- BTC has dipped under $60K as soon as once more, sparking renewed discussions within the crypto world.

- A reversal may very well be attainable if a number of key situations are met.

Bitcoin [BTC] surged above $60K over the weekend after a two-week consolidation. Nevertheless, the momentum was short-lived, as BTC retraced again to $58,580 at press time.

With the momentum fading, AMBCrypto analyzed the elements behind the decline—Is that this only a momentary blip, or is the development prone to proceed?

Why is Bitcoin down right now? STHs clarify

Trying on the every day value chart, it wouldn’t be stunning if many buyers determined to lock in income after a run of six consecutive inexperienced candles.

That is significantly related following the bearish pullback in late August, which noticed BTC drop under $55K.

Consequently, after a difficult battle, stakeholders squeezed in earlier than the momentum stalled.

Supply : CryptoQuant

A look on the chart above clearly confirmed how STHs and LTHs strategize otherwise throughout market cycles. LTHs await value drops to build up BTC, whereas STHs usually act as the worth nears a market high.

In consequence, every time BTC approaches a vital value zone, the STH provide will increase, usually adopted by a pointy decline.

This sample illustrates how STHs capitalize on LTH accumulation to drive the worth up, then exit as soon as the highest is reached.

To additional verify whether or not STHs promoting contributed to Bitcoin’s decline, AMBCrypto examined the index under.

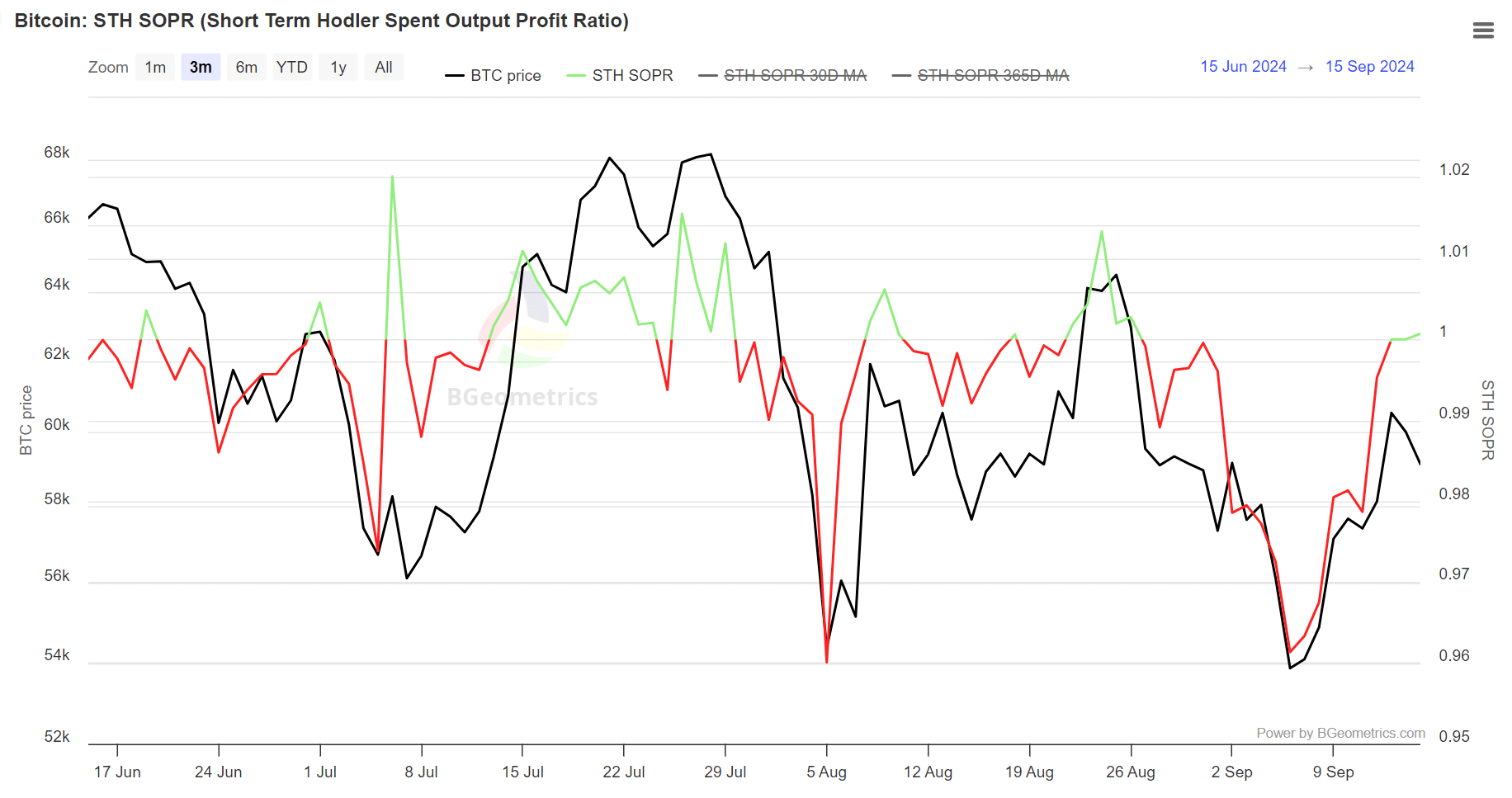

Supply : BGeometrics

Unsurprisingly, the day after BTC closed close to $60,500, the STH-SOPR rose above 1, indicating that extra short-term holders have been cashing in on their positive factors.

