- Uniswap noticed a FOMO that ushered in worth correction.

- BTC has fallen off the $69,000 worth vary.

The worth pattern of Uniswap [UNI] stirred up Concern of Lacking Out (FOMO) on the tenth of June, suggesting a possible correction. This correction has already begun, however may not be solely because of FOMO.

Bitcoin [BTC] additionally skilled a notable decline, and its pattern usually impacts the broader market.

Uniswap and Bitcoin: Evaluating social metrics

In accordance with current information from Santiment, Uniswap noticed a spike in its social dominance on the tenth of June. The info indicated that UNI was essentially the most notable amongst belongings experiencing a rise on that day.

The worth surge introduced important consideration to UNI, creating FOMO.

Nevertheless, the rise in worth and social dominance was extra of a bearish sign than a bullish one, particularly contemplating the concurrent decline in Bitcoin, which generally influences the broader market sentiment.

Supply: Santiment

AMBCrypto’s evaluation of the Bitcoin social dominance pattern confirmed that it didn’t witness any notable motion throughout the identical timeframe.

Though Bitcoin maintained a better social dominance than UNI, its pattern appeared comparatively regular. As of this writing, BTC’s social dominance is round 23%, whereas UNI’s is round 0.5%.

How UNI trended

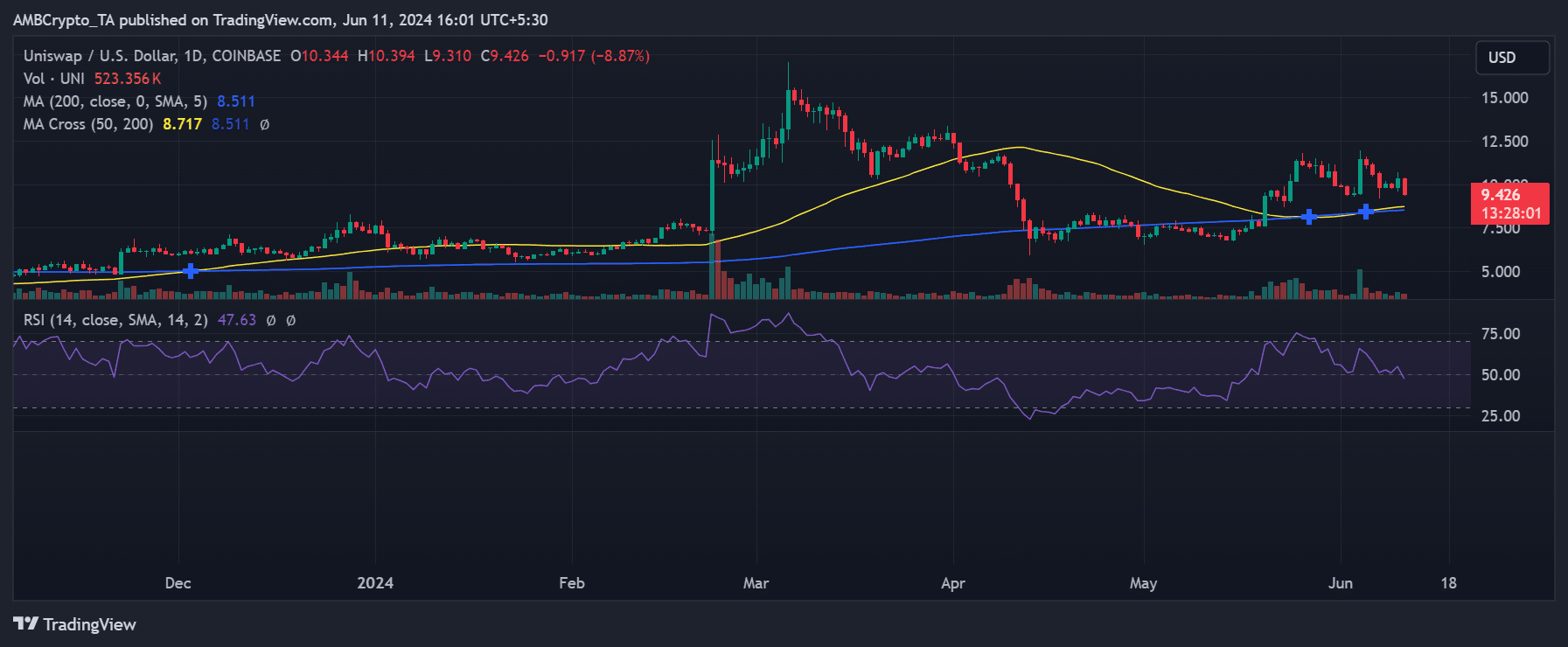

A take a look at Uniswap’s every day worth confirmed a rise of 5% on the tenth of June, from round $9.80 to $10.30. Nevertheless, this achieve and extra have since been worn out.

