- A vital resistance at $68,000 might set off a BTC pullback.

- Whereas the coin may get well to $72,000 later, the worth may pattern greater.

AMBCrypto’s market evaluation revealed that Bitcoin’s [BTC] leap to $67,740 doesn’t imply that the worth would not nosedive. In reality, there’s a probability that BTC might drop to $60,000.

To reach at this conclusion, the liquidation heatmap got here into play. The liquidation heatmap helps merchants to forestall additional losses. Excessive liquidation areas could possibly be assist or resistance areas.

North shouldn’t be the one manner

In line with knowledge from Coinglass, there was an enormous cluster of liquidity from $67,626 to $68,000, indicating that Bitcoin might strategy the degrees yet another time.

On the draw back, there was a significant degree at $60,160. As such, resistance between $67,000 and $68,000 might power BTC to drop to $60,000 which might later act as assist.

Supply: Coinglass

Nonetheless, probably the most concentrated space of liquidity was $72,000, which means that the subsequent uptrend might push Bitcoin thus far. Establishing this bias was the Realized Value.

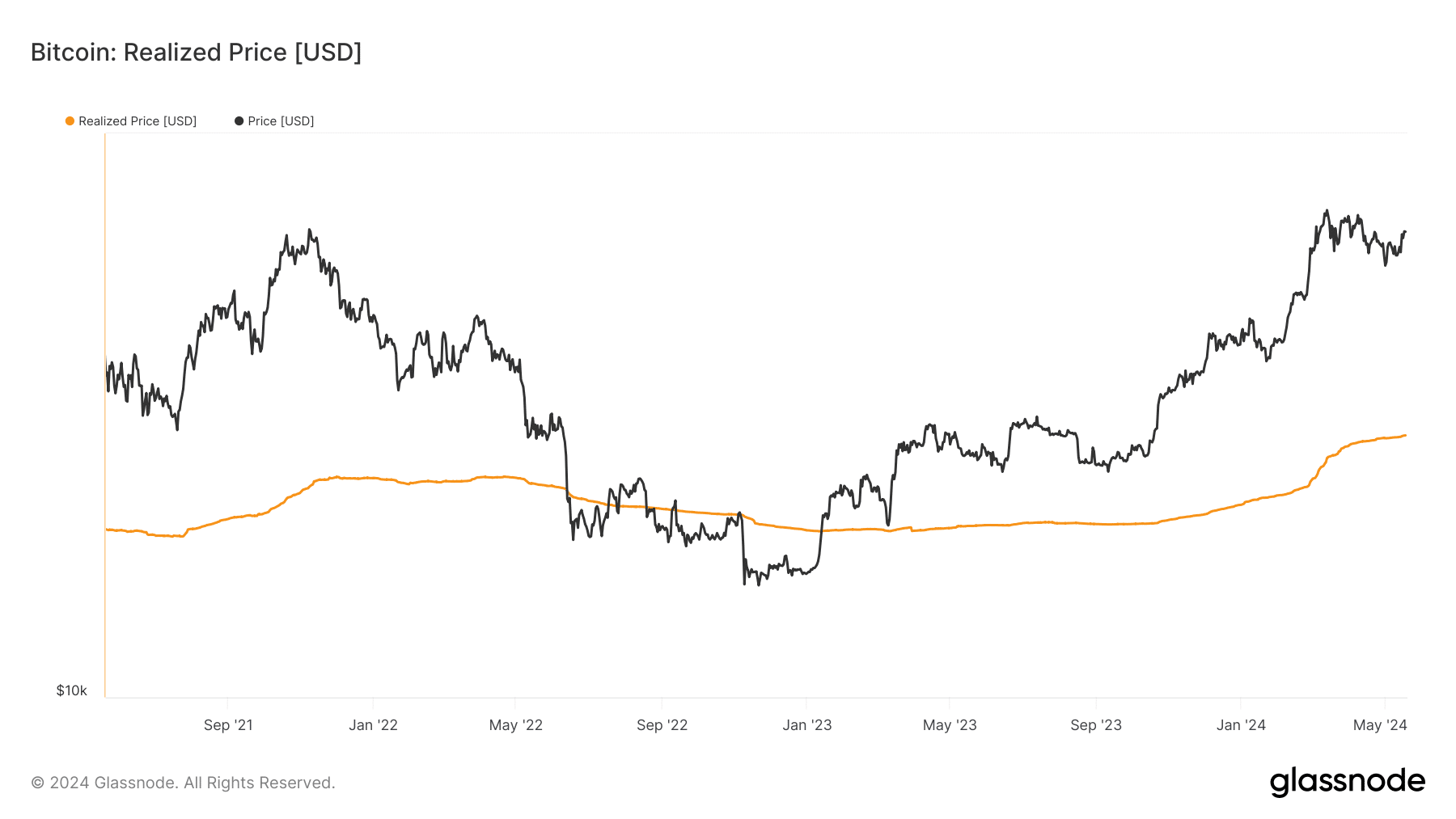

Realized Value measures the typical value divided by Bitcoin’s provide. This helps to know the financial state of the coin. Just like the liquidation heatmap, this metric can act as on-chain assist or resistance.

Bitcoin shouldn’t be again to the bear market

If the Realized Value hits or crosses Bitcoin’s worth, it signifies that the coin has fallen right into a bear section. For instance, the metric flipped BTC in November 2022, confirming a crash within the value.

