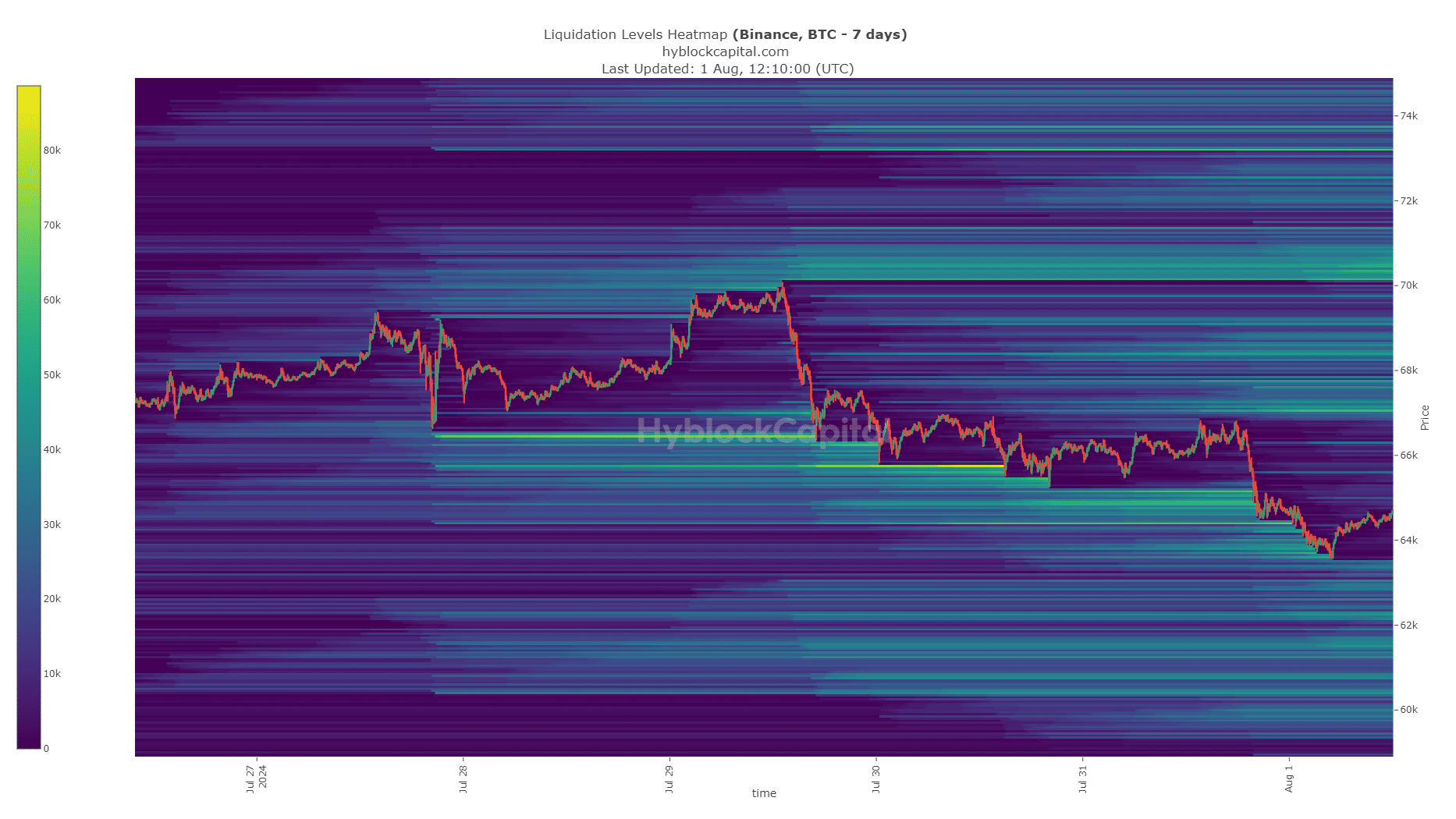

Supply: Hyblock

Learn Bitcoin’s [BTC] Value Prediction 2024-25

The liquidation cluster at $63.7k-$63.9k was reached, and the worth has begun to maneuver away from it. The short-term liquidation heatmap confirmed that $67k is the subsequent goal.

Total, the market sentiment was bearish and the September expectations of a fee reduce have been numbed. Collectively, they defined why the crypto market costs and sentiment have been down previously couple of days.