- U.S. Bitcoin ETFs expertise the third-largest sell-off, highlighting the contrasting strikes within the crypto markets.

- Historical past is about to repeat itself as analysts predict a bull run much like that of 2021 after FED cuts pursuits charge this September.

U.S. ETFs just lately traded 3,750 Bitcoin [BTC], marking the third-largest sell-off since their inception. Regardless of this, BlackRock bucked the development by shopping for 683 BTC.

In the meantime, different main gamers within the ETF market made important gross sales: Constancy offloaded 1,646 BTC, ARK bought 1,387 BTC, Grayscale parted with 569 BTC, Bitwise bought 465 BTC, and VanEck bought 364 BTC.

This substantial sell-off as per Web Bitcoin ETF Flows on Flows.heyapollo.com mirrored different methods and market views amongst these main monetary establishments.

The contrasting strikes highlighted the continued volatility and differing outlooks inside the cryptocurrency market, significantly amongst institutional buyers.

This will end in short-term decline on the Bitcoin market.

Supply: Flows.heyapollo.com

Will August see Bitcoin attain $44k?

There’s potential for the crypto market to get slammed into subsequent week, however that is once you wish to be bullish, not throughout huge inexperienced candles on the again of $BTC strategic reserve information story.

BTC was bearish from mid-March to April, failed to interrupt the excessive in Might, and have become bearish once more from mid-June.

The bias stays unchanged, anticipating a low in August although we don’t know precisely the place this low will land, however quickly it is going to be bullish once more.

First, we should enter the demand zone and the interval of alternative. The BTCUSD chart urged that reaching the $44k zone would possibly result in worth skyrocketing to $100k.

Supply: TradingView

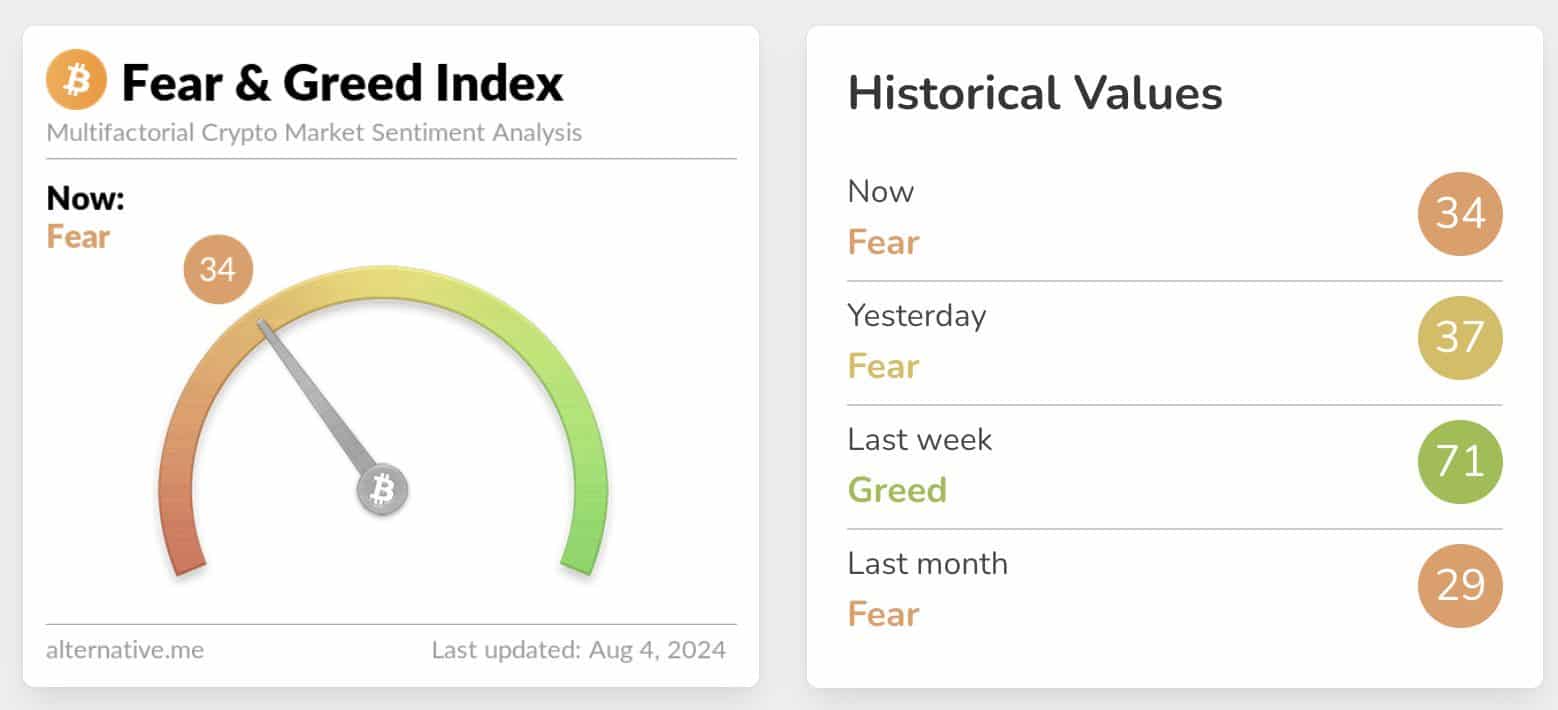

Moreover, in simply two weeks, the Concern & Greed Index has shifted from a grasping 71 to a fearful 34, indicating that extra persons are liquidating their belongings amidst rising market uncertainty.

Supply: Different.me

Will the 2021 crypto bull run repeat itself?

Nonetheless, 2020 historical past appears poised to repeat itself when markets crashed attributable to financial concern from COVID-19 and the following financial decline however later rallied.

The Federal Reserve responded by slicing rates of interest and implementing quantitative easing to help the economic system, resulting in the crypto bull market of 2021.

As we speak, markets are once more plummeting attributable to financial fears from a weak job report and financial decline.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

The Federal Reserve is predicted to chop charges in September and provoke quantitative easing as soon as extra.

AMBCrypto’s evaluation of TradingView knowledge urged comparable financial fears and financial responses are in play, probably setting the stage for one more market restoration akin to the post-2020 state of affairs.

Supply: TradingView