- CryptoQuant CEO Ki Younger Ju additionally famous that whales are accumulating Bitcoin and we’re in the midst of the bull cycle.

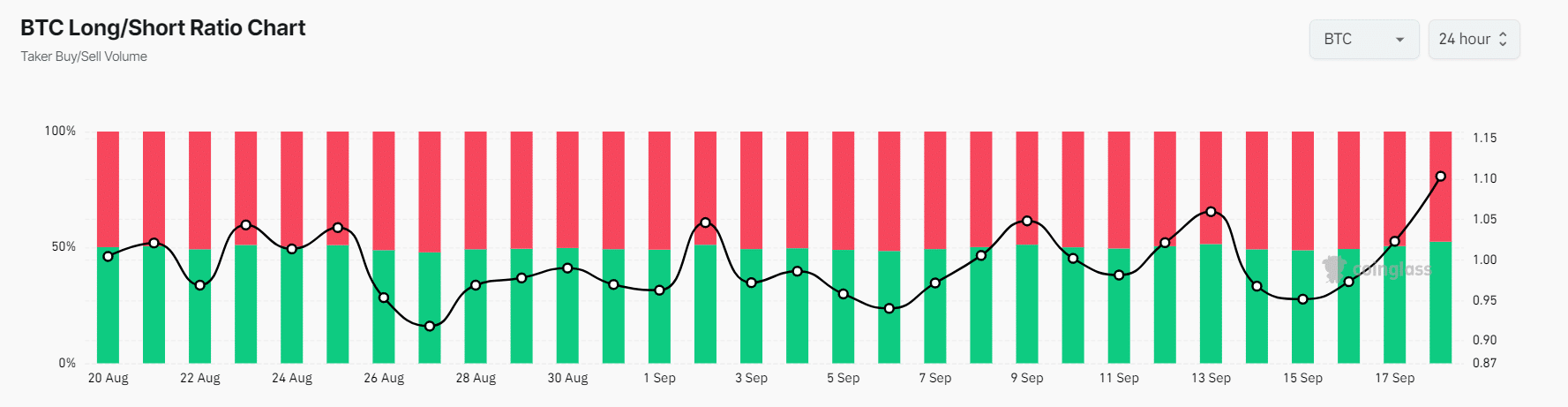

- BTC’s Lengthy/Quick ratio presently stands at 1.1048 (a price of ratio above 1 signifies bullish market sentiment amongst merchants).

Regardless of important volatility within the cryptocurrency market, Bitcoin [BTC] whales and establishments seem like capitalizing on the present sentiment by closely accumulating cash.

In current days, the general cryptocurrency market sentiment has been difficult, with main cryptocurrencies like Ethereum, Solana, and XRP struggling to achieve momentum.

Whales and institutional accumulation

On-chain analytics agency made a publish on X (beforehand Twitter) that digital asset and blockchain chief Galaxy {Digital} had accrued a big 4,491 BTC, price $267.03 million, inside every week from the exchanges together with OKX, Coinbase, and Gemini.

With this current accumulation, the agency now holds an enormous 8,790 BTC, price $532.38 million.

Along with this publish on X, CryptoQuant CEO Ki Younger Ju additionally shared knowledge supporting the identical perspective on Bitcoin whales. In a publish on X, Ki Younger famous that whales are accumulating Bitcoin.

He added, “Six days of accumulation alerts in a row, primarily from custody wallet inflows. Nothing has changed for Bitcoin; we’re in the middle of the bull cycle.”

Preferrred shopping for alternative?

Bitcoin accumulation on this difficult situation is a constructive signal and doubtlessly indicators a really perfect shopping for alternative.

Regardless of the numerous accumulation and the bullish outlook of whales, Bitcoin stays regular and has been consolidating between $58,000 and $60,000.

