Picture supply: Getty Photos

Looking for ultra-cheap dividend shares is a good pleasure of mine proper now. Each the FTSE 100 and FTSE 250 indices are loaded with shares which might be buying and selling manner, manner under worth.

Take Phoenix Group (LSE:PHNX) as an example. Not solely does it look dust low-cost relating to predicted earnings. Its dividend yield’s approaching double-digit percentages.

Phoenix isn’t a family identify like Authorized & Basic or Aviva. However it definitely isn’t a minnow within the monetary providers sector, with a market capitalisation of £5.5bn.

The enterprise — which affords financial savings and retirement merchandise within the UK — has round 12m clients on its books. And proper now, its shares seem like a superb discount to me.

Too low-cost to disregard?

Its ahead price-to-earnings (P/E) ratio of 12.2 instances doesn’t look that spectacular. Nonetheless, scratch just a little deeper and the agency seems like a discount within the context of doable earnings.

Predicted earnings progress of 37% in 2024 leaves Phoenix on a price-to-earnings progress (PEG) ratio of 0.3 instances. Any studying under 1 implies {that a} share is undervalued.

In the meantime, the dividend yield on its shares is a large 9.8%, reflecting predictions of a 54p per share dividend for 2024.

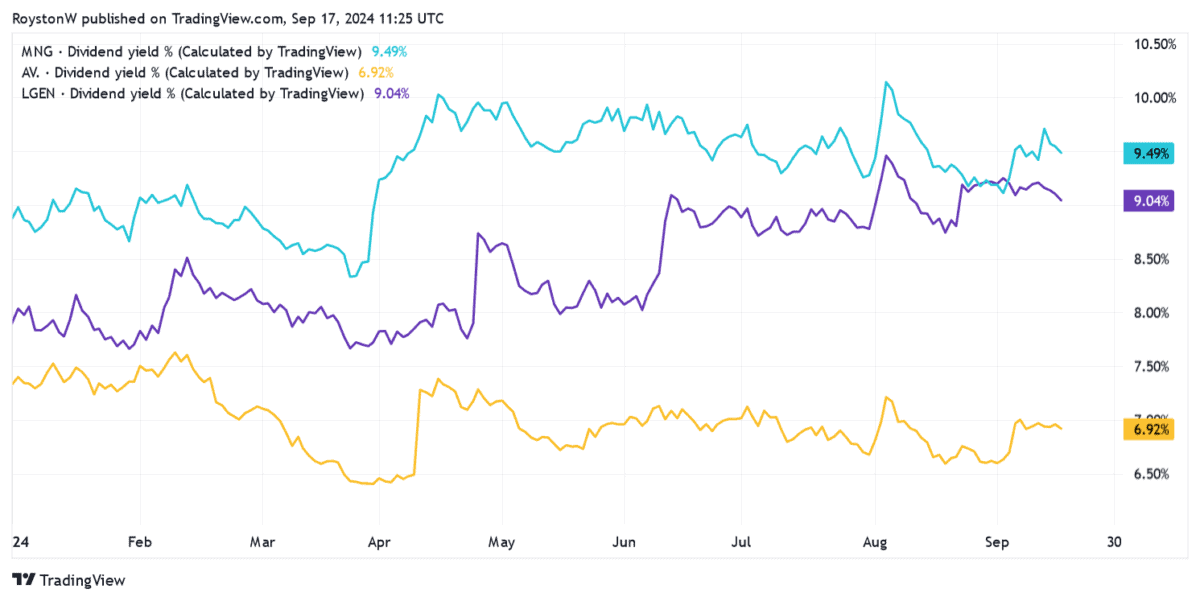

Not solely is that this miles above the three.5% FTSE 100 ahead common. It additionally beats the corresponding yields on Aviva, Authorized & Basic, and M&G shares.

Vibrant future

After all, these engaging PEG ratios and yields are primarily based on dealer forecasts, neither of which will be assured.

As an illustration, Phoenix’s earnings might fall in need of estimates if powerful financial circumstances dent monetary product demand. They might additionally disappoint if the worldwide inventory market sinks.

Nonetheless, as a affected person investor I’m ready to take just a little threat within the quick future if the long-term image’s compelling sufficient. And within the case of Phoenix, the earnings image’s extraordinarily brilliant, pushed by rising demand for pensions and different retirement merchandise.

10%+ dividend yields

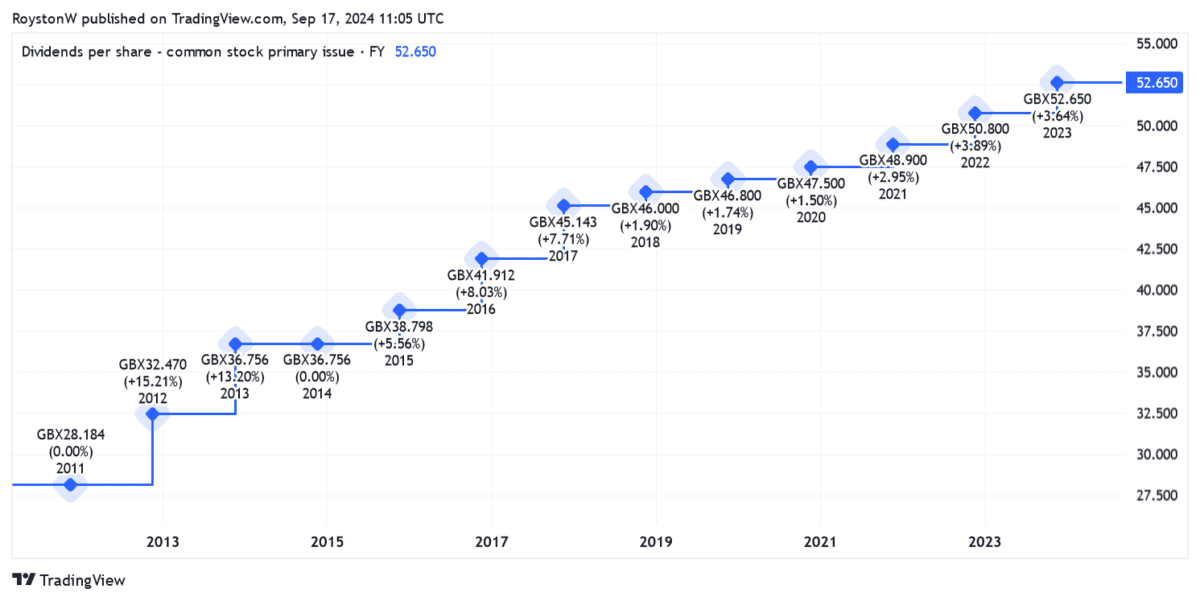

I imagine the corporate will proceed paying giant and rising dividends from 2024 onwards.

I discussed earlier that the dividend yield on Phoenix Group shares falls simply in need of double-digit territory. Effectively, that’s solely half true. It sits at under 10% for 2024. However predictions of additional dividend progress, to 55.9p and 57.3p for 2025 and 2026 respectively, drive the yield to 10.1% and 10.4%.

Once more, dividends are by no means assured. However I’m not about to wager in opposition to the Footsie agency. It has an incredible monitor document of rising shareholder payouts, because the chart above exhibits.

Phoenix’s robust stability sheet definitely places it in fine condition to proceed elevating dividends. Its shareholder capital protection ratio was 168% as of June, on the higher finish of its 140-180% goal.

And the agency stays on track to attain complete money technology of £4.4bn throughout the three years to 2026. Whereas it’s not with out threat, I believe Phoenix is an excellent FTSE discount to contemplate proper now. And particularly for passive earnings traders.