- BTC might be muted as a result of key gamers are dumping, per Capriole Investments founder.

- The Bitcoin miner disaster persists and might be a key headwind for the restoration of BTC.

After peaking at $63.8K on 1st July, Bitcoin [BTC] has weakened and dropped to a low of $57K on 4th July. That was a 9% decline in July and marked the fourth consecutive month of sideways motion since Q2.

What’s inflicting the plunge?

Charles Edwards, founding father of crypto hedge fund Capriole Investments, claimed that the weakening BTC was partly as a result of ‘key players’ dumping holdings.

‘This is why we haven’t mooned but… If you have a look at the information of the 4 most vital gamers in Bitcoin, now we have internet flows equal to $24B being dumped available on the market in 2024’

Supply: X/Charles Edwards

Edwards’ perspective was based mostly on demand and provide from BTC miners, ETFs, and long-term holders (LTH). Primarily based on these three entities, about 374K BTC, price above $20 billion, has been dumped out there, per Edwards.

When the LTH metric was adjusted from +2 years to 155 days, the online outflow was about—$40 billion, per Edwards.

Moreover, when Grayscale’s GBTC outflows are factored in and eliminated, the general dump throughout the three entities amounted to $18 billion price of BTC outflow.

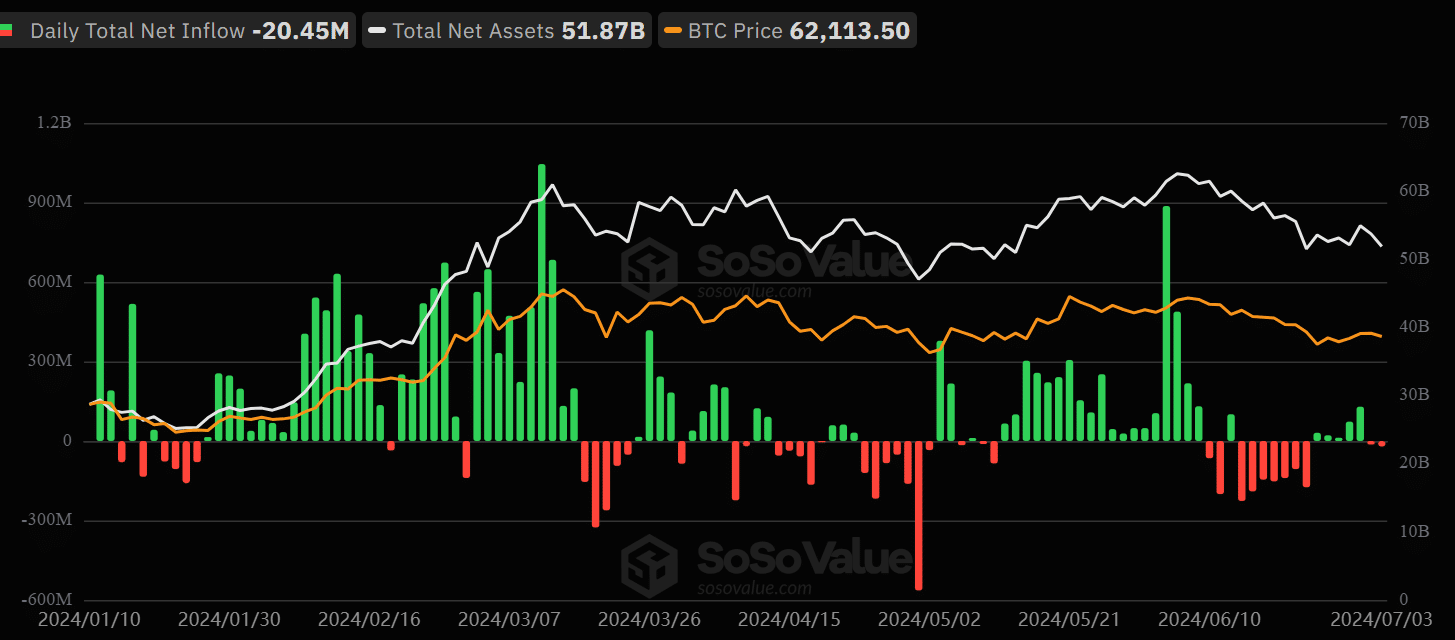

AMBCrypto’s analysis spot BTC ETF flows revealed that internet flows fluctuated significantly in Q2, in contrast to the regular optimistic flows recorded in Q1. The stagnating demand from ETFs, thus, corroborated Edwards’ thesis.