At press time, BTC is buying and selling close to the $60,550 stage and has skilled a worth surge of over 3.35% prior to now 24 hours. Throughout the identical interval, its buying and selling quantity has elevated by 40%, indicating larger participation amongst merchants.

BTC’s bullish on-chain metrics

At present, Bitcoin’s on-chain metrics are flashing bullish indicators. In accordance with the on-chain analytic agency Coinglass, BTC’s Lengthy/Quick ratio presently stands at 1.1048 (a price of ratio above 1 signifies bullish market sentiment amongst merchants), the best since August 2024.

Supply: Coinglass

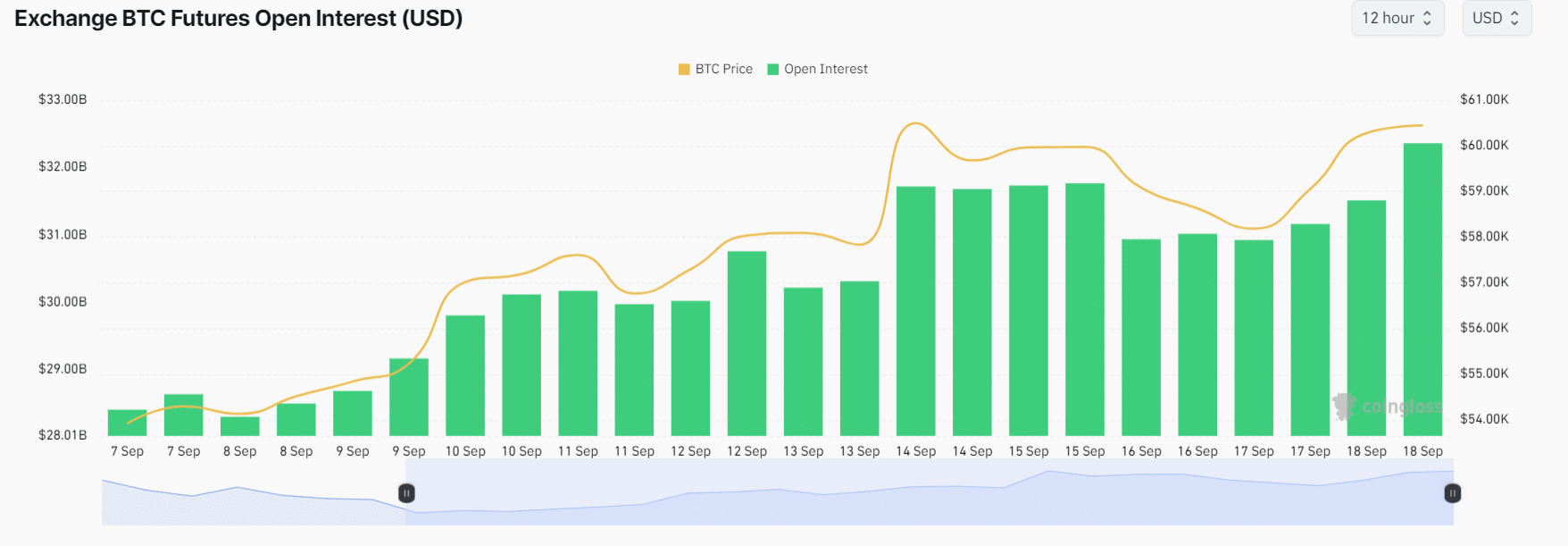

Moreover, BTC’s future open curiosity has elevated by 6% within the final 24 hours and continues to develop, indicating rising curiosity from merchants and buyers.

Supply: Coinglass

Learn Bitcoin’s [BTC] Value Prediction 2024-25

At present, 52.5% of prime Bitcoin merchants maintain lengthy positions, whereas 47.5% maintain quick positions, indicating that bulls are again and dominating the asset.

In the meantime, the BTC OI-weighted funding fee stands at +0.0053% and is within the inexperienced, reflecting bullish sentiment amongst merchants and buyers.