- BTC adoption by companies has surged by greater than 30% over the previous 12 months.

- How is that this huge adoption altering the monetary panorama?

Bitcoin [BTC] has been consolidating for three-days straight, with its worth fluctuating between an outlined worth vary of $56K — $59K.

Amid hypothesis from analysts that BTC might drop beneath the $51K assist, a brand new pattern has emerged, doubtlessly growing the chance of a worth correction.

May the company world be the subsequent hidden catalyst for Bitcoin’s revival? AMBCrypto investigates.

Companies are growing BTC accumulation

In a put up on X (previously Twitter), a brand new research revealed a 30% surge in Bitcoin adoption by companies in a single 12 months.

For context, the report recognized 52 public corporations with Bitcoin holdings, a quantity that has elevated by 40% over the previous 12 months.

In accordance with AMBCrypto’ evaluation of the report, a quieter but vital pattern is rising.

Supply : X

Whereas a lot focus has been on particular person buyers, funding corporations, and huge firms making headlines with multimillion-dollar BTC buys, small-scale companies are steadily including to the Bitcoin ecosystem.

Immediately, companies collectively maintain greater than 3% of all Bitcoin in circulation – a outstanding 500% enhance over the previous few years.

Apparently, companies have swiftly surpassed governments in Bitcoin accumulation.

If this pattern continues, companies might quickly rival ETFs in Bitcoin holdings, boosting Bitcoin’s monetary significance.

Clearly, companies are viewing Bitcoin as a retailer of worth, successfully preserving wealth over time. Nevertheless, can it endure volatility and retain its worth?

Companies have immense religion that it could

Apparently, the report revealed a key pattern : Bitcoin possession amongst companies is concentrated among the many 5 largest holders.

5 corporations – MicroStrategy, Block.one, Tether, BitMEX, and Xapo – maintain 82% of all holdings, totaling 559K BTC.

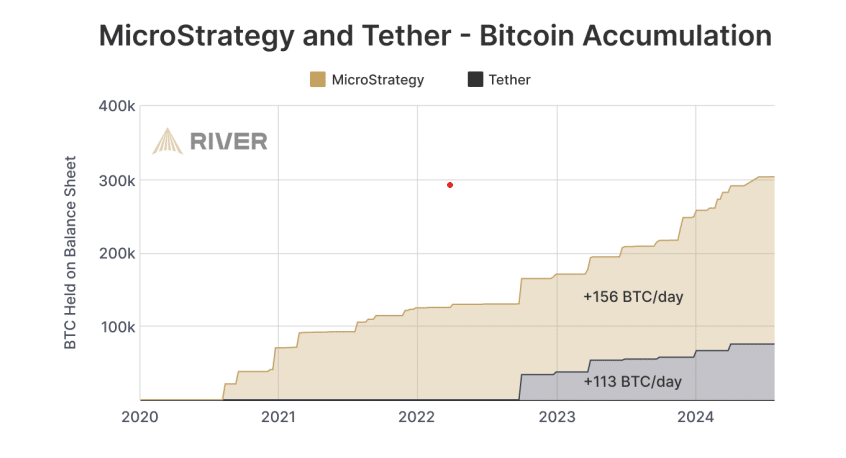

Notably, MicroStrategy and Tether account for 85% of reported BTC purchases in early 2024, shopping for a median of 269 BTC per day since late 2022.

Supply : X

In abstract, substantial enterprise holdings have been key in boosting BTC’s worth, constantly pushing its worth up regardless of macroeconomic upheaval.

That being stated, BTC started September on a bearish be aware, with quick positions dominating the spinoff market and preserving BTC beneath $60K.

Given the report’s perception into Bitcoin being held by just a few massive enterprise gamers, might they be inflicting the pullback?

