- Is a surge incoming for Bitcoin earlier than the upcoming U.S. elections?

- BTC may rally to $70K by the top of October.

On the 14th of October, Bitcoin [BTC] rallied 5% and retested $66K as analysts linked the upswing to imminent U.S. elections.

Quinn Thompson, founding father of crypto hedge fund Lekker Capital, termed the most recent rally a “Trump bump,” citing growing odds of Trump profitable the U.S. elections.

However Kamala Harris’s current pledge to help a crypto regulatory framework has made some pundits imagine that the 2024 elections might be a win-win for the trade.

U.S. election issue

On its half, crypto buying and selling agency QCP Capital believed the rally was a part of historic tendencies forward of the U.S. elections.

“The timing ahead of the U.S. elections mirrors historical patterns. In both 2016 and 2020, #BTC surged just three weeks before #Election2024 Day.”

In 2016, BTC hiked from $600 three weeks earlier than the U.S. elections and doubled by January 2017. Equally, BTC exploded from $11K earlier than the 2020 elections and hit $42K by January 2021.

Will the development repeat in 2024? AMBCrypto requested Bitget Analysis’s chief analyst, Ryan Lee, what his ideas had been,

Lee stated that BTC has remained resilient regardless of the strengthening U.S. greenback. This might sign a bullish section for the asset within the medium time period.

He projected BTC may stay range-bound or explode above $70K by the top of October.

“Volatility in the crypto market will likely increase ahead of key events — the next November Fed meeting and the US elections at the same time. BTC price fluctuations may range from $58,000 to $69,000.”

Supply: CryptoQuant

That stated, the demand for BTC has elevated up to now 30 days, hitting ranges final seen in April. This was an entire turnaround from the low demand in Q2/Q3, 2024.

Moreover, the current BTC hike confirmed the next low development that would sign a possible market construction shift and an finish to the re-accumulation section witnessed since March.

Supply: Stockmoney Lizards

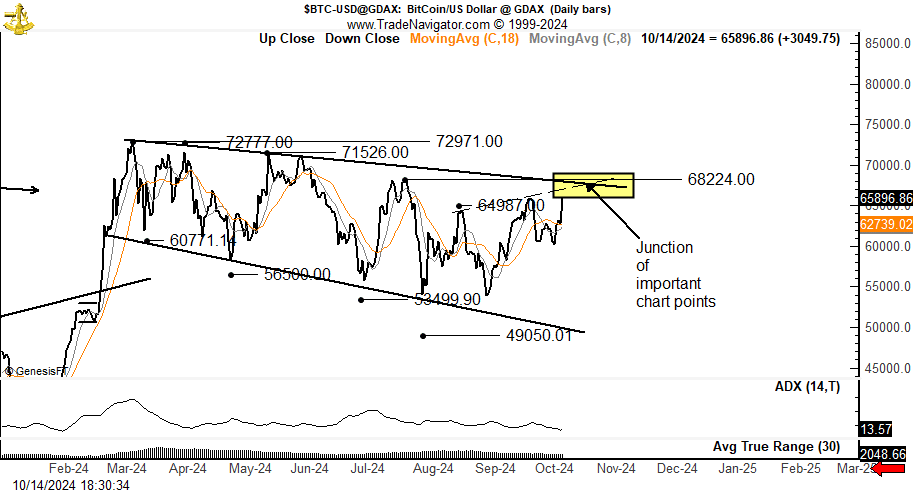

However, famend analyst Peter Brandt believed a market construction shift may occur provided that BTC surged above $68.2K.

At press time, BTC was valued at $65.6K, about 12% beneath its ATH of $73.7K.

Supply: Peter Brandt