As of this writing, the Realized Value was $29,142— two occasions lower than the press time worth. With this place, one can infer that BTC has not hit the highest of this cycle.

Supply: Glassnode

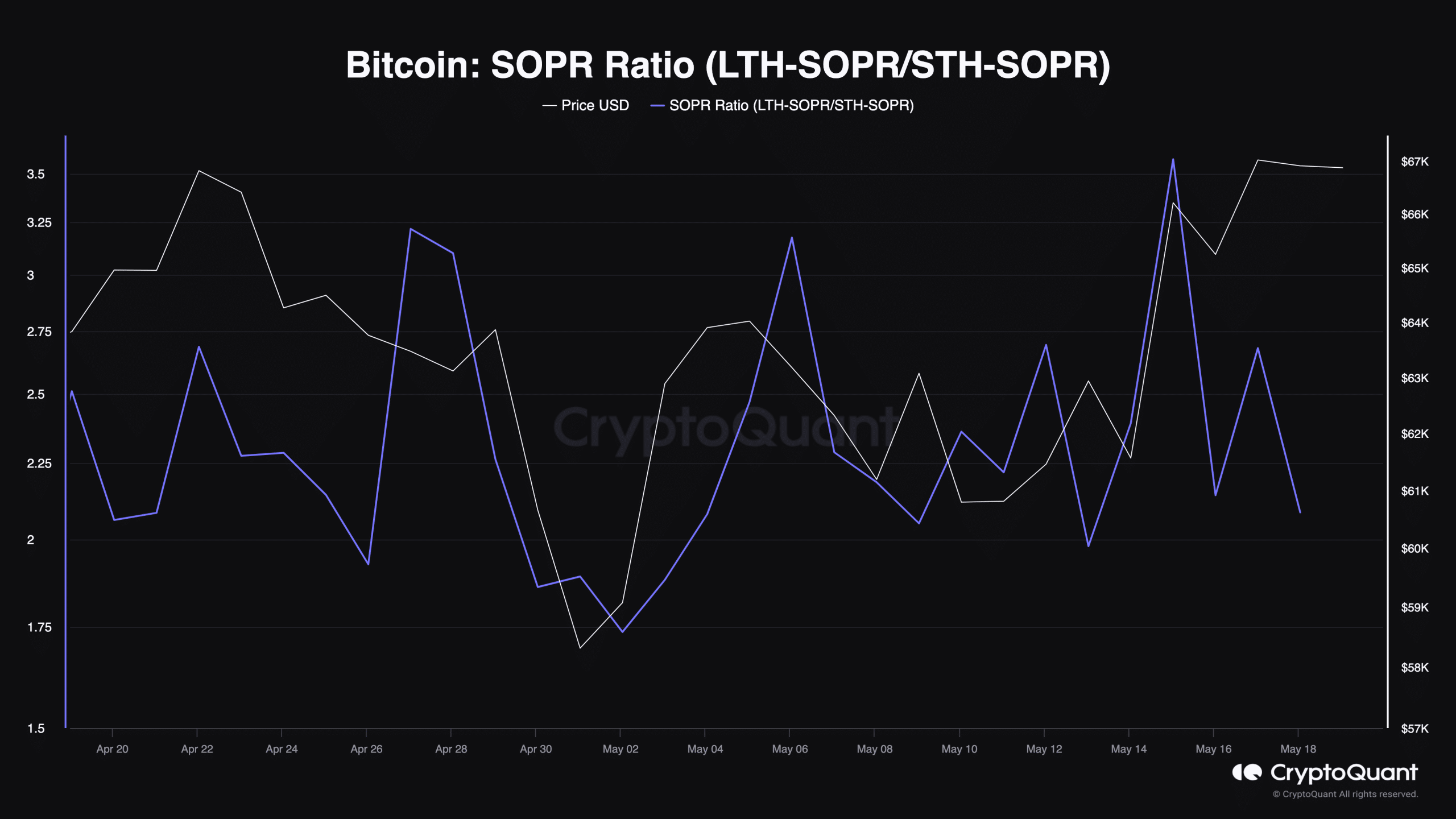

As well as, we assessed the SOPR Ratio. SOPR stands for Spent Output Revenue Ratio. By definition, SOPR measures the revenue ratio of your entire market.

The worth of this metric is calculated because the division of the long-term holder’s SOPR by that of the short-term holder. A excessive SOPR ratio means greater income for long-term holders than short-term holders.

If that is so, it signifies that the market is near the highest. Conversely, a low SOPR ratio signifies that short-term holders have made extra positive factors than their long-term counterparts.

At press time, the ratio was 2.08. Falling to this degree means that Bitcoin’s value can transfer greater. For instance, the ratio hit the identical studying earlier than Bitcoin’s all-time excessive in March.

Supply: CryptoQuant

Moreover, the present state of the metric implied that BTC might rally once more. This time, a transfer to $72,000 could possibly be validated.

Learn Bitcoin’s [BTC] Value Prediction 2024-2025

However as talked about earlier, step one to hitting the area could possibly be a correction to $60,000.

Within the meantime, BTC might bear a consolidation section first. After that, extra liquidity might movement out of the coin which might propel the downturn earlier than the upswing.