- An trade move metric confirmed that the native backside could be in for BTC, ETH.

- The market sentiment was not bullish and holder conduct at essential help ranges can be key for the subsequent worth transfer.

Bitcoin [BTC] and Ethereum [ETH] bulls struggled to shift the market dynamic of their favor. The massive losses of the previous ten days meant that the worth was again at a help zone the place consumers are anticipated to halt the sellers.

Ethereum’s MVRV and NVT ratios confirmed the asset could be undervalued. The liquidity pocket at $3500 might see a brief squeeze, however momentum was bearish in any other case.

In the meantime, one other BTC investigation confirmed that mining exercise had receded and that miners had been promoting Bitcoin. Nevertheless, the promoting stress had begun to drop in depth over the previous two days.

AMBCrypto determined to have a look at the motion of each belongings from exchanges to gauge the market sentiment. It revealed that bulls may not have an excessive amount of to cheer for but.

What does the trade netflow metric point out?

The trade internet flows metric provides invaluable insights into the market. When the flows are constructive, it reveals inflows are larger.

This in flip is an indication of potential promoting stress on the asset, because it implies individuals are sending the crypto to exchanges to promote them.

Values under zero imply that outflows are larger, which is an efficient signal for consumers.

It signifies that market individuals are withdrawing their belongings from exchanges, more likely to place them in safer storage, and signifies accumulation.

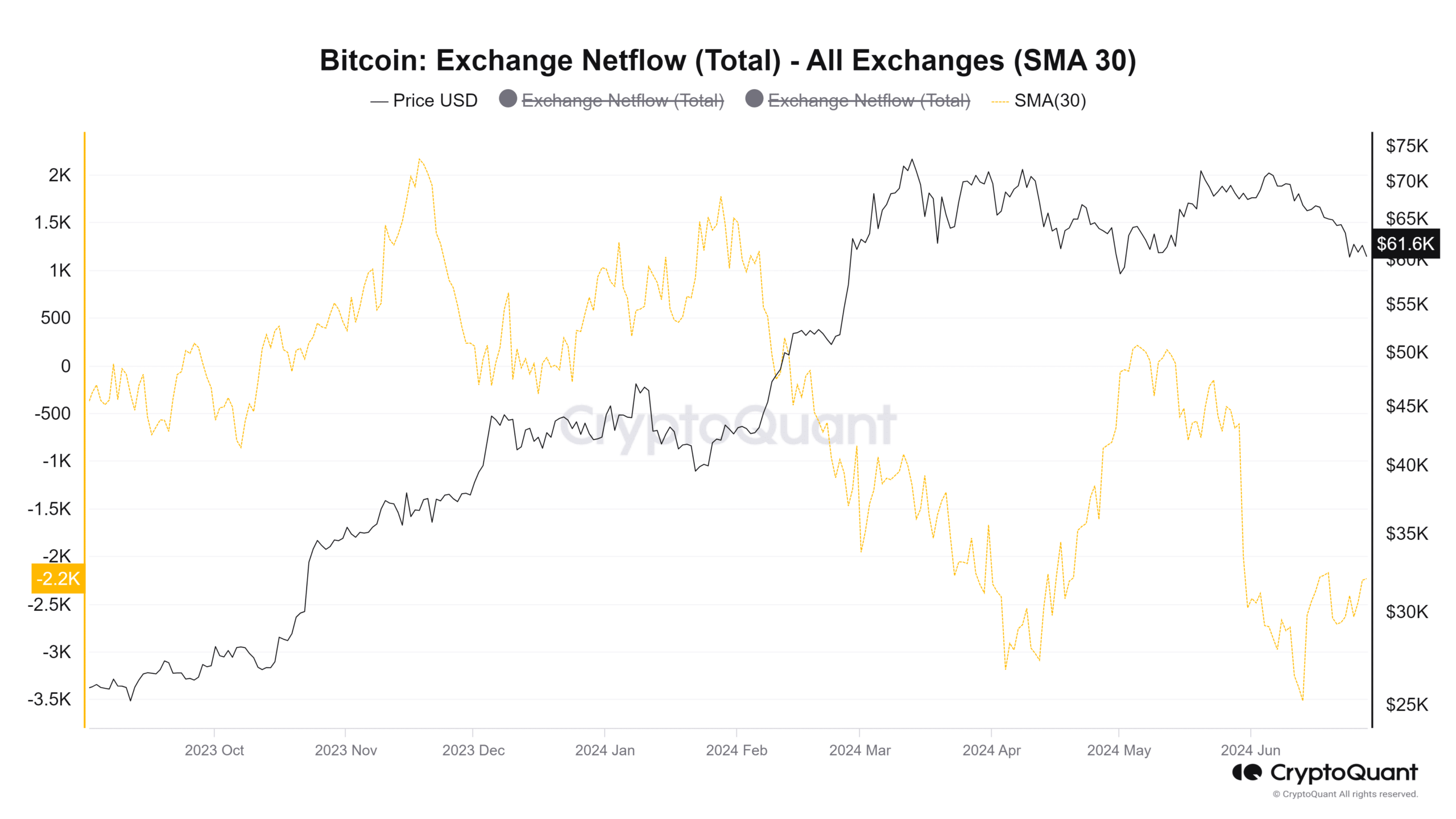

Supply: CryptoQuant

The 30-day easy shifting averages had been used to higher perceive the trade move traits. The ETH inflows had been appreciable in mid-March and towards late Might.

Each occurrences marked a neighborhood high for the worth.

