- Extra establishments held and elevated positions within the US spot BTC ETFs in Q2.

- Morgan Stanley and Goldman Sachs at the moment are the highest 5 holders of BlackRock’s IBIT.

Institutional traders’ urge for food for US spot Bitcoin [BTC] ETFs hasn’t waned, regardless of the digital asset’s drawdowns and volatility in Q2.

In line with Bitwise’s CIO Matt Hougan, the buildup development witnessed after the merchandise debuted in Q1 remained ‘intact’ in Q2, with a 30% enhance in holders.

“I count 1,924 holders ETF pairs across all 10 ETFs, up from 1,479 in Q1. That’s a 30% increase; not bad considering prices fell in Q2…Institutional investors continued to adopt bitcoin ETFs in Q2. The trend is intact.”

Establishments held BTC ETFs regardless of Q2 dump

Hougan additionally famous that 66% {of professional} traders who purchased the merchandise in Q1 both held or elevated their holdings in Q2.

“Among Q1 filers, 44% increased their position in bitcoin ETFs in Q2, 22% held steady, 21% decreased their position, and 13% exited. That’s a pretty good result, on par with other ETFs.”

This went in opposition to the perceived notion that they might capitulate and dump upon any slightest volatility or plunge. For context, BTC plummeted 12% in Q2, dropping from $72K to $56K earlier than closing above $60K.

In consequence, the Bitwise exec known as them ‘diamond’ arms for holding regular regardless of the headwinds.

Current 13F filings additionally revealed that Goldman Sachs and Morgan Stanley have been among the many high 5 holders of BlockRock’s iShares Bitcoin Belief (IBIT).

As of the thirtieth of June, Goldman Sachs held $238.6M of IBIT, whereas Morgan Stanley held $187M.

It’s value noting that Morgan Stanley and Goldman Sachs are a part of the key wirehouses (massive sellers), which have been anticipated to drive the second wave of adoption for BTC ETFs from Q3 onwards.

Morgan Stanley has already begun recommending BTC ETFs to particular purchasers, which might drive additional adoption.

The development might additionally rally institutional traders’ contribution to the BTC ETF’s AUM (belongings underneath administration).

In Q1, establishments accounted for $3 — $5 billion (7%- 10%) of the BTC ETF’s complete AUM, which stood at $50B then. On the time of writing, the whole BTC ETF’s AUM was $53.6B.

Supply: Soso Worth

Apparently, institutional traders’ accumulation of BTC ETF has picked momentum in Q3, too.

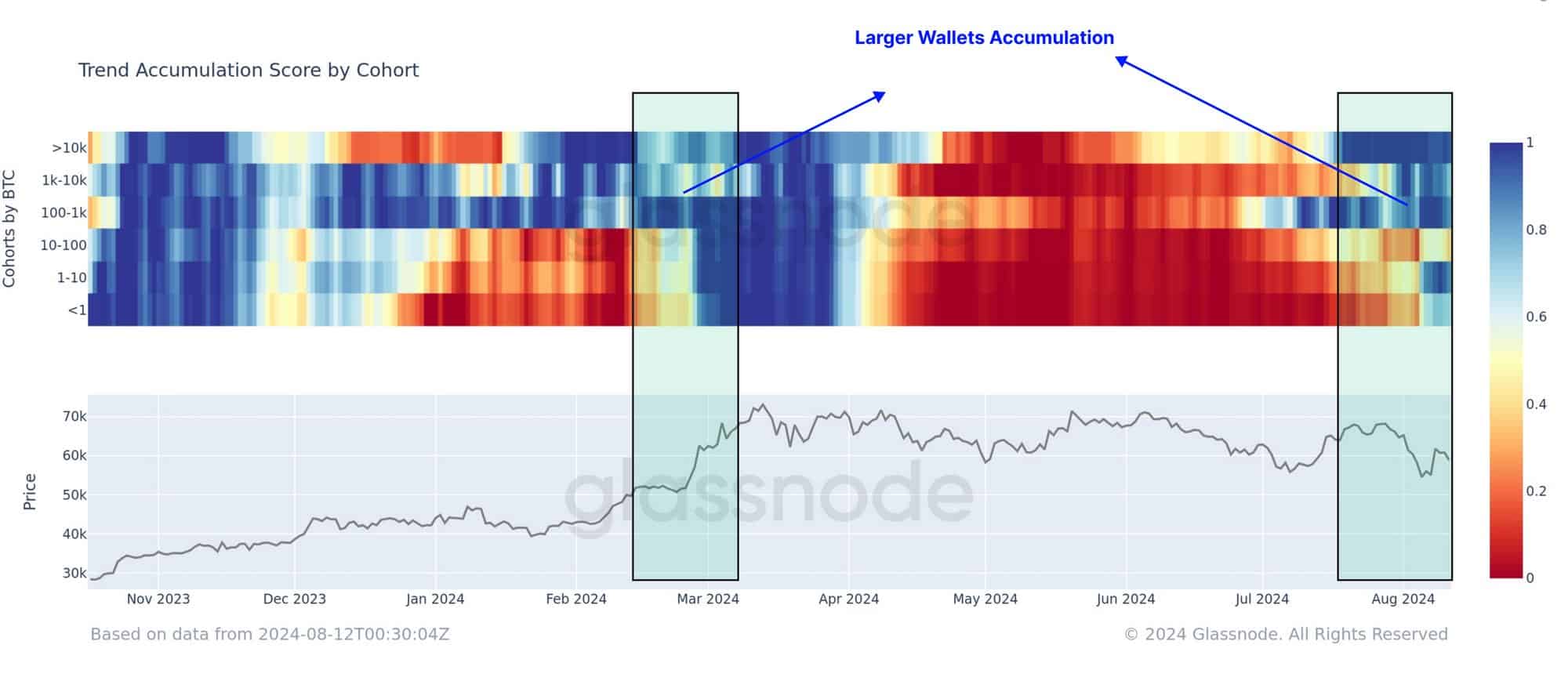

In line with Glassnode knowledge, main ETF wallets have ramped up accumulation, a development witnessed in March that tipped BTC to hit an ATH of $73K.

“Recently, this trend (supply distribution) has shown signs of reversing, especially among the largest wallets, often linked to ETFs, which are now returning to accumulation.”

Supply: Glassnode