- Per Hayes, BTC might drop under $50k regardless of the anticipated Fed fee minimize.

- Monetary establishments are reportedly parking cash into the Fed’s RRP for increased yields as a substitute of threat property like BTC.

In lower than every week into September, Bitcoin [BTC] has shed 4%, slipping from $59.8k to barely holding above $56k on the time of writing. Market observers have broadly anticipated the doubtless Fed fee cuts in September to be a possible catalyst for BTC and the danger market.

Nonetheless, in response to BitMEX founder Arthur Hayes, the short-term weak spot might persist even after the Fed fee cuts anticipated on 18th September.

Per Hayes, BTC might chop or drop in the direction of $50K as monetary establishments direct liquidity to the Fed’s RRP (Reverse repurchase settlement) for increased yields. A part of his newest evaluation report learn,

‘As such, RRP balances should continue to rise, and Bitcoin, at best, will chop around these levels and, at worst, slowly leak lower towards $50,000.’

Supply: Bloomberg

RRP is a key Fed financial coverage software, particularly in controlling cash provide (liquidity) and short-term rates of interest. A pointy rise in RRP would restrict US liquidity and vice versa.

Macro uncertainty for BTC?

Initially, Hayes had projected that the US might enhance treasury payments (T-bill) issuance, value over $300 billion, injecting the wanted liquidity and boosting BTC. Nonetheless, he just lately famous a hike in RRP in comparison with T-bill issuance, which is a web unfavourable for US liquidity.

‘Assuming the Fed doesn’t minimize charges earlier than the September assembly, I count on T-bill yields to remain firmly under these of the RRP.’

For context, BTC has been positively correlated with US liquidity. As such, the aforementioned liquidity crunch may be dangerous information for the digital asset within the brief time period.

Nonetheless, the chief famous that his bearish BTC outlook was short-term, and the weak spot can be a shopping for alternative.

‘My shift in opinion keeps my hand hovering over the Buy button. I am not selling crypto because I am short-term bearish.’

Moreover this doubtless caveat on the macro entrance, BTC has traditionally posted weak September outcomes. Nonetheless, as famous by QCP Capital, the crypto may see sturdy reduction in October.

‘October, however, has the strongest bullish seasonality, with BTC showing positive returns and an average gain of 22.9% in 8 out of the last 9 Octobers.’

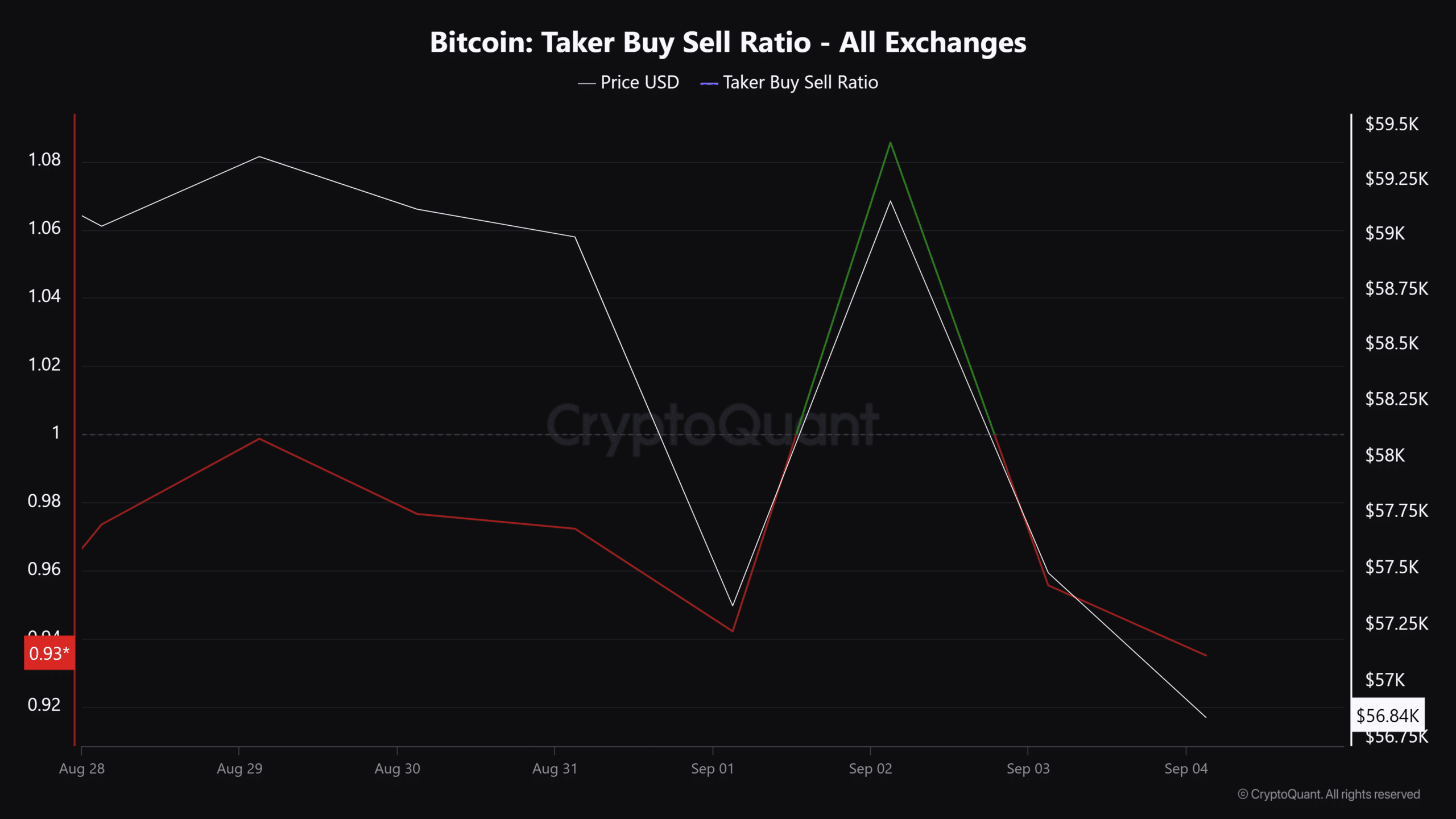

Within the meantime, the crypto Concern and Greed index studying was at 27 and flashed ‘fear’ at press time. The derivatives section was additionally overwhelmingly bearish, as proven by the unfavourable Taker Purchase Promote Ratio.

The studying meant vendor quantity dominated patrons, illustrating that weak sentiment prevailed.

Supply: CryptoQuant