Picture supply: Getty Pictures

Nvidia (NASDAQ: NVDA) inventory commonly seems among the many high buys and sells on the UK’s largest funding platforms. It’s been like that for 2 years now.

Over the previous week, it was the third most purchased inventory on AJ Bell and the second on Hargreaves Lansdown. Solely MicroStrategy has seen extra motion, when it comes to each shopping for and promoting.

Nonetheless, it appears to be like like extra UK buyers are shopping for it than promoting. Why are they so obsessive about Nvidia shares? Let’s talk about.

Momentum

One easy cause why some will probably be leaping on board is because of momentum within the share value. It’s up 173% in 2024, and a couple of,397% over 5 years. That kind of efficiency is bound to catch eyes and switch heads.

Undoubtedly, some will probably be motivated by FOMO (concern of lacking out). However as Warren Buffett says: “The dumbest reason in the world to buy a stock is because it’s going up.”

Income progress

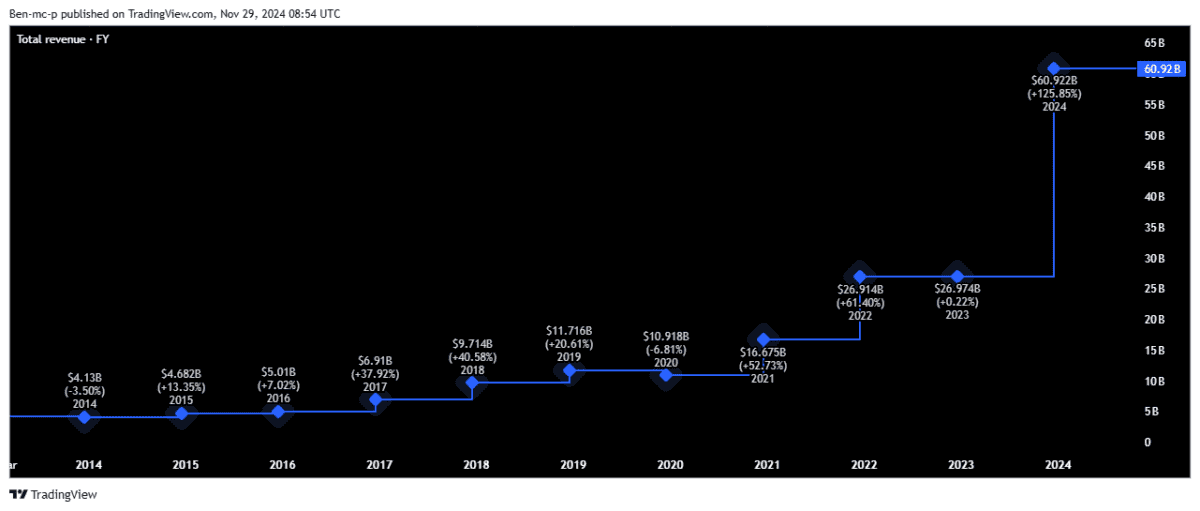

Nonetheless, many savvy buyers could have thought-about the underlying fundamentals of Nvidia as an organization. Essentially the most placing factor to notice concerning the chipmaker is how briskly it’s been rising the highest line.

Following the discharge of ChatGPT in late 2022, income has exploded increased. Certainly, Nvidia reported extra within the final quarter ($35.1bn) than it did in each quarter mixed between 2017 and 2019!

Tech corporations of all sizes are greedily gobbling up Nvidia’s graphics processing items (GPUs) as a result of they’re your best option to coach and run AI techniques.

Over the long term, income progress is a elementary driver of a share value. Nvidia’s is forecast to high $200bn in 2026!

Margin growth

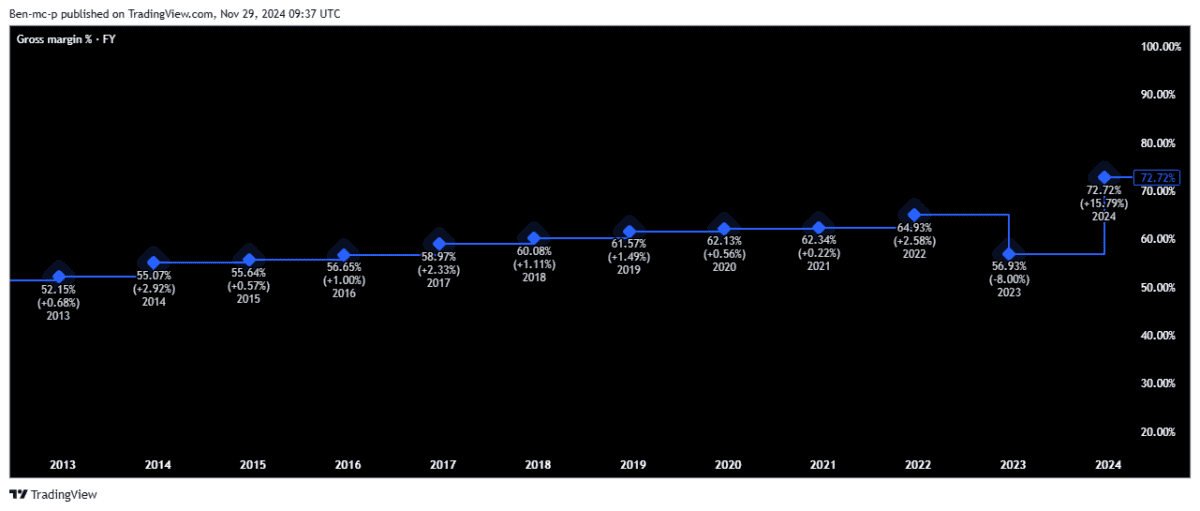

One more reason buyers have been bullish on the inventory is all the way down to increasing revenue margins.

The corporate enjoys very robust pricing energy as a result of unimaginable demand for its GPUs. And economies of scale have lowered manufacturing prices as gross sales volumes develop.

The gross margin is now above 70%, up from 60% in 2018.

Compelling narrative

A massively necessary issue for Nvidia is the general progress story round AI. It’s definitely probably the most thrilling tech growth because the web.

To be honest, founder and CEO Jensen Huang does a world-class job of fuelling pleasure round AI. His visionary language when discussing its potential can get buyers salivating.

In Q3, he wrote: “The age of AI is in full steam, propelling a global shift to Nvidia computing… AI is transforming every industry, company and country.”

That is one threat I see although. If the narrative all of the sudden adjustments, resulting from slowing AI tools capital expenditure or rising regulation, then investor sentiment might shortly bitter.

Additionally, for large-scale AI adoption, the prices should come down considerably, particularly on the subject of coaching techniques. It’s attainable Nvidia’s margins come underneath stress within the years forward.

As a consequence of this uncertainty, I offered my Nvidia shares earlier this yr. I’d solely take into account reinvesting if the inventory offered off closely.

Silly takeaway

In conclusion, Nvidia ticks practically each field for why a inventory goes up dramatically.

We’ve received surging income progress, margin growth, a better valuation, and a charming story centred round a once-in-a-generation technological revolution.

Given all this, it’s hardly shocking that many UK buyers are obsessive about Nvidia shares!