- Merchants are overleveraged at $96,957 on the decrease facet and $99,813 on the higher facet.

- Bitcoin will as soon as once more cross the $100,000 mark if it closes a every day candle above the $99,700 degree.

The cryptocurrency market confronted a setback after Bitcoin [BTC], the world’s largest digital asset, skilled a big 5.47% worth decline in only one minute, following its historic crossing of the $100,000 mark for the primary time.

This notable worth decline has shifted general market sentiment as merchants have liquidated almost a billion value of lengthy and quick positions.

Why is BTC falling?

The potential for this important worth decline is but to be identified. Nevertheless, information from the on-chain analytics agency Coinglass reported {that a} important influx into the exchanges is likely to be accountable for this worth decline.

Supply: Coinglass

BTC spot influx/outflow metrics reported that exchanges have witnessed a big $732.5 million of BTC outflow. Within the cryptocurrency context, “outflow” refers back to the motion of belongings from wallets to exchanges, typically seen as an indication of promoting strain and a possible worth decline.

Nevertheless, the current worth decline has created concern amongst merchants and traders and has additional raised concern about whether or not the worth will drop additional or if the market will rebound.

Bitcoin technical evaluation and key ranges

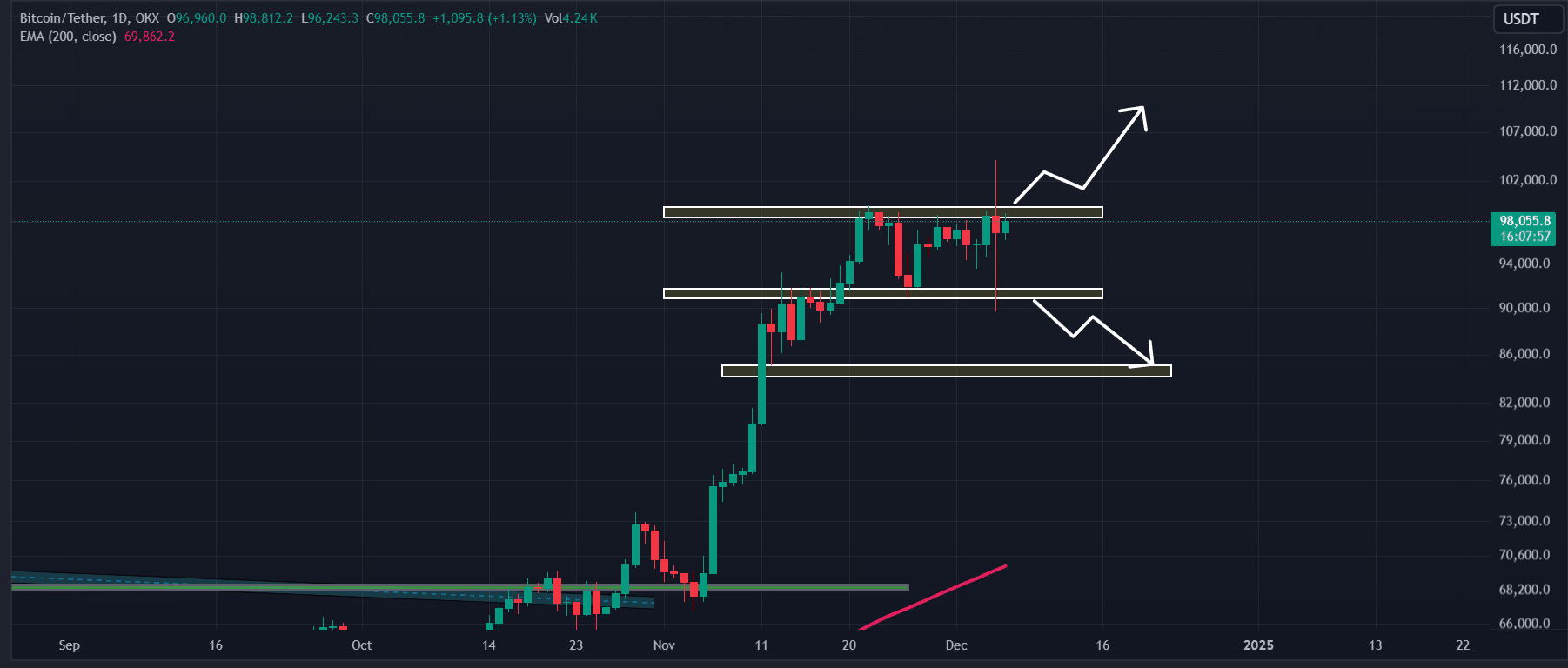

In line with AMBCrypto’s technical evaluation, BTC is consolidating in a good vary between $92,000 and $99,100. Nevertheless, a current breakout from this zone appears to have been a bull lure, as BTC didn’t maintain its place above the vary and has fallen again inside it.

