Picture supply: Getty Pictures

Investing in UK fairness earnings funds is a straightforward approach to acquire publicity to a number of prime FTSE 100 dividend shares. However I consider investing in particular person shares could be a extra worthwhile choice.

By choosing shares individually, buyers are inclined to analysis the businesses they select and, subsequently, acquire a greater understanding of the market. This data might help to information and stability a portfolio, which might repay considerably in the long term

Nevertheless, funds have their place. They might help present perception into which shares professionals are selecting. Within the UK, among the most typical shares are Shell, GSK, HSBC and Unilever. However the preferred inventory seen within the majority of fairness earnings funds is main oil and fuel large BP (LSE: BP).

Why is it so fashionable and is it value consideration?

Worth investing

Wanting on the BP share value over the previous 10 years, the worth proposition isn’t instantly apparent. As we speak’s 490p share value is mere pence away from the place it was in July 2014. It will be simple responsible Covid for the low development, however between 2004 and 2014 it was equally stagnant.

In actual fact, the value has endured hardly any noticeable development because the late 90s, but it stays a frequent fixture within the portfolios of worth buyers. This may be complicated for novices who usually search for shares with excessive development potential.

BP’s worth is extra deeply rooted in its power as a dependable dividend-payer with sturdy earnings development. Whereas the share value could lack that WOW issue, sturdy earnings forecasts give the agency a ahead price-to-earnings (P/E) ratio of seven.4. That’s under the business common of seven.9 and significantly decrease than the FTSE 100 common of 18.5.

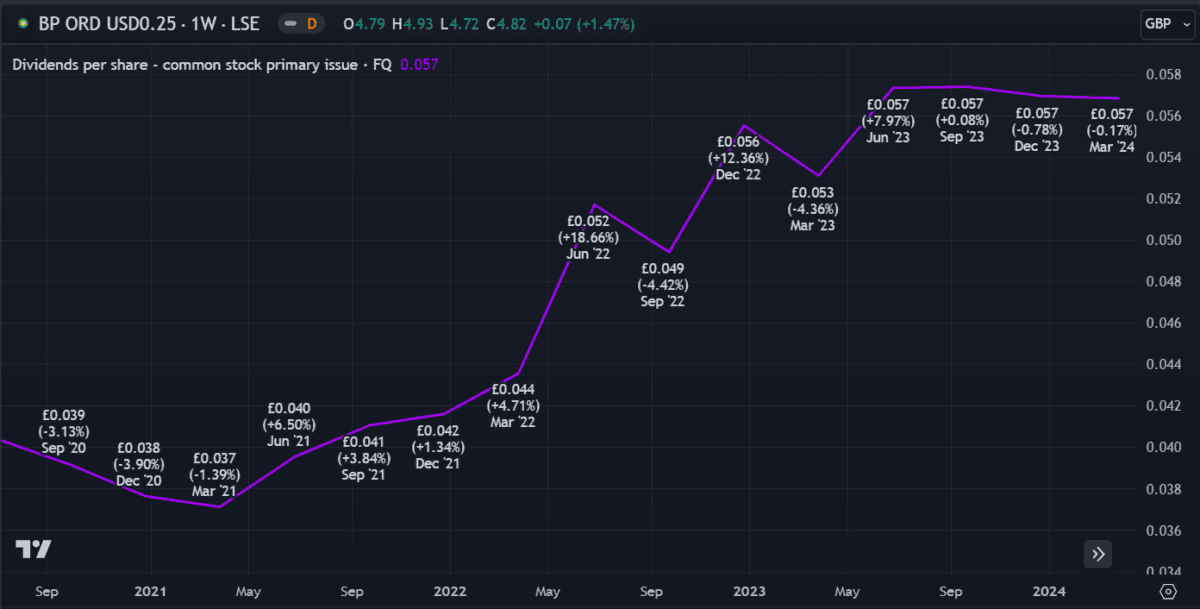

That is what worth buyers wish to see. Sturdy earnings often equate to revenue, and with earnings shares, that always ends in larger dividends. Apart from a partial minimize in 2010, BP’s been paying constant quarterly dividends a few years.

Environmental challenges

Dependable dividends or not, eco-conscious buyers could discover BP a tough tablet to swallow. Final week, it introduced a slowdown on its renewable initiatives, with new CEO Murray Auchincloss shifting focus again to grease and fuel. Lacklustre returns from wind and renewables have left shareholders wanting.

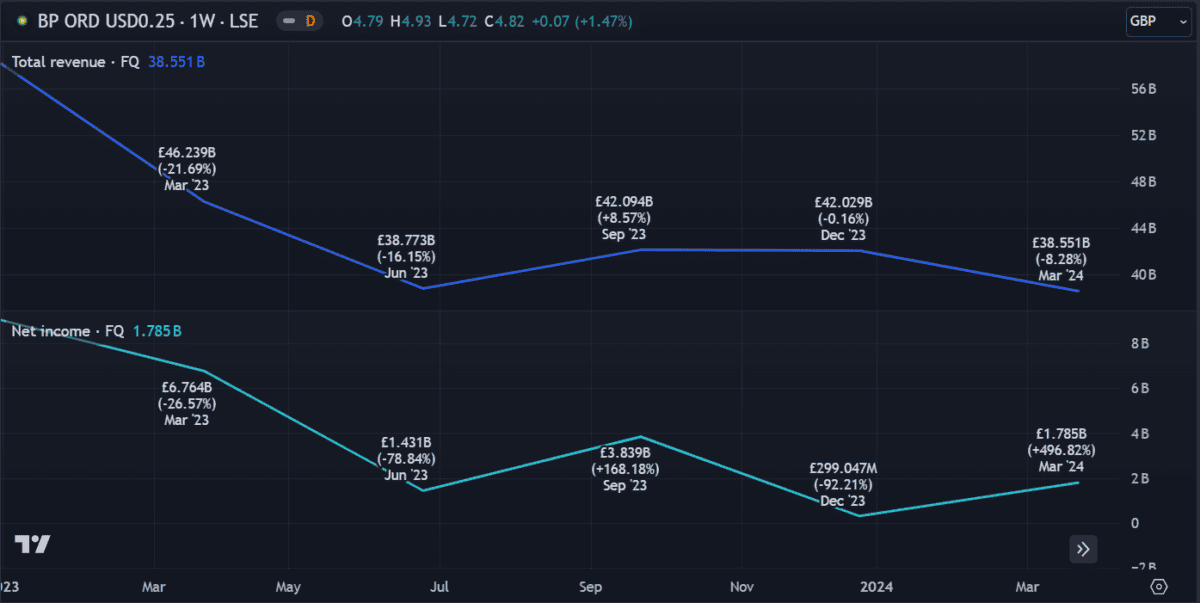

In its newest Q1 name, income and earnings missed analyst expectations by 14% and 24% respectively.

Subsequently, the ‘environment’ part of BP’s ESG rating has now fallen under that of rival Shell — though it stays nicely forward of US oil large Chevron. The shift in focus is dangerous. Auchincloss could also be underestimating the influence of ESG scores and the lengths that activists will go to carry corporations accountable.

Protecting shareholders pleased whereas assembly more and more strict emission targets is now the most important problem that oil and fuel corporations face.

Making the correct selections

For newbie buyers, funds can present a straightforward entry level. Nevertheless, buyers could find yourself supporting corporations with insurance policies they don’t essentially agree with. They might additionally discover the funding technique doesn’t align with their private targets.

Time spent assessing the dangers and advantages related to every funding alternative is invaluable. It’s a crucial a part of the funding journey, serving to buyers higher perceive their private targets and danger urge for food.