- Bitcoin surged by 7.96% over the previous week.

- Market fundamentals prompt that Bitcoin may expertise a market correction quickly.

As anticipated, Bitcoin [BTC] has skilled a powerful October. Whereas the month began on a low be aware, the crypto has made vital good points outweighing the earlier losses.

Since hitting a low of $58867, BTC has made a powerful upswing reaching July ranges of $69k.

In reality, as of this writing, Bitcoin was buying and selling at $69028.This marked a 7.96% over the previous week, with the crypto gaining 9.52% on month-to-month charts.

The current upsurge has left analysts each optimistic and pessimistic in equal measures. As an illustration, CryptoQuant analyst Burak Kesmeci prompt that Bitcoin would possibly see a market correction, citing the NVT golden cross.

Market sentiment

In his evaluation, Kesmeci posited that Bitcoin’s NVT Golden Cross has entered a scorching zone within the brief time period.

Supply: X

In accordance with him, the market will finally expertise correction earlier than making an attempt one other uptrend.

For the uninitiated, the NVT Golden Cross reaching the new zone means that BTC is at the moment increased than what its community exercise justifies.

Thus, it has grow to be overvalued relative to the quantity of worth being transferred on the blockchain.

This implies a possible overbought situation the place worth development will not be supported by the basic utilization of the community.

These situations typically precede a worth correction, the place the market adjusts and brings the value again to align with the community fundamentals.

Primarily based on this analogy, Bitcoin will expertise a pullback within the close to time period.

What BTC’s charts say

As noticed by Kesmeci, the present fundamentals don’t assist a sustained rally and will drop to satisfy the demand.

Due to this fact, the query is, how sustainable is the present rally, and what do market indicators recommend?

Supply: CryptoQuant

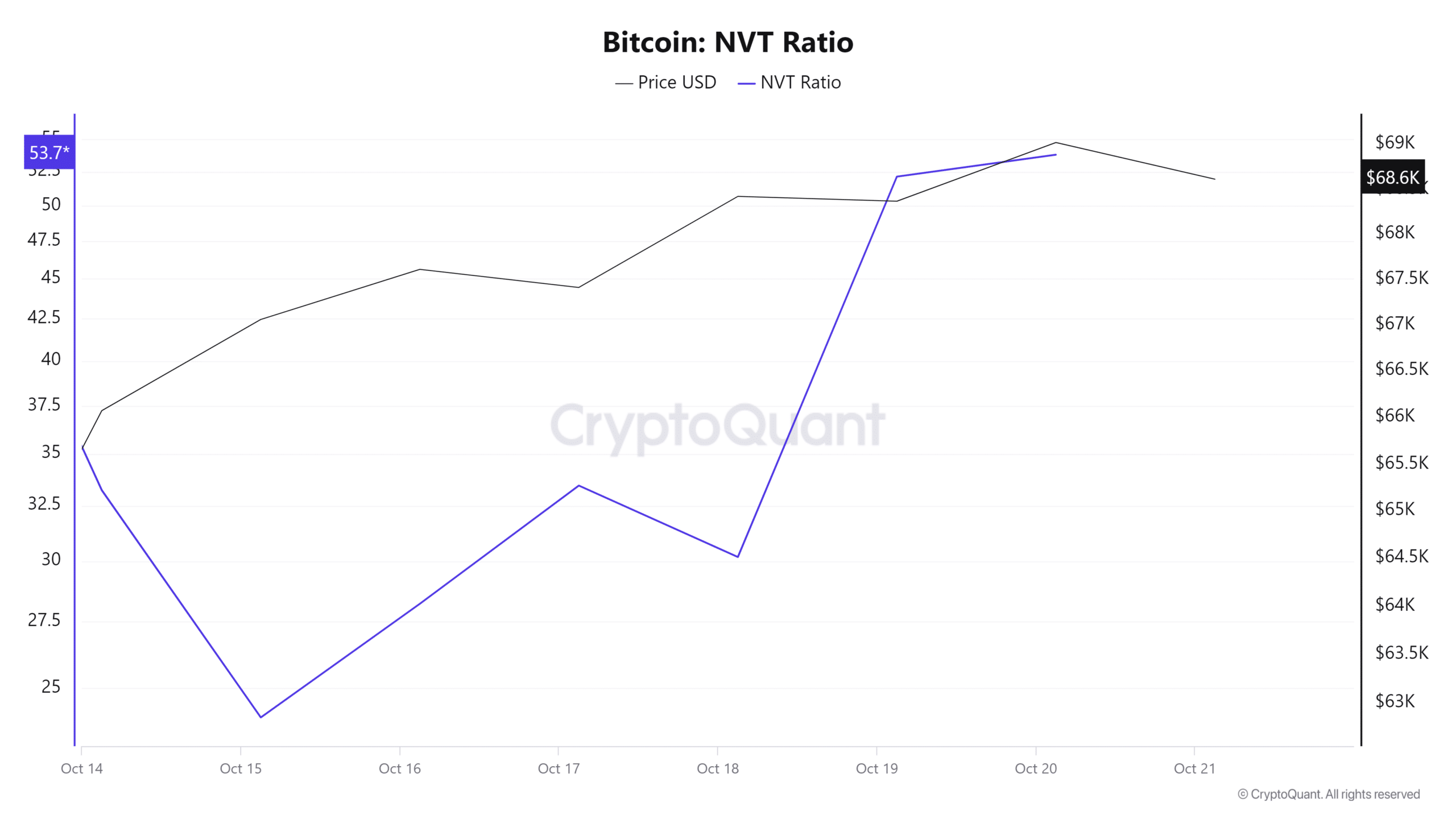

The primary indicator to contemplate is Bitcoin’s NVT Ratio, which measures community worth to transaction.