Supply: TradingView

Based mostly on current worth motion, if BTC breaks out above the higher boundary of the vary and closes a every day candle above the $99,700 degree, there’s a robust chance it’ll as soon as once more cross the $100,000 mark and maintain its place.

Conversely, if BTC breaks beneath the vary and closes a every day candle below the $91,500 degree, there’s a robust probability it may drop to the $86,000 degree.

In the meantime, BTC’s Relative Power Index (RSI) at present stands at 62, just under the overbought territory, indicating that the asset nonetheless has room to rise within the coming days.

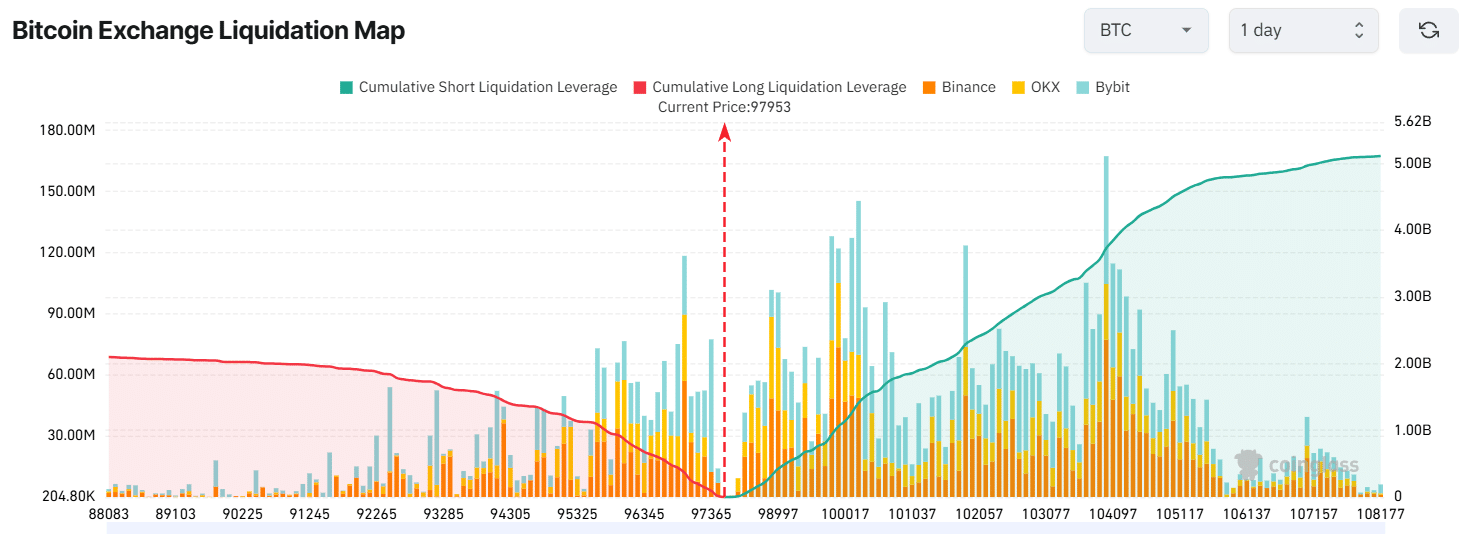

Main liquidation ranges

Along with technical evaluation, the most important liquidation ranges at present stand at $96,957 on the decrease facet and $99,813 on the higher facet, with merchants overleveraged at these factors, in response to Coinglass.

Supply: Coinglass

If sentiment shifts in direction of bullish momentum and the worth rises to the $99,813 degree, almost $938 million value of quick positions may very well be liquidated.

Conversely, if sentiment turns bearish and the worth drops to $96,957, roughly $364 million value of lengthy positions may very well be liquidated.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

This liquidation information signifies that bearish sentiment is strongly dominating the asset, as many imagine the BTC worth is not going to surpass the $99,813 degree.

At press time, BTC was buying and selling close to $97,970 and has registered a worth decline of 4.10% previously 24 hours. Throughout the identical interval, its buying and selling quantity elevated by 4%, indicating a modest rise in investor and dealer participation in comparison with the day prior to this.