MicroStrategy knowledge indicators…

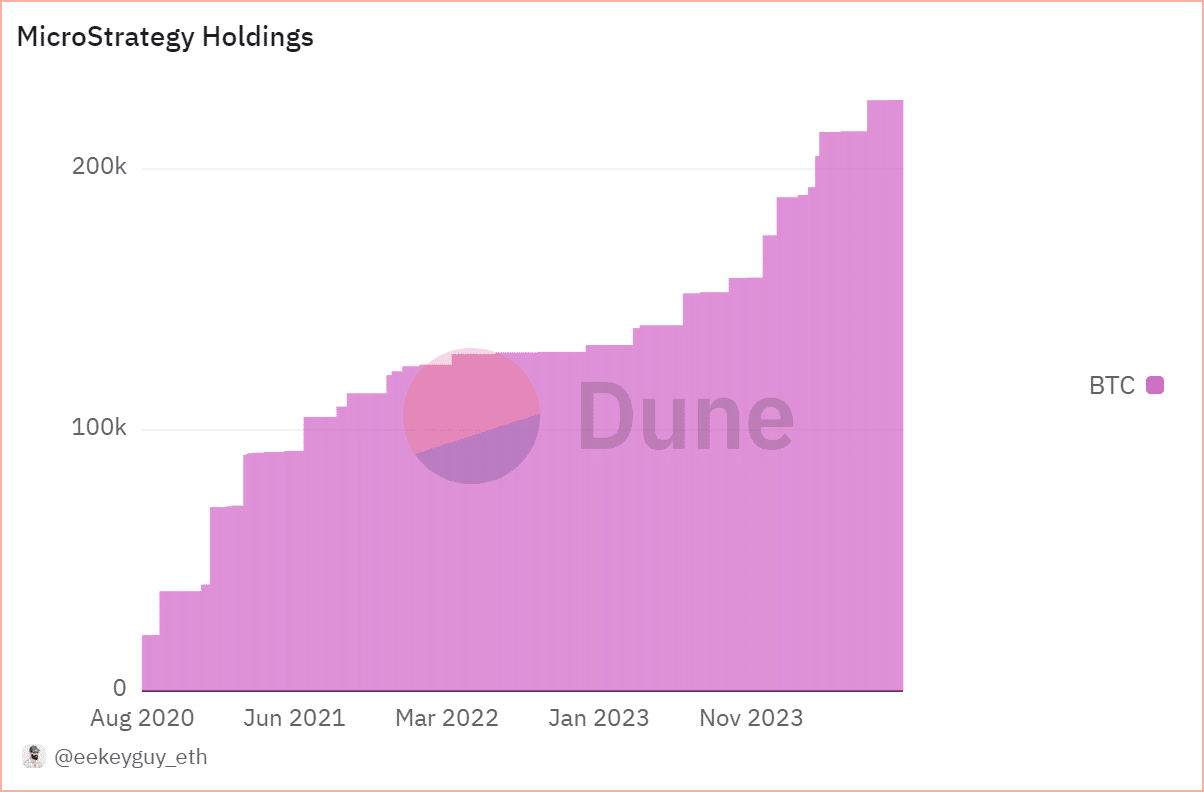

On the twenty ninth of April, MicroStrategy launched its Q1 monetary report, revealing it now holds 214,400 Bitcoin. The corporate has acquired a further 25,250 Bitcoin at a complete value of $1.65 billion, averaging $65,232 per coin.

Supply : Dune

In accordance with the chart above, MicroStrategy’s BTC holdings have surged over tenfold up to now 4 years, rising from 21,000 in early 2020 to 216,000 at press time.

In the meantime, the USA authorities has maintained a watchful eye on its Bitcoin steadiness, recurrently depositing BTC into exchanges.

Briefly, main companies have held onto their Bitcoin regardless of short-term worth swings – a transparent bullish signal.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

Including to this optimism, the report emphasised the rising view of Bitcoin as a retailer of worth, predicting enterprise adoption might close to 1 million by 2026.

Due to this fact, AMBCrypto predicts that Bitcoin could also be approaching a worth correction, although it finally relies on the actions of institutional buyers and savvy merchants.