- BTC hit a two-week excessive above $65K after Trump assault.

- The macro and US political scenes look nice for BTC, regardless of Mt. Gox’s provide.

Bitcoin [BTC] was up 7% on a weekly foundation and traded above $65K, boosted partially by the crypto market and updates from the US political scene.

Final week, the German authorities cleared its $50K BTC provide strain, which was a set-up for BTC’s restoration. After bottoming out beneath $55K, BTC recovered and reclaimed $60K, rallying 8.8% final week.

Trump boosts Bitcoin restoration?

The restoration prolonged into the present week, pushing the biggest digital asset above $65K. This week’s bullish momentum coincided with the failed assassination try on Donald Trump on thirteenth July.

Moreover, the crypto market has considered Trump’s Vice President (VP) decide, Ohio Senator James David Vance, favorably as pro-crypto. JD Vance reportedly supported a number of crypto legislations, together with the SAB 121 repeal, and owns BTC.

Reacting to Trump’s VP decide, Ryan Adams of Bankless acknowledged,

‘JD Vance is Trump’s VP decide and the probably subsequent Vice President. He strongly helps crypto. He voted for SAB121 repeal. He’s a holder – owned $250k Bitcoin in 2022 – probably extra now. He’s slammed Gensler in open letters. Additional proof that Trump white home is pro-crypto.’

Apparently, Trump’s VP decide on fifteenth July additionally coincided with a 6% rally for BTC, accounting for the biggest each day features this week.

Can BTC push above $67K

Supply: BTC/USDT

Nevertheless, the restoration has hit an impediment and breaker block, marked pink, close to $67K. The asset might see the $70K stage regardless of this short-term hurdle, per BTC value chart analyst Cryp Nuevo. The analyst projected that BTC might eye range-highs above $70K.

Based on some market analysts, even the continued Mt. Gox compensation, with over 30% of BTC on the transfer, won’t have an effect on the restoration. As of press time, BTC held above $65K regardless of the huge transfer by Mt. Gox.

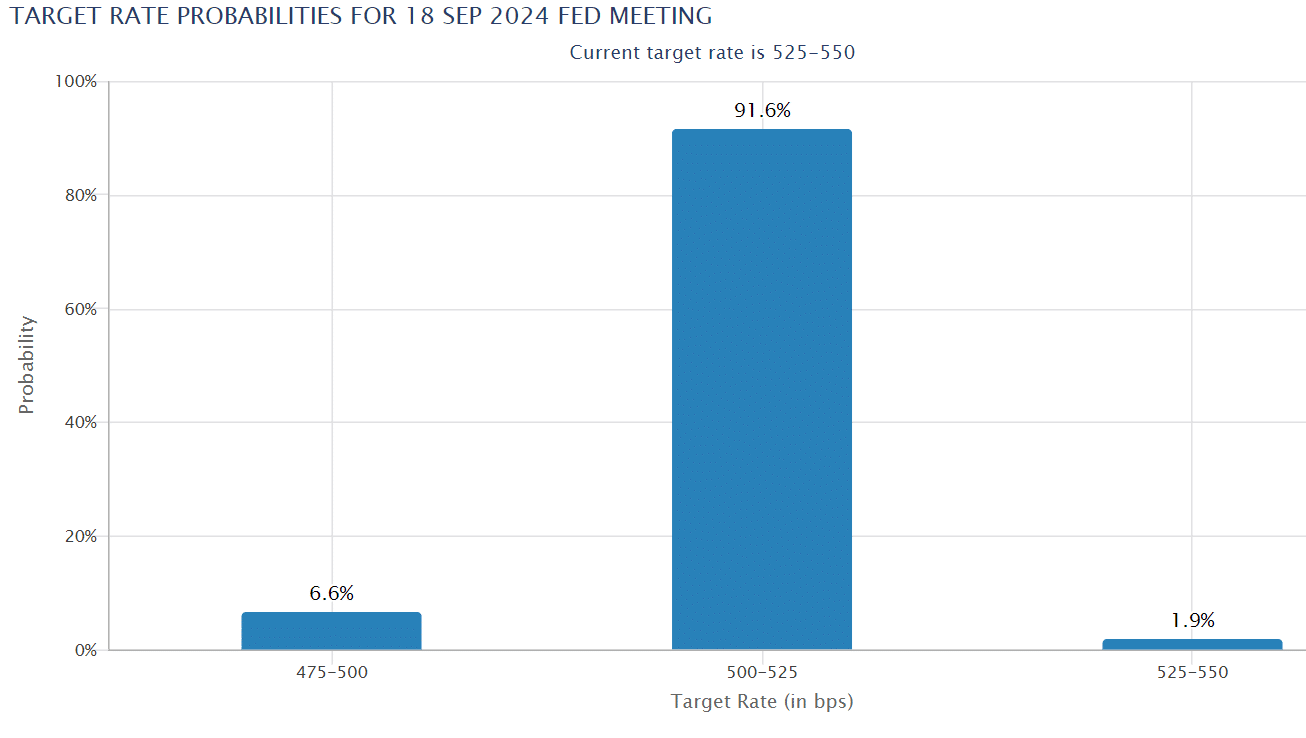

In the meantime, the long-term outlook stays bullish, particularly from a macro perspective. Over 90% of rate of interest merchants anticipate Fed price cuts in September, which might gas danger belongings, together with BTC and crypto markets.

Supply: CME Fed Watch Instrument