- USDT typically presents conflicting demand and provide alerts, making it essential to maintain a detailed eye on.

- With the market within the crimson, stablecoins may be changing into an more and more engaging various.

If Bitcoin [BTC] is digital gold, Tether [USDT] is the digital greenback, firmly holding its $1 peg.

As soon as a distinct segment asset, USDT has seen a large surge in demand, changing into the go-to instrument for seamless transactions – whether or not for on a regular basis purchases or large cross-border transfers.

This surge is clear, with the worldwide stablecoin provide hitting a report $190 billion, including over $60 billion because the begin of 2024.

Nonetheless, within the crypto world, the demand/provide dynamic takes on an entire new which means.

Exploring the 2 sides of the coin

USDT, essentially the most broadly used stablecoin within the crypto market, has lengthy acted as a security web throughout occasions of shaky market sentiment. Proper now, we’re seeing that development once more.

December kicked off robust, with Bitcoin not solely surpassing $100K but in addition hitting a brand new all-time excessive of $104K inside the first 5 days. Consequently, USDT dominance slipped to a 6-month low of three.80%.

Nonetheless, with Bitcoin’s subsequent market prime nonetheless unsure, volatility is ramping up. If this development holds, extra traders may flock to the steadiness of USDT, particularly with a bearish MACD crossover additional supporting this shift.

Moreover, from an financial standpoint, provide will increase to satisfy rising demand.

With the stablecoin provide reaching $190 billion – $60 billion of which got here this yr – it’s clear that demand for USDT is rising quickly, significantly among the many massive gamers.

Supply : IntoTheBlock

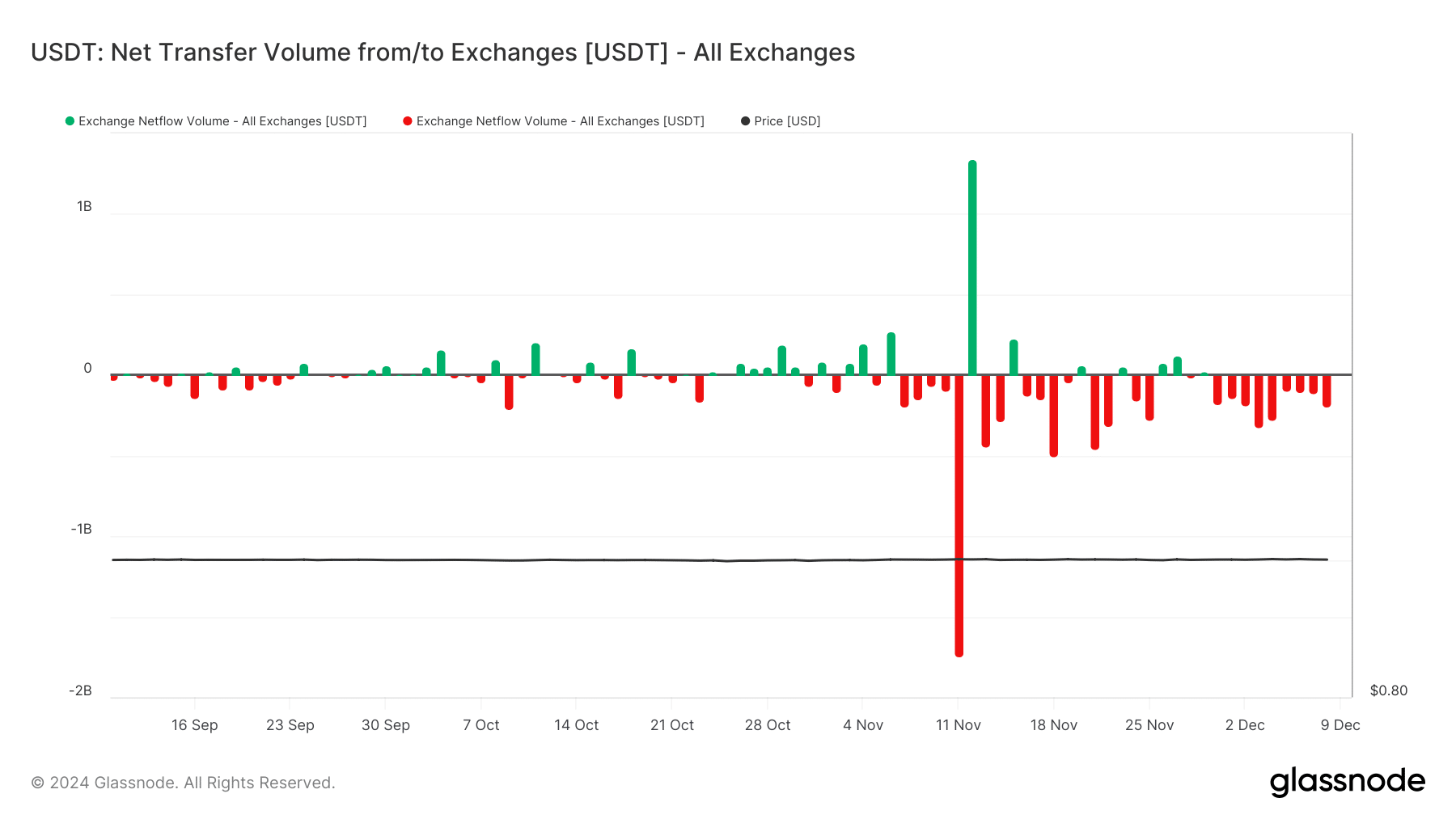

In November alone, whales ramped up their USDT accumulation, scooping up over $2 billion throughout 4 separate time durations, additional solidifying the stablecoin’s rising position as a hedge towards higher-risk belongings.

Nonetheless, this may increasingly solely symbolize one facet of the coin. Rising USDT demand doesn’t essentially spell doom for the market. Actually, it may imply the other.

Similar to after the election outcomes, when massive whales snatched up over $2.5 billion in USDT, positioning themselves to swap for Bitcoin, this development could possibly be the precursor to a serious rally.

So, does excessive USDT demand sign correction or rally?

Clearly, two dynamics are at play. Both market members are unloading USDT in anticipation of a large bull run, driving its provide to new highs, or concern of a correction is sparking a rush to hoard USDT as a secure haven.

Wanting on the chart above, whales have considerably decreased their USDT holdings prior to now two days—from over $2 billion to a -$240 million place—exhibiting robust conviction in upcoming positive aspects.

Nonetheless, the retail sector seems to be taking a special route. For the reason that begin of December, there have been consecutive crimson bars, indicating an rising withdrawal of USDT from exchanges.

Supply : Glassnode

In contrast to earlier than, when USDT accumulation signaled Bitcoin’s bullish outlook, traders could now be turning to stablecoins for security. Why?

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Bitcoin’s 4 failed makes an attempt to interrupt $100K, concern over its overvaluation, and a scarcity of FOMO are making traders extra cautious.

So, with volatility spiking, merchants are both chasing fast, massive positive aspects in mid and low-cap tokens or looking for stablecoins as a safer wager.