In accordance with CryptoQuant, the NVT ratio has been rising over the previous week. This enhance implies that BTC is overvalued in comparison with precise utility and community exercise, thus costs are unsustainably excessive.

Supply: CryptoQuant

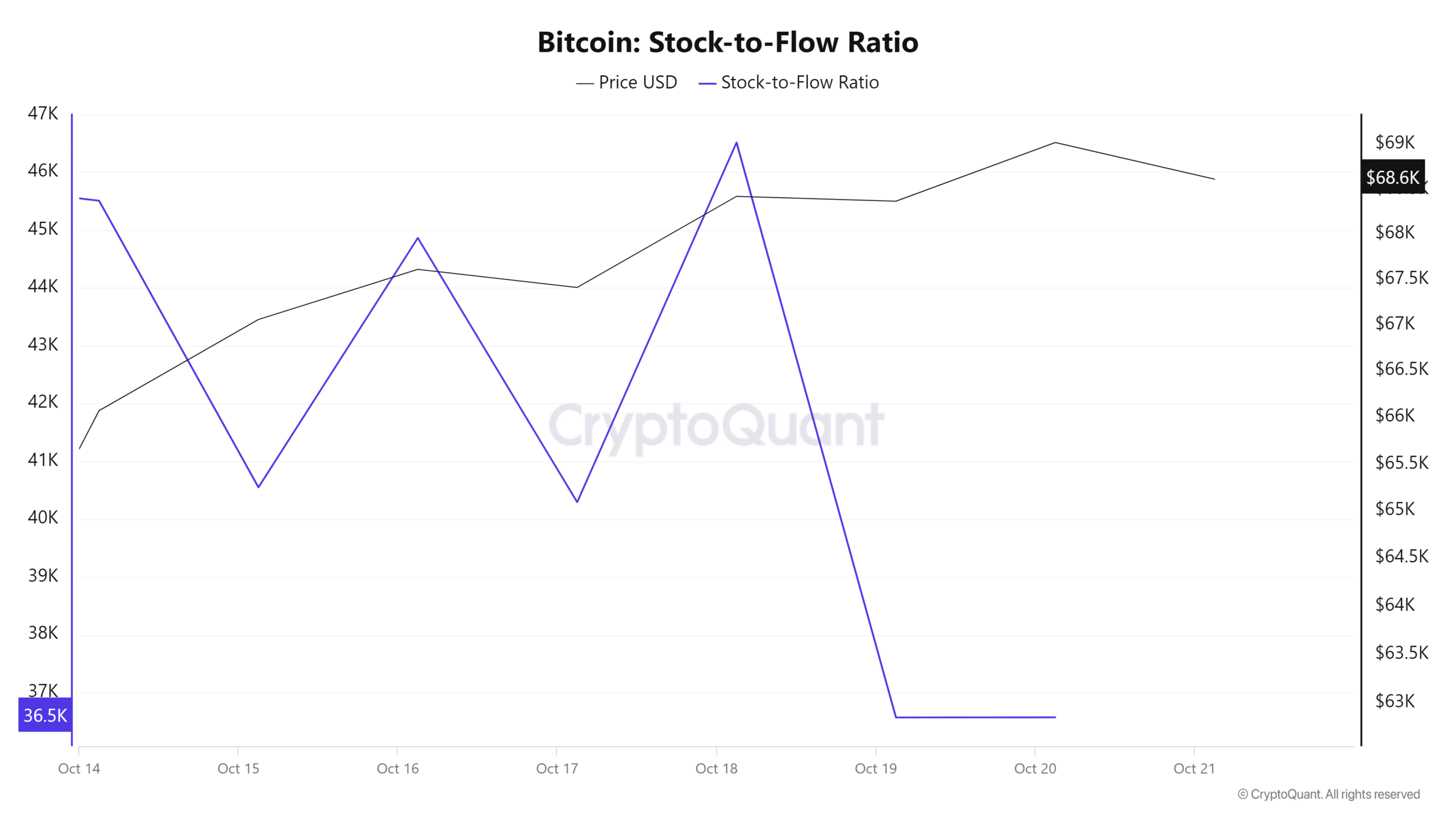

Moreover, Bitcoin’s Inventory-to-Circulation Ratio has declined over the previous week, suggesting an increase in provide. The elevated availability of BTC tends to show the market into bearish, particularly if the demand will not be rising.

Supply: Santiment

Lastly, Bitcoin’s Worth DAA divergence has remained adverse all through the previous week. This means that there’s an unsustainable worth enhance.

When the Worth DAA is adverse, it suggests the present rally is pushed by hypothesis or short-term demand.

Learn Bitcoin’s [BTC] Worth Prediction 2024 – 2025

Merely put, though BTC has surged to a current excessive, the market fundamentals recommend a correction is imminent. As such, the present rally is usually pushed by hypothesis and never supported by demand.

A correction will see Bitcoin drop to the $65872 assist degree.