Supply: SoSo Worth

One other key entity talked about within the evaluation, BTC miners, was nonetheless deep in a profitability disaster after the halving occasion. In consequence, struggling miners may dump extra of their BTC holdings to remain afloat.

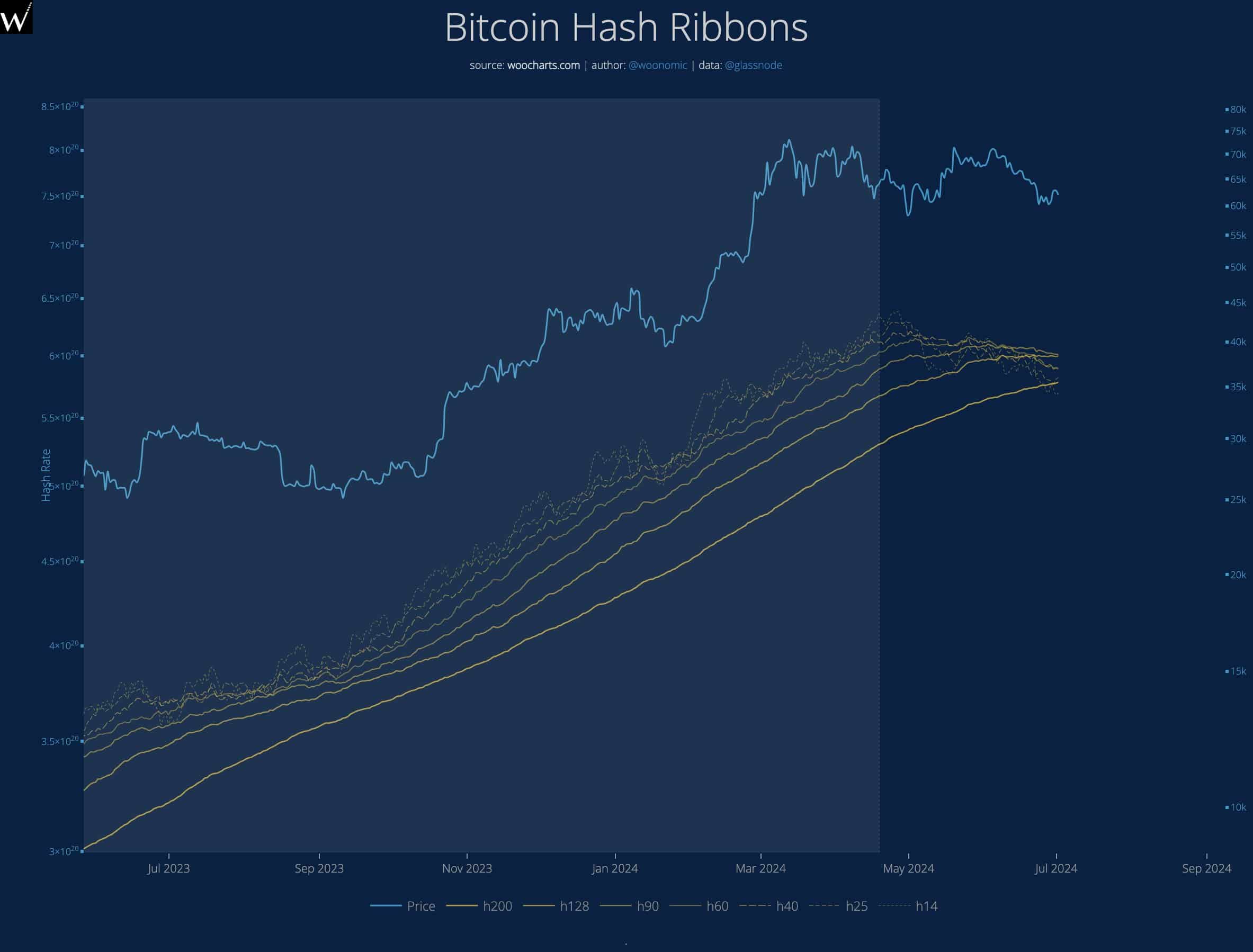

The miner disaster may additional delay the bullish reversal for the most important digital asset, famous Willy Woo.

‘Every day, I look at 7 squiggly lines to see if it’s time. Nope, not but. Miners are nonetheless bleeding out, writhing in ache.’

Supply: Willy Woo

For perspective, the Bitcoin Hash Ribbons are transferring averages that sign when hash charges drop, particularly throughout miners’ profitability crises.

Though additionally they traditionally signaled a market backside, the metric has but to get better and additional reinforce BTC’s weakening market construction.