As of this writing, Uniswap was buying and selling at round $9.40, with a decline of over 8%.

Supply: TradingView

The decline has pushed Uniswap right into a bear pattern. Its Relative Energy Index (RSI) confirmed that it’s at the moment under the impartial line.

This decline is attributed to the rise in FOMO and the current decline in Bitcoin.

How has Bitcoin fared?

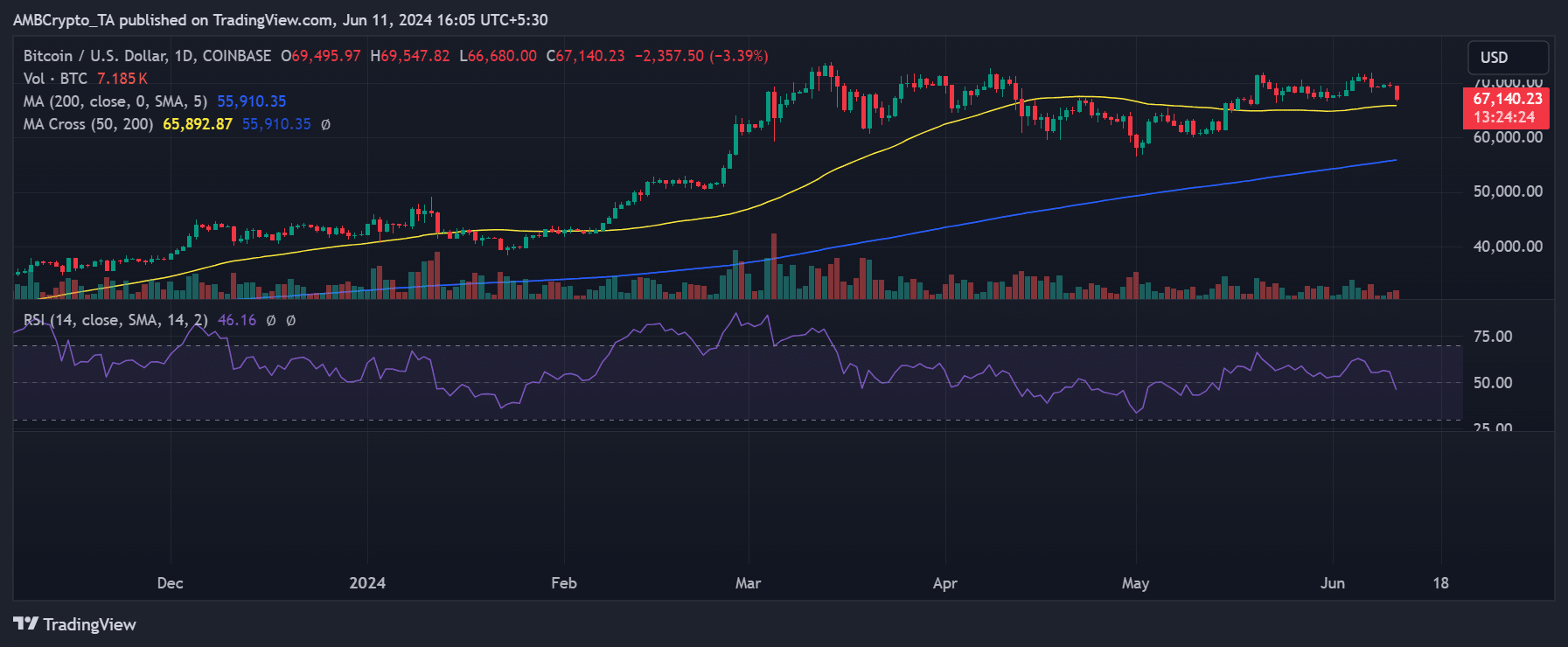

AMBCrypto’s evaluation of Bitcoin confirmed that it has declined by 0.2% within the final 24 hours, regardless of the absence of FOMO, in contrast to UNI. At press time, the king coin was buying and selling at round $69,497.

Supply: TradingView

Is your portfolio inexperienced? Take a look at the UNI Revenue Calculator

As of this writing, this downward pattern has continued, buying and selling with an over 3% decline at round $67,400.

An evaluation of its Relative Energy Index (RSI) confirmed it’s now under the impartial line, indicating a bear pattern.