- Bitcoin surged previous $89,000, rising by 30% previously week leaving many to marvel what’s behind the surge.

- Rising open curiosity and elevated buying and selling quantity point out robust market exercise, however have triggered important liquidations.

Bitcoin [BTC] has just lately captured the crypto market’s consideration, surging by a formidable 30% over the previous week. The main cryptocurrency has been setting new all-time highs for greater than three consecutive days.

The newest peak was recorded at $89,864, with BTC at present buying and selling at $89,319—a slight 0.6% dip from its excessive.

This speedy rise in value has positively impacted Bitcoin’s market cap, bringing it to just about $2 trillion, a determine that locations it among the many prime eight largest property globally.

This surge has additionally lifted the broader crypto market, with the worldwide market cap growing by 7.5% to over $3.1 trillion. Furthermore, Bitcoin’s day by day buying and selling quantity has seen a major increase, climbing from under $50 billion simply final week to over $140 billion right this moment.

Why is Bitcoin up?

As Bitcoin’s bullish momentum continues, a number of elements are contributing to the continuing rally. One of many key causes to the query “why is Bitcoin up” is the latest re-election of pro-Bitcoin politician Donald Trump because the forty seventh president of the US.

Trump’s assist for BTC and the broader crypto trade has fueled optimism available in the market.

Traders are betting that his presidency will carry much-needed regulatory readability, fostering a extra favorable setting for cryptocurrency. Throughout his marketing campaign, Trump’s guarantees—together with the creation of a Bitcoin nationwide reserve—additional boosted investor confidence, contributing to the optimistic value motion.

One other issue answering the query is the latest high-profile institutional exercise. MicroStrategy, a distinguished institutional investor in Bitcoin, introduced a $2 billion buy of the cryptocurrency.

The agency acquired 27,200 BTC at a median value of $74,463 per coin, leading to an instantaneous achieve of over $300 million on this newest funding. Such large-scale purchases from institutional gamers not solely validate Bitcoin’s place as a key asset but in addition affect market sentiment, driving additional value appreciation.

Along with these macroeconomic and institutional elements, Bitcoin’s open curiosity has been on the rise.

Knowledge from Coinglass indicated a ten.26% improve, with a present valuation of $54.38 billion. Open curiosity quantity has surged much more considerably, growing by 111% to succeed in $221.58 billion.

Supply: Coinglass

Rising open curiosity suggests rising market participation and heightened curiosity in BTC derivatives, which frequently alerts a rise in buying and selling exercise and market engagement.

BTC liquidation developments

Whereas Bitcoin’s value surge has generated pleasure, it has additionally led to heightened market volatility and dangers for sure merchants.

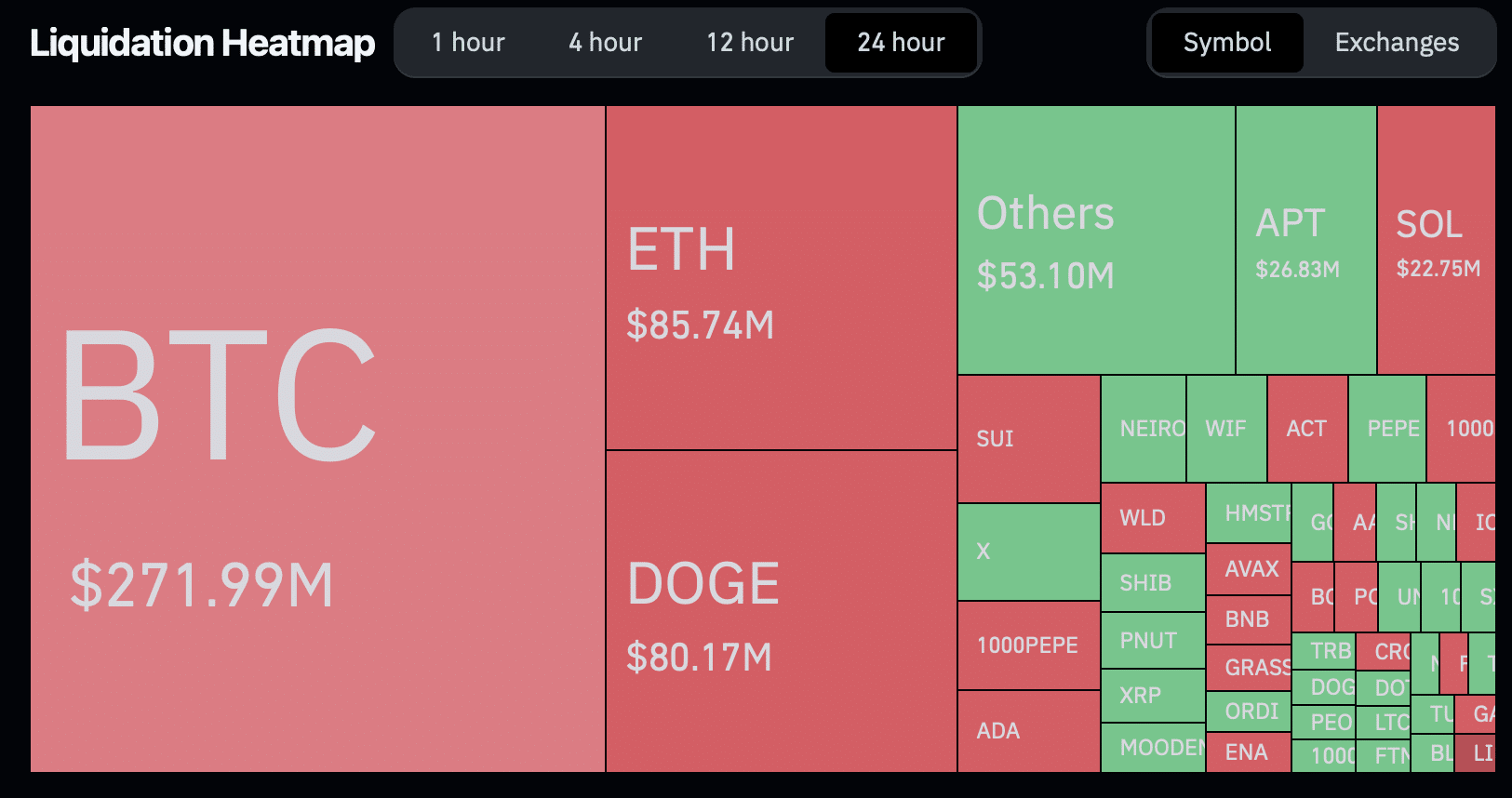

Knowledge from Coinglass confirmed {that a} complete of 175,515 merchants had been liquidated previously 24 hours, leading to complete liquidations of $693.87 million.

Supply: Coinglass

Learn Bitcoin’s [BTC] Value Prediction 2024-25

The vast majority of these liquidations concerned BTC and Ethereum, with $271.99 million and $85.74 million in liquidations, respectively.

Notably, quick merchants have borne the brunt of this market motion, with $218 million in Bitcoin quick positions and $48.78 million in Ethereum quick positions being worn out.