- Technique eyes $500M increase from inventory gross sales for BTC acquisition.

- The agency’s replace elicited combined views from the crypto neighborhood.

On the 18th of March, Michael Saylor, founding father of Technique (previously MicroStrategy), introduced a plan to promote $500M value of latest ‘perpetual preferred stock’ (STRF) for Bitcoin [BTC] buys.

Not too long ago, the agency had issued one other most well-liked inventory ‘STRK’ for comparable BTC goals.

This was a part of the agency’s objective to boost $21B via inventory issuance and one other $21B via debt (convertible notes) for BTC buys.

Combined views on Technique’s plans

Clarifying the distinction between Technique’s new class of inventory issuance, Bitwise’s Head of Alpha, Jeff Park, mentioned,

“You can buy STRK today for a 9.4% yield with upside convertibility or STRF for a 10% yield with virtually no redemption feature.”

Merely put, STRK may very well be swapped for MSTR, however STRF doesn’t have such a characteristic and carries extra threat.

Nonetheless, some crypto neighborhood members seen Technique’s ‘high leverage’ as a threat issue for your entire BTC market. One pseudonymous market analyst, Wazz Crypto, acknowledged,

“This id*ot is making Bitcoin uninvestable at this point. Can it even be digital gold anymore if it’s tied to the solvency of a single company?”

One other person, Simon Dixon, termed it a ‘next-level risk’ that might require a bailout if it goes beneath.

“Strategy’s announcement of a perpetual 10% dividend paid in dollars—despite lacking sufficient dollar revenue & operating with a Bitcoin-based balance sheet—is next-level risk.”

Nonetheless, Bitmex Analysis clarified that the agency might keep away from paying MSTR and STRF holders dividends.

“Seems $MSTR can avoid paying these 10% to 18% dividends “for any reason.” The possible consequence right here is class A $MSTR shareholders by no means ever get a dividend fee.”

Supply: X

For his half, long-term BTC critic Peter Schiff termed the brand new inventory issuance ‘ridiculous’ and added,

“The only thing keeping it (BTC) from deflating completely is the Trump administration’s support. Once that goes, it’s all over for Bitcoin and $MSTR.”

