- BTC might hit $350k per coin, per VanEck CEO.

- Peter Brandt suggestions each BTC and gold as a retailer of worth.

Jan Van Eck, CEO of $107 billion asset supervisor VanEck, sees Bitcoin hitting $350k as quantitative easing begins amongst main central banks.

In a latest interview with Fox Enterprise, the CEO mentioned the worth goal might be hit if the digital asset attains half of gold’s market cap.

‘Eventually, the Fed will start easing, and that’s nice for gold and Bitcoin. Bitcoin is rising up. It might ultimately be half the overall market cap of gold. In order that’s $350k.’

On an excessive stretch, Van Eck projected that BTC might hit $2.9M by 2050 if central banks undertake BTC and it turns into a part of the financial system.

The above projection was just like Michael Saylor’s latest worth goal through the Bitcoin 2024 convention. Saylor claimed that BTC might hit $3M by 2045 in a bear-case situation, particularly if BTC hit 5% of worldwide wealth.

Can Bitcoin catch as much as Gold?

Van Eck’s $350k was linked to BTC’s means to draw a minimum of half of gold’s market cap. As of press time, BTC ranked quantity 9 primarily based on high world property by market cap ($1.27 trillion).

However, gold was on the high place with a $16.8 trillion market cap. Which means the gold market cap was 13X greater than BTC.

Nevertheless, BTC might quickly eclipse Silver’s market cap, which stood at $1.6 trillion and ranked eighth globally primarily based on market measurement.

Given VanEck and Saylor’s reported bullish outlook for BTC, would you retailer worth with gold or BTC?

Famend market analyst, Peter Brandt, would relatively purchase each property than be compelled to aspect with one. Utilizing the BTCGLD ratio,

Brandt established that the ratio might drop to fifteen in a worst-case situation or rally as much as 154 in a bull market situation.

‘The longest-term chart indicates that BTC could (not will) advance to 150+; I believe in owning both Gold and Bitcoin.’

Supply: X/Peter Brandt

For perspective, the BTCGLD ratio tracks BTC’s relative efficiency in gold phrases. The ratio has risen increased since 2023, hitting 26.

Which means that BTC has outperformed gold prior to now yr and is price 26x greater than gold.

Based mostly on Brandt’s chart, a drop to the range-low of the BTCGLD ratio of 15 would imply gold outperforming BTC, because it has prior to now few weeks.

Nevertheless, a surge to 154 couldn’t be overruled. It means that BTC might nonetheless outperform gold by 154X in the long run.

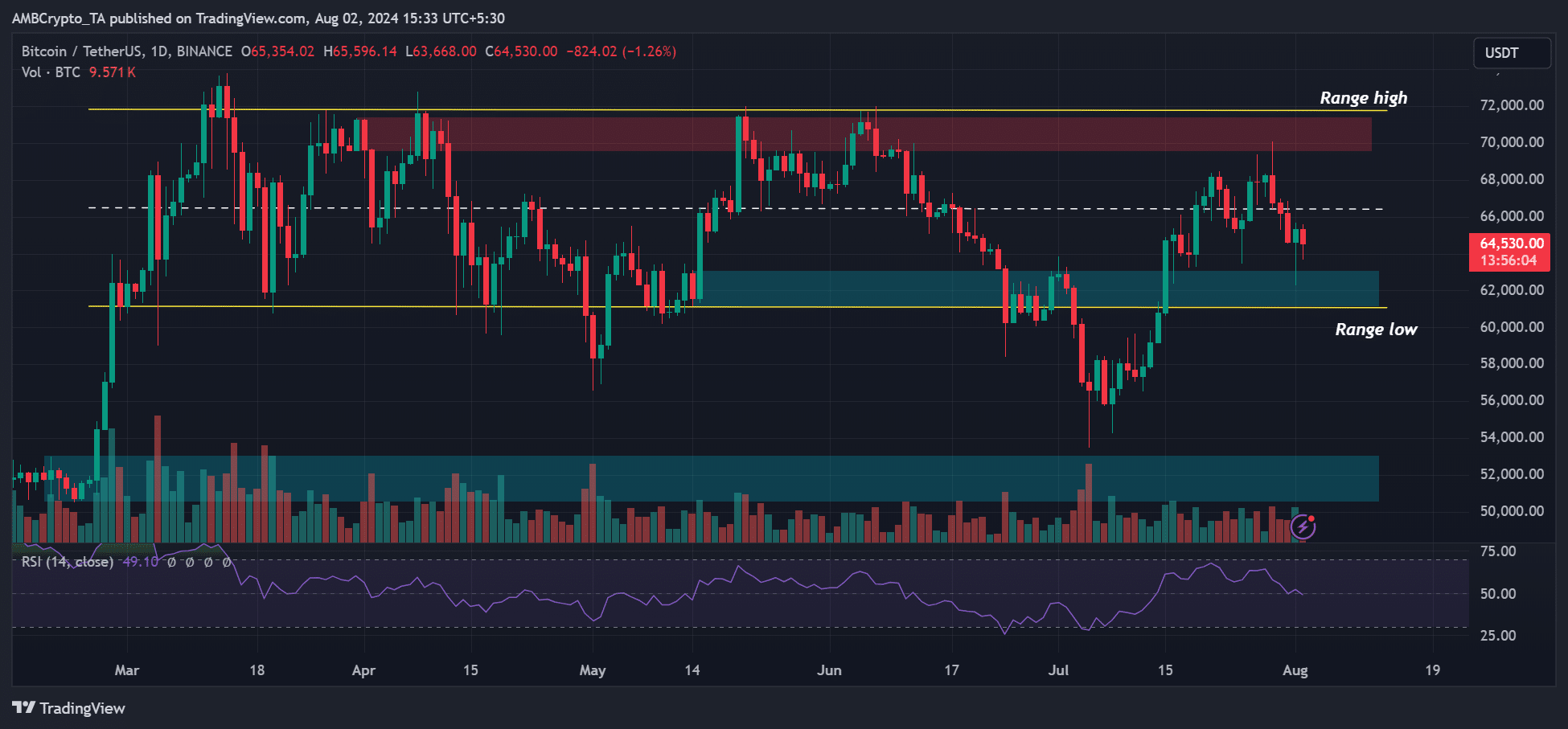

In the meantime, BTC had bounced again properly on the demand and bullish order block round $62k (cyan) forward of the U.S. Jobs report.

Whether or not the U.S. July jobs report will induce BTC to reverse latest losses stays to be seen.

Supply: BTC/USDT, TradingView