To make issues worse, whales additionally scaled again their holdings, intensifying the promoting stress. This bearish development might need dampened the short-squeeze alternative that fueled the preliminary surge.

Now, the subsequent dip may very well be extra interesting, permitting LTHs to step in and counter the pullback.

Discovering the subsequent dip

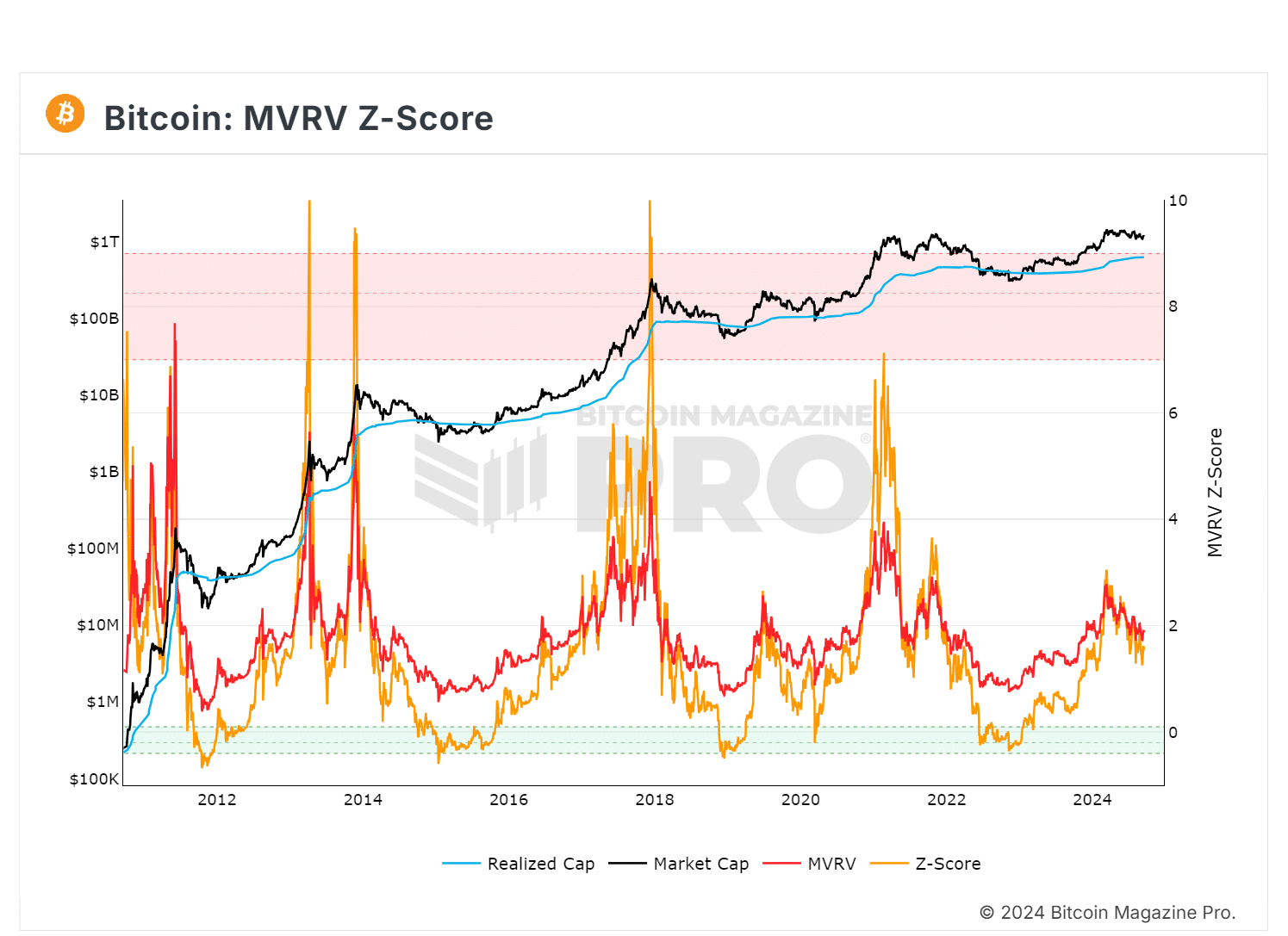

The chart under confirmed Bitcoin’s MVRV momentum has been declining for the reason that value fell under $66,750 in June. Regardless of fluctuations, this downward development has continued with no reversal.

Supply : Bitcoin Journal Professional

If the bulls don’t push for a right away rebound, a break under the $58,100 help might result in a drop in direction of $55,000.

Traditionally, when the z-score enters the inexperienced field, shopping for BTC results in outsized returns, prompting LTHs to build up.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

In the meantime, different macroeconomic elements would possibly set off a value correction, inflicting the z-score to achieve the market high earlier than getting into the buildup section.

In brief, a reversal isn’t assured except sure situations are met: profit-taking is changed by a robust bull rally, both resulting from a dip to $55K or an impending fee lower by the Fed.