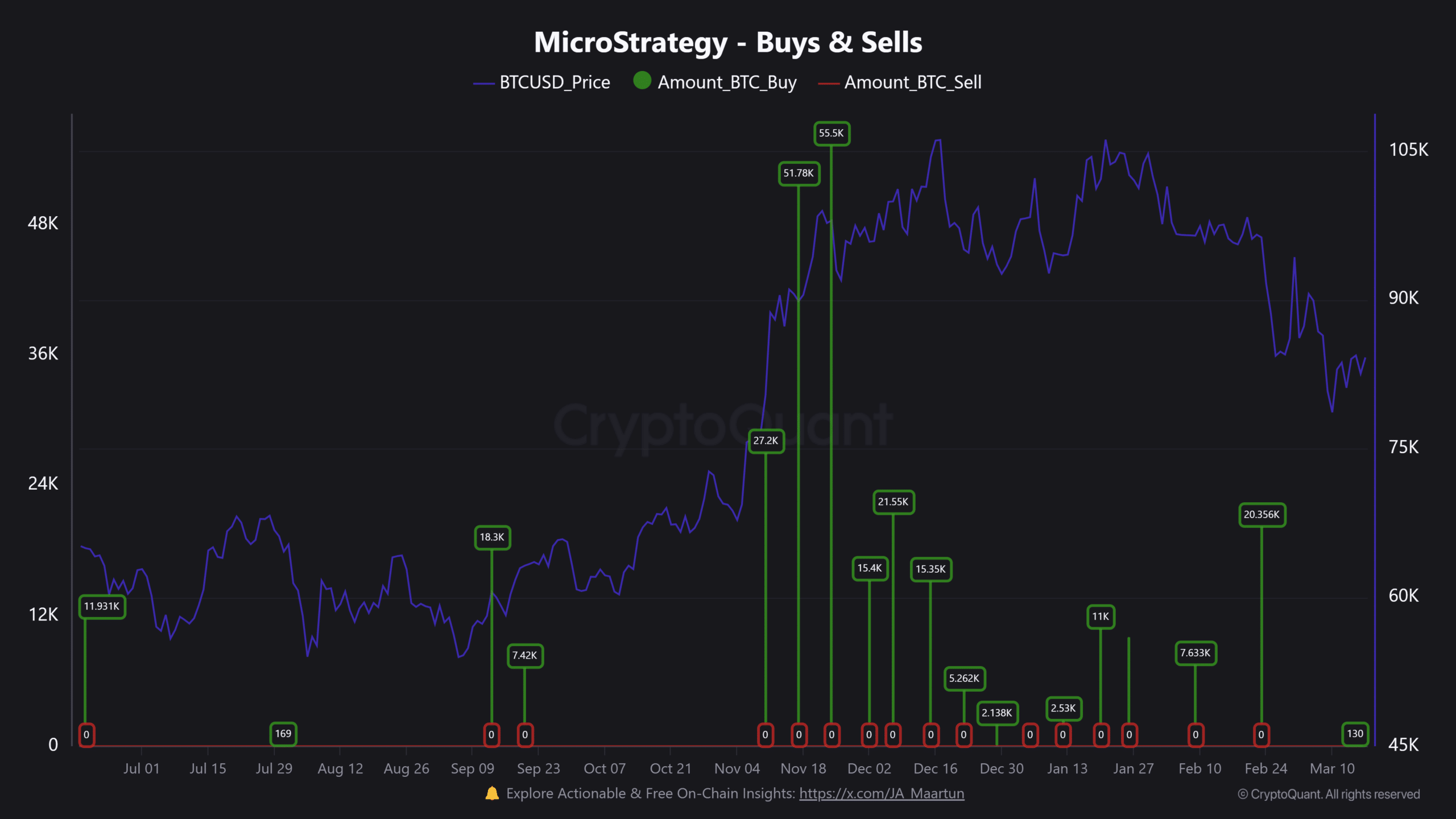

In comparison with final quarter, the agency’s BTC shopping for tempo has slowed in 2025. On sixteenth March, it purchased 130 BTC, growing its stash to 499,226 cash – A 2.3% management of complete BTC provide.

Supply: CryptoQuant

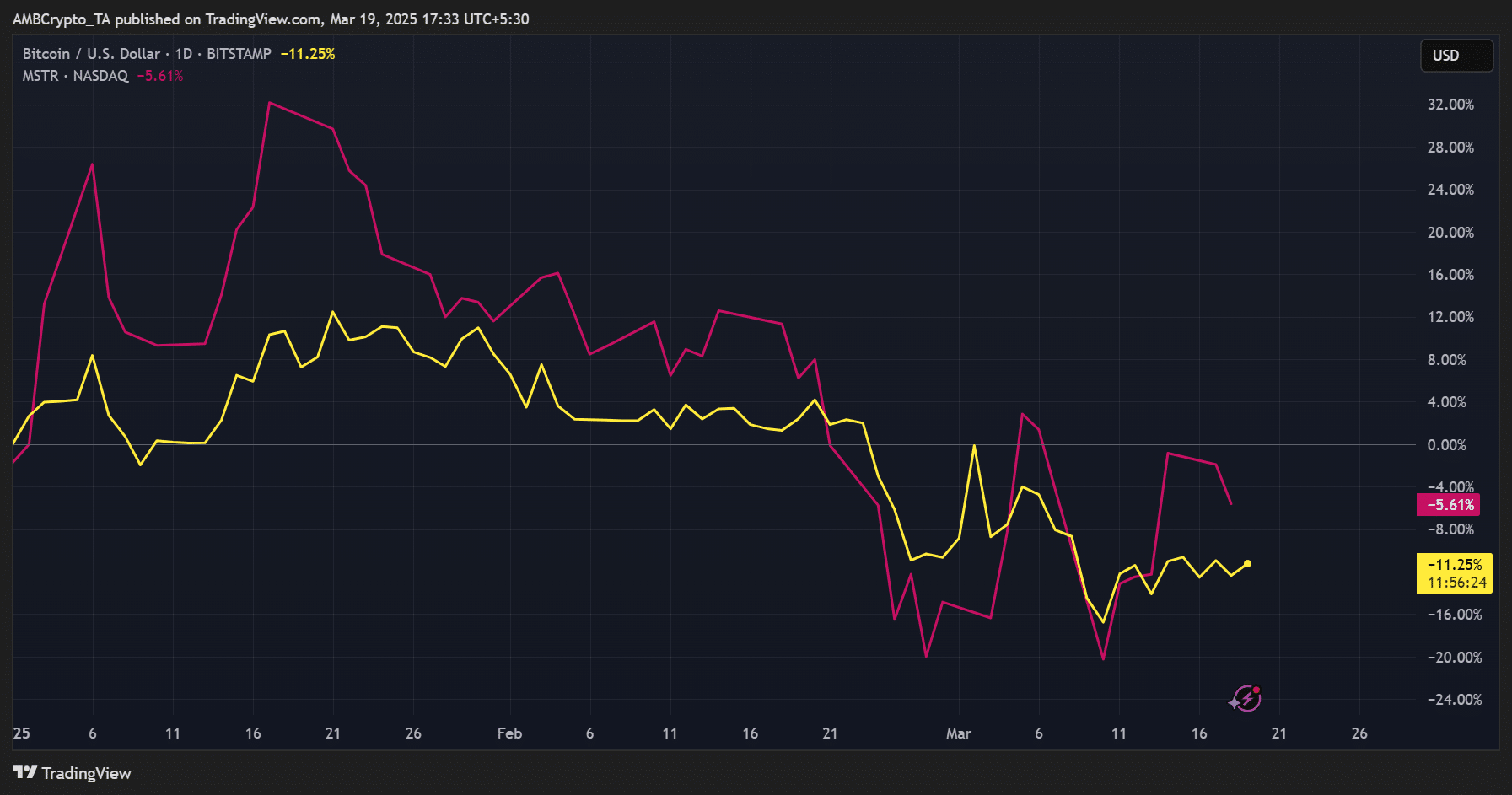

As of this writing, MSTR was valued at $282, down 48% from its current highs of $543, following current BTC losses. Up to now two weeks, it fluctuated between $230 and $300 as BTC remained beneath $90K over the identical interval.

On a year-to-date (YTD) efficiency, MSTR held the risk-off sentiment higher and was down solely 5% in comparison with BTC’s 11% decline.

Supply: MSTR vs BTC, TradingView

Final week, MSTR posted a 26% achieve as BTC retested $85K, suggesting the inventory might publish a powerful restoration if the cryptocurrency reversed its losses.