- MicroStrategy, Mara, and Riot shares noticed a surge in worth as BTC hit $107K.

- BTC’s demand from new buyers exceeds the March demand on the $70K stage by 4%.

MicroStrategy aggressively acquired 15,350 Bitcoins [BTC] at a mean worth of $100.3K, elevating their complete holdings to 439,000 BTC. These have been bought for $27.1 billion at a mean of $61,725 every.

This strategic accumulation is mirrored of their reported BTC yields of 46.4% for the quarter and 72.4% year-to-date.

CEO Michael Saylor’s feedback on X (previously Twitter) emphasised a long-term view on digital property by evaluating Bitcoin funding to historic valuations of Manhattan.

His advocacy for a {Digital} Belongings Framework and a Bitcoin Strategic Reserve, alongside MicroStrategy’s inclusion within the Nasdaq 100, highlighted their pivotal position in shaping the monetary house.

The MSTR strategy might counsel future developments in company asset allocation and the broader integration of digital property in monetary methods.

Different crypto shares have been up

MARA Holdings’ inventory climbed 11% in response to Bitcoin’s ascent to a brand new all-time excessive of round $107K.

This upswing in MARA’s inventory worth paralleled positive factors throughout crypto-linked equities, highlighting the market’s growing interdependence with crypto efficiency.

MARA utilized proceeds from its zero-coupon convertible notes choices to purchase 11,774 BTC. The $1.1 billion acquisition at $96K per BTC yielded a return of 12.3% for the quarter and 47.6% year-to-date.

MARA’s Bitcoin holdings now stand at 40,435 BTC, valued at $3.9 billion. The corresponding worth motion has its inventory poised to hit $45.

Supply: TradingView

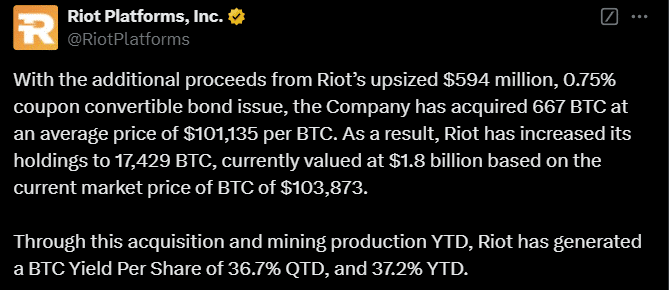

Moreover, Riot Blockchain capitalized on its elevated funding from an upsized $594 million convertible bond subject, buying 667 BTC at a mean of $101,135 every.

This strategic transfer expanded Riot’s holdings to 17,429 BTC, valued at $1.8 billion. All year long, each acquisitions and mining operations contributed to the corporate’s monetary efficiency.

Supply: X

Consequently, Riot reported a considerable Bitcoin Yield Per Share, attaining 36.7% for the quarter and 37.2% year-to-date.

This monetary maneuver demonstrates Riot’s strong place in leveraging market dynamics to reinforce shareholder worth, highlighting its adept technique within the evolving cryptocurrency panorama.

Bitcoin demand on the rise

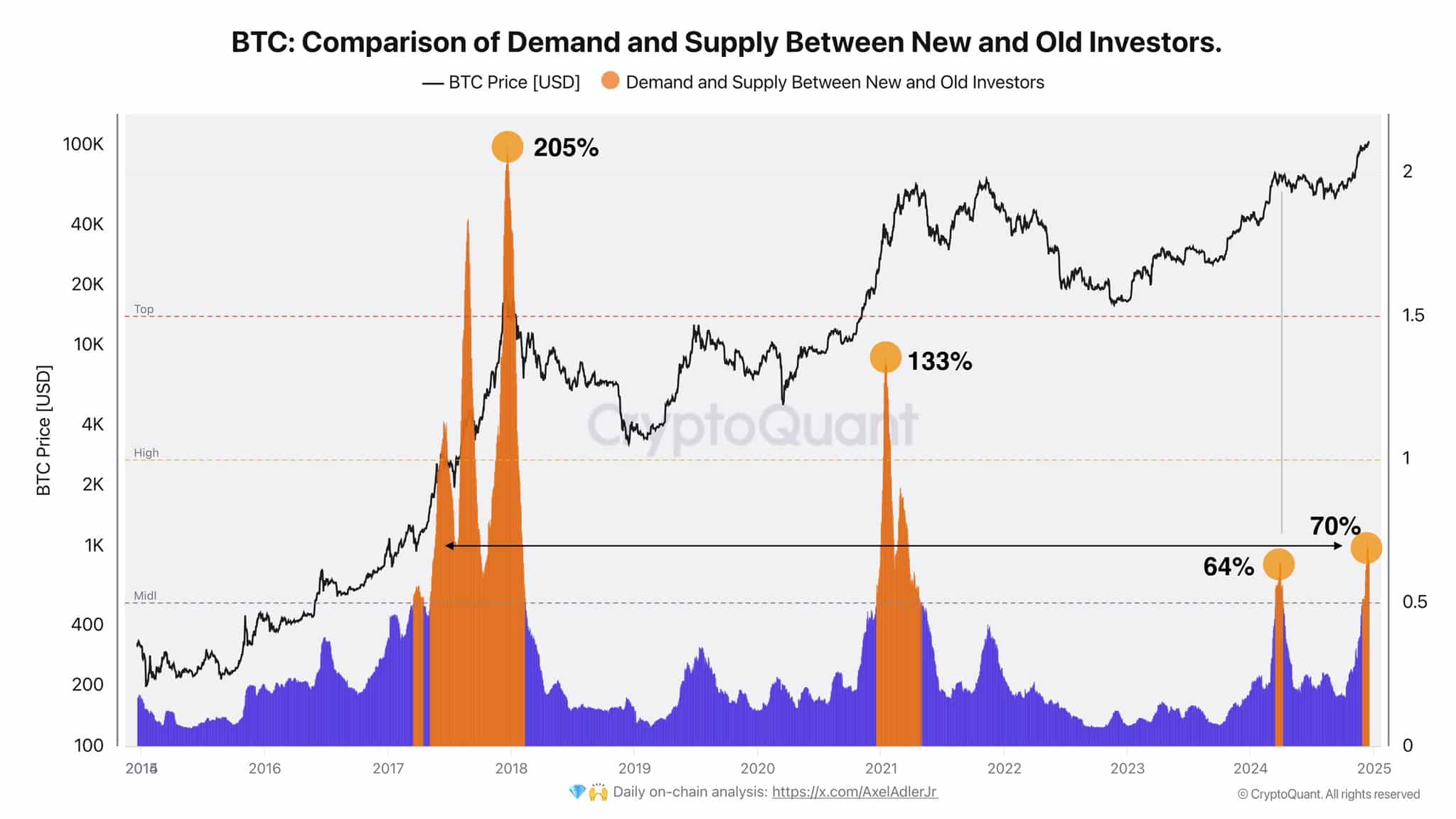

Moreover, the present cycle’s demand from new buyers has exceeded the earlier March peak, when Bitcoin reached $70K, by 4%.

Though important, this stage of demand is extra reasonable in comparison with prior cycles, the place demand peaks surged to 205% and 133%. This moderation might counsel a shift in dynamics or investor sentiment at these costs.

Supply: CryptoQuant

Traditionally, these peaks typically preceded substantial market actions, indicating that Bitcoin might expertise additional important adjustments in valuation.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Anticipation of potential volatility or development primarily based on historic patterns has aligned expectations with rising market conduct.