- The cryptocurrency market noticed greater than $489 million in whole liquidations after Bitcoin and most altcoins plunged decrease.

- Pressured promoting from lengthy liquidations and profit-taking fuelled the downtrend.

The cryptocurrency market skilled a spike in volatility over the weekend in any case the highest ten largest cryptos by market capitalization traded decrease.

At press time, the market confirmed indicators of restoration however the whole market cap was nonetheless down by 0.47% in 24 hours to $3.35 trillion.

Bitcoin [BTC] noticed violent worth swings after oscillating between $95,700 and $98,600 within the final 24 hours. In the meantime, Ethereum [ETH], the biggest altcoin was down by 1.39% to commerce at $3,383 at press time.

Moreover a surge in volatility, which is usually seen through the weekends attributable to low buying and selling volumes, a number of different elements additionally induced the value decline.

$360M in lengthy liquidations fueled the downtrend

Knowledge from Coinglass exhibits that in simply 24 hours, the entire liquidations throughout the crypto market reached $489 million. These liquidations affected greater than 186,000 merchants.

Merchants with leveraged lengthy positions suffered the largest blow, with greater than $360 million being worn out. Bitcoin recorded $56 million in liquidations, marking the biggest single-day lengthy liquidations on BTC in over every week.

On the similar time, Ethereum and Dogecoin [DOGE] noticed the best liquidations amongst altcoins, with $32 million and $21 million being worn out, respectively.

Supply: Coinglass

Every time lengthy merchants are liquidated, they’re pressured to shut their positions via promoting. Due to this fact, this state of affairs fuelled the current downturn.

Revenue-taking exercise

As aforementioned, weekends are normally related to low buying and selling volumes. Resulting from this, a slight uptick in shopping for or promoting exercise can have a big impression on worth.

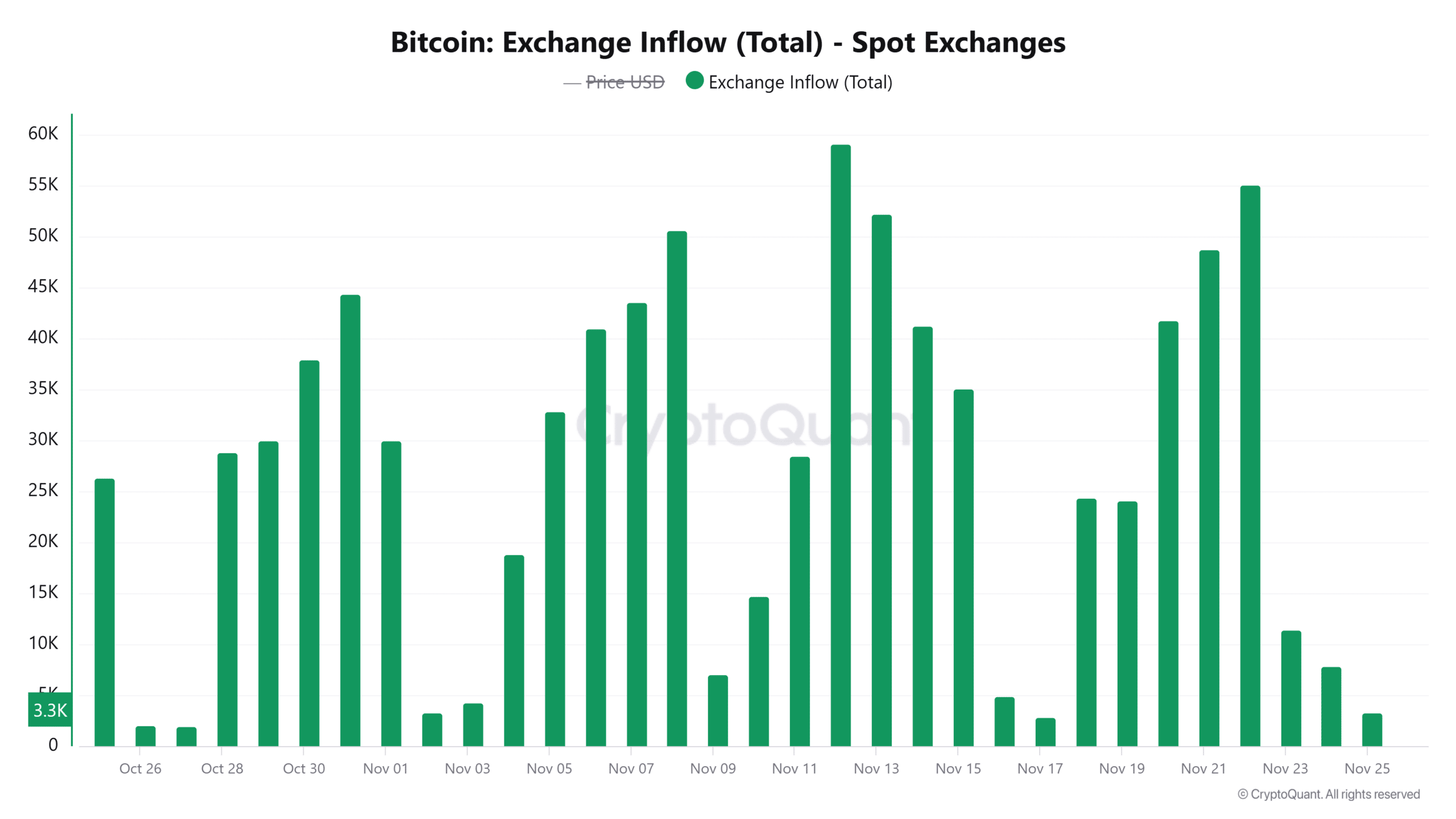

Knowledge from CryptoQuant exhibits that within the final three days, greater than 74,000 BTC have been moved to identify exchanges. These inflows counsel that some merchants are eager on taking income after the current positive aspects.

Supply: CryptoQuant

Furthermore, out of this quantity, round 19,238 BTC was deposited to exchanges over the weekend. Attainable promoting exercise after these deposits might need fuelled a downtrend in Bitcoin costs and subsequently, altcoins.

Market sentiment nonetheless exhibits greed

Regardless of the current correction, the market sentiment stays bullish. That is seen within the Concern and Greed Index with a price of 82, exhibiting “extreme greed.”

Whereas this metric exhibits that merchants are extremely optimistic and assured, it may additionally trace at an upcoming correction or development reversal. Due to this fact, merchants ought to be careful for indicators of intense profit-taking, as that might gas additional dips.