Prior to now month, the web move was closely destructive, exhibiting accumulation. Over the previous eight days, the outflow has slowed down, however the 30DMA internet move remained in destructive territory.

Supply: CryptoQuant

In the meantime, Bitcoin noticed constant accumulation in February and March. The 30DMA confirmed that the move of BTC out of the exchanges continued to dominate.

In late April and on the twenty first of Might, there have been spikes within the BTC influx, however they had been exceptions to the development.

Are Bitcoin, Ethereum headed for a consolidation?

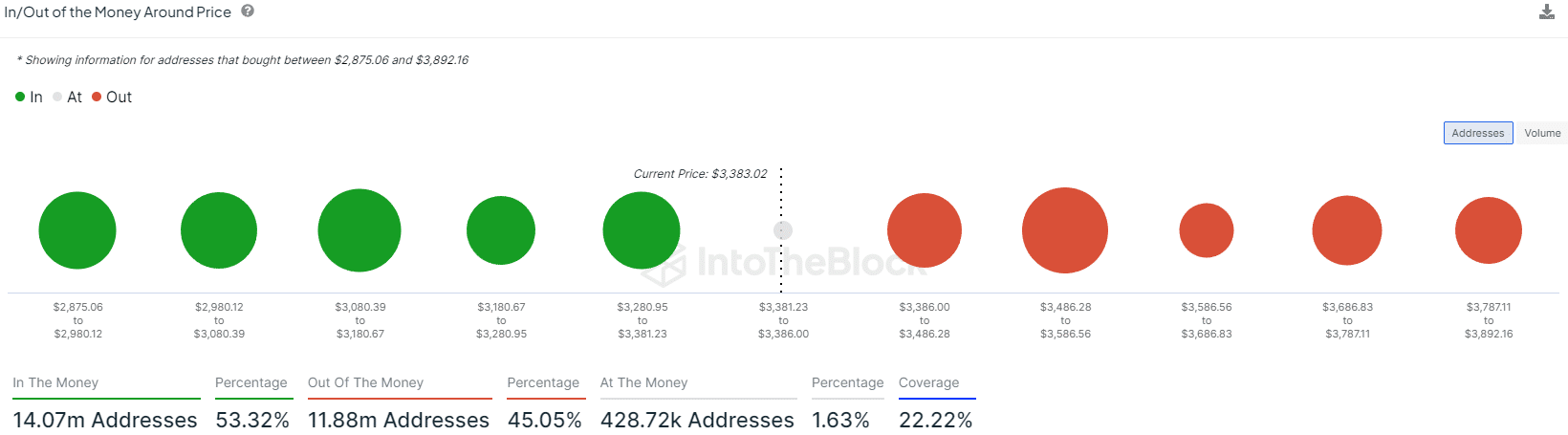

Supply: IntoTheBlock

AMBCrypto’s examination of the in/out of the cash knowledge from IntoTheBlock highlighted key help areas.

The in/out of cash across the worth confirmed Ethereum has a powerful bastion of help from $3080-$3180 and $3280-$3381. Equally, the $3486-$3586 can also be a staunch resistance.

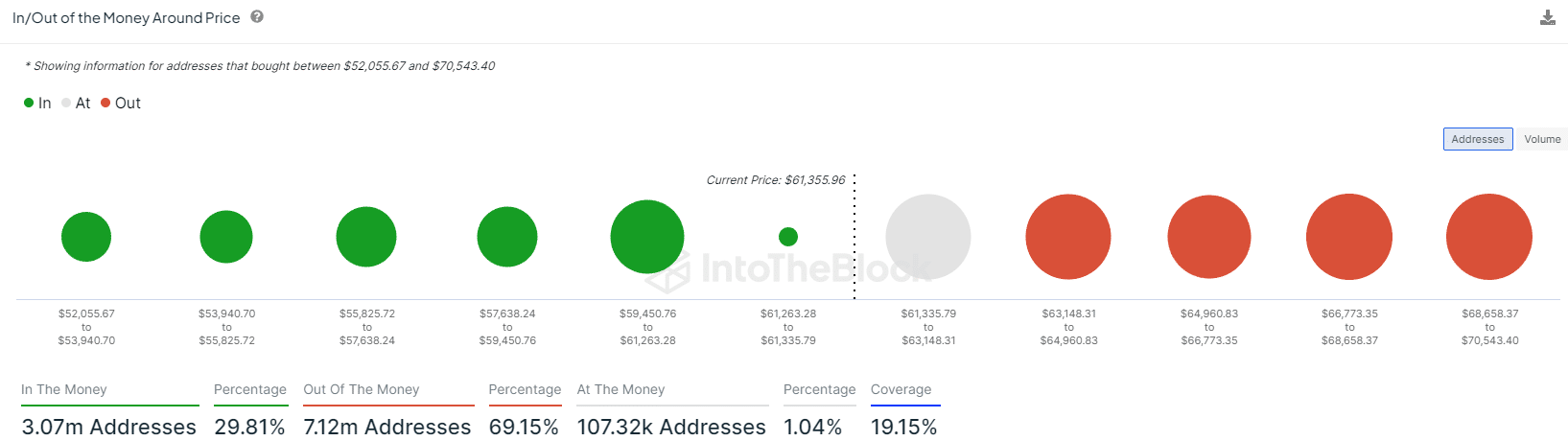

Supply: IntoTheBlock

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

For Bitcoin, the $59,450-$61,263 is help and $63,148-$64,960 resistance.

This meant that the present worth consolidation of each these crypto market leaders might be confined inside these ranges and